Audio By Carbonatix

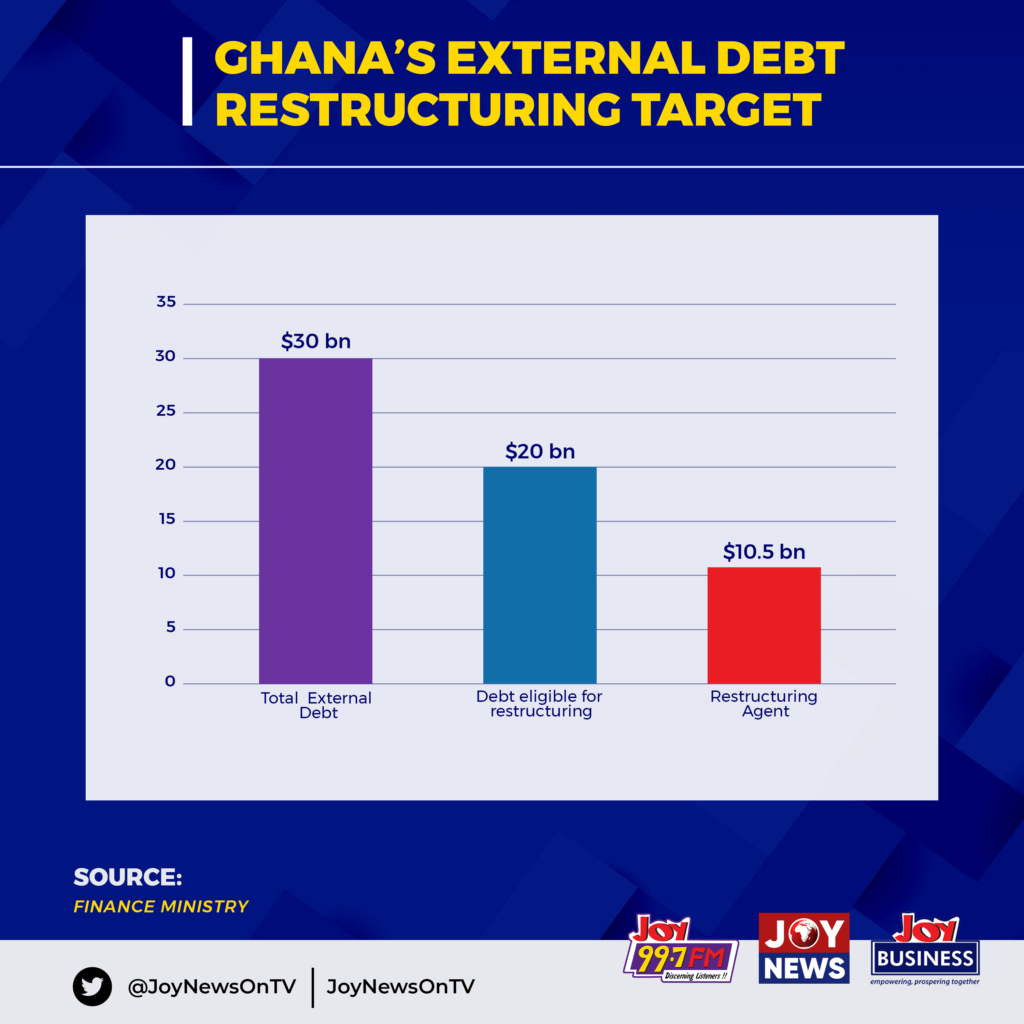

Ghana is currently working hard to reduce its external debt stock by some $10.5 billion. To obtain this debt relief, the country has identified bonds worth $20 billion that are eligible for restructuring. This is to help trim Ghana’s total debt portfolio to a sustainable level and alleviate balance of payment pressures in both the medium and short term.

