Audio By Carbonatix

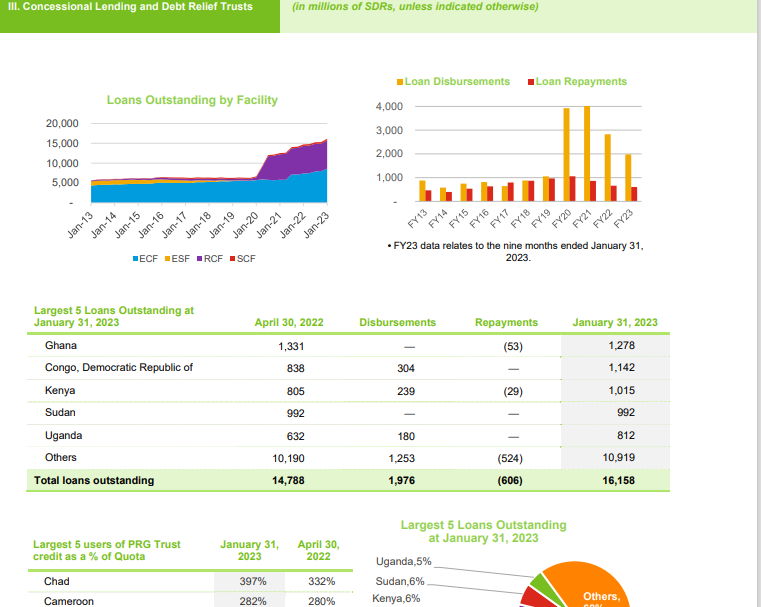

Ghana’s outstanding loans to the International Monetary Fund was relatively unchanged at 1.278 billion Special Drawing Rights (SDR 1.278 billion) at the end of January 2023, equivalent to $1.708 billion.

According to the Fund’s Quarterly Finances, the country is still ranked as number one in Africa with the largest outstanding debt to the Bretton Wood institution.

Ghana's loan exposure to the Bretton Woods institution is classified as concessional lending. Concessional loan comes with a low-interest financing.

The country has so far repaid SDR 53 million, equivalent to $75.7 million to the IMF.

According to the data from the Fund, the Bretton Wood institution has not disbursed any funds to Ghana so far.

However, it is the expectation that the country will secure an IMF support programme by the end of March 2023, to boost its balance of payment and stabilise the economy.

In October 2022, Ghana’s loans outstanding to the Fund were estimated at SDR 1.28 billion, equivalent to about $1.68 billion.

The loans outstanding excluded the Covid-19 support of which the country received more than $1.2 billion to fight the pandemic and aid economic recovery. However, the country’s debt to the IMF will go up after the approval of a programme by the Board of the Fund by the first quarter of 2023.

Meanwhile, Democratic Republic of Congo and Kenya were ranked 2nd and 3rd in Africa with the largest outstanding loans of SDR 1.142 billion and SDR 1.015 to the Fund.

In terms of continent, Africa is ranked 3rd, owing the IMF SDR 13.045 billion as of the end of January 2023. Western Hemisphere is ranked 1st with SDR 45.74 billion.

Latest Stories

-

Song banned from Swedish charts for being AI creation

5 minutes -

Barcelona reach Copa del Rey quarter-finals

14 minutes -

Players need social skills for World Cup – Tuchel

19 minutes -

Labubu toy manufacturer exploited workers, labour group claims

23 minutes -

Lawerh Foundation, AyaPrep to introduce Dangme-language maths module

54 minutes -

US forces seize a sixth Venezuela-linked oil tanker in Caribbean Sea

1 hour -

Votes being counted in Uganda election as opposition alleges rigging

1 hour -

Ntim Fordjour accuses government of deliberate LGBT push in schools

1 hour -

National security task force storms ‘trotro’ terminals to halt illegal fare hikes

1 hour -

U.S. visa restriction development for Ghana concerning – Samuel Jinapor

1 hour -

Uganda election chief says he has had threats over results declaration

1 hour -

Quality control lapses allowed LGBT content into teachers’ manual – IFEST

1 hour -

Akufo-Addo’s name will be “written in gold” in Ghana’s history in the fullness of time – Jinapor

1 hour -

Tread cautiously about financial hedging – US-based Associate Professor to BoG

1 hour -

LGBTQ curriculum row: Quality control failure, not timing, caused teacher manual controversy – Dr Anti-Partey

1 hour