Ghana's external debt restructuring target

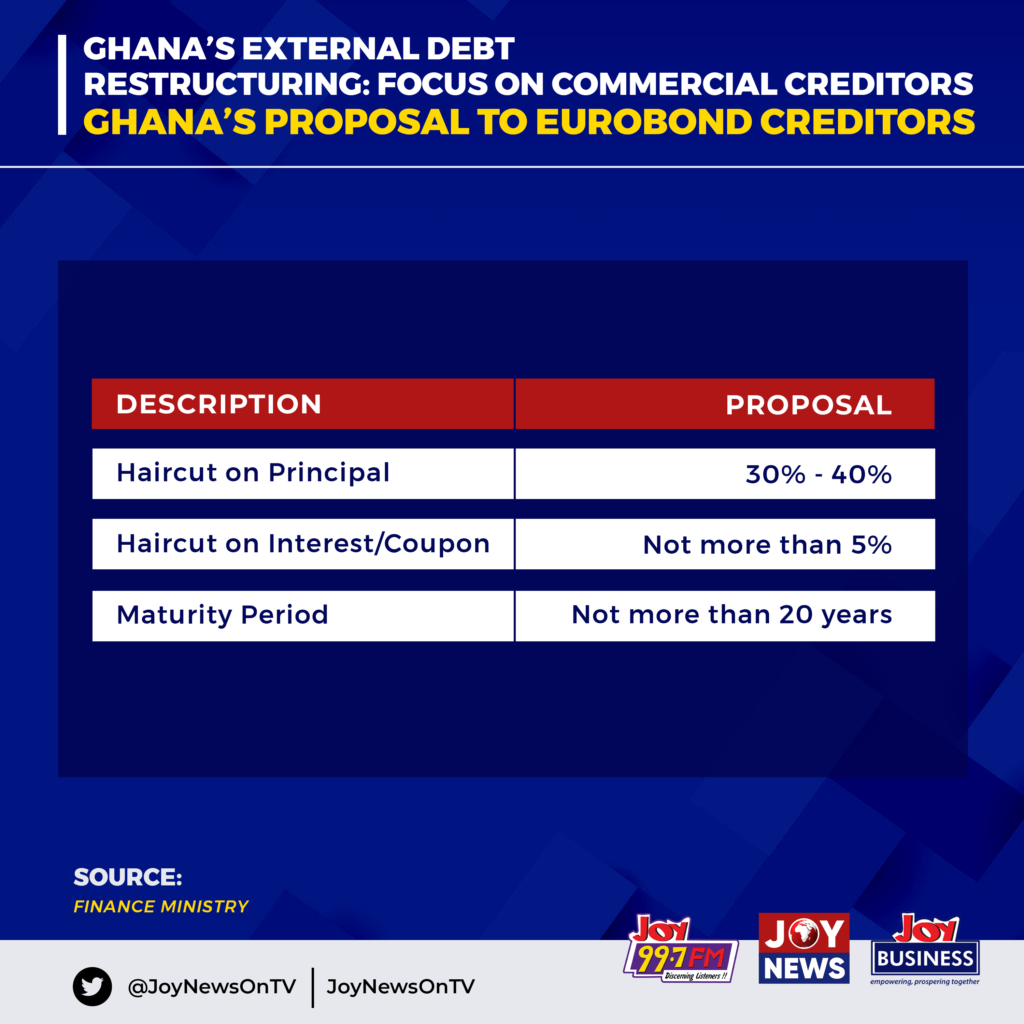

A significant part of Ghana's debt relief is expected to come from its commercial creditors (Eurobonds especially). However, the nation faces a monumental challenge as it navigates the intricate process of negotiating debt restructuring with external commercial creditors.

A recent update by the Finance Minister, Ken Ofori-Atta indicates that Ghana has pinpointed bonds amounting to $14.6 billion in the external commercial sector as eligible for restructuring and has boldly tabled a proposal which contains a 30 to 40 percent haircut on principal.

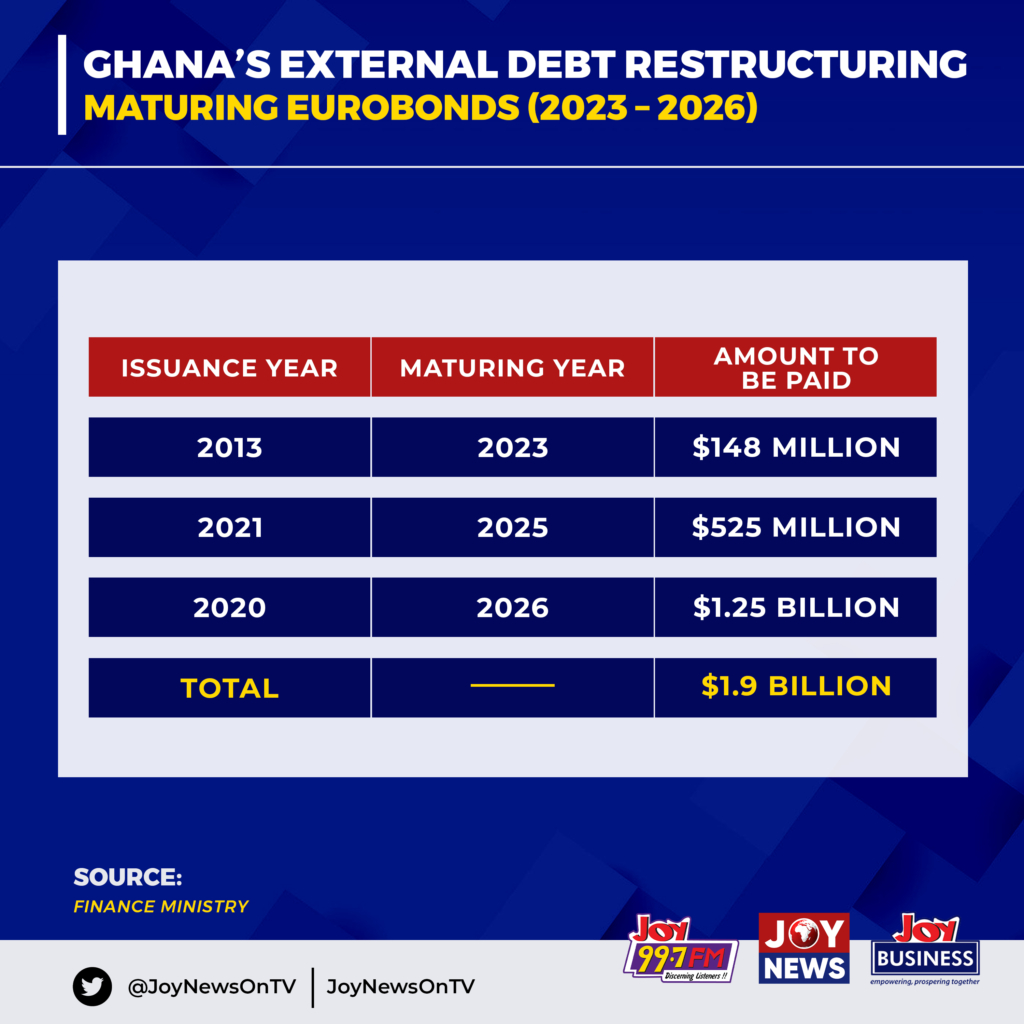

The West African nation's sovereign dollar bonds experienced a significant decline on Tuesday, following the government's announcement of its request for a percentage write-off on the principal and interest of its Eurobonds. The reaction in the bonds market was swift, leading to some bonds reaching their lowest levels in three months. The Black Star of Africa is expected to service maturing Eurobonds worth $1.9 billion (2023-2026) which is 60% of the total IMF bailout package. Projected interest payments on foreign loans crossed $3 billion this year.

In fact, Ghana's journey towards external debt restructuring is riddled with challenges and complexities. The negotiation process involves delicate diplomacy and strategic financial planning. The government's proposal to secure a significant reduction in principal and interest payments is essential to alleviate the country's economic burden. However, this pursuit is met with scepticism and potential opposition from creditors. Balancing the necessity of debt relief with the concerns of creditors who may be wary of financial losses poses a significant hurdle.

Latest Stories

-

Mrs Emily Mamle Abotsi

17 seconds -

TOR can refine Ghana’s local crude – Corporate Affairs Officer clarifies

35 seconds -

DJ Spinall, Davido, King Promise, Wande Coal and more light up Detty Rave 7 in Accra

8 minutes -

AIG partners PAJ Foundation to reward outstanding performers

13 minutes -

Detty Rave 7 shuts down Accra as Mr Eazi pledges $2m investment

22 minutes -

Ho mosque shooting incident: Police release 14 suspects from custody

25 minutes -

Firecrackers, knockouts still illegal ahead of 31st night crossovers – Small Arms Commission

28 minutes -

Thousands expected at ICGC Christ Temple East for life-changing Crossover Service

30 minutes -

IMF support goes beyond loans to boost Ghana’s economic credibility – Kobby Amoah

34 minutes -

IES hails TOR’s return to crude oil refining after years of shutdown

39 minutes -

Thousands of guns retrieved under amnesty with 15 days to deadline – Small Arms Commission

41 minutes -

AfroFuture Festival Day One delivers late-night thrills as Asake shuts down the stage

43 minutes -

Sign 5 new players or forget about league title – Aduana coach Cioarba Aristica tells management

44 minutes -

Adom FM’s Strictly Highlife slated for Jan. 1 to celebrate authentic Ghanaian sound

47 minutes -

Part 2: Key Observations on the Constitutional Review Committee Report Submitted to President Mahama

49 minutes