Audio By Carbonatix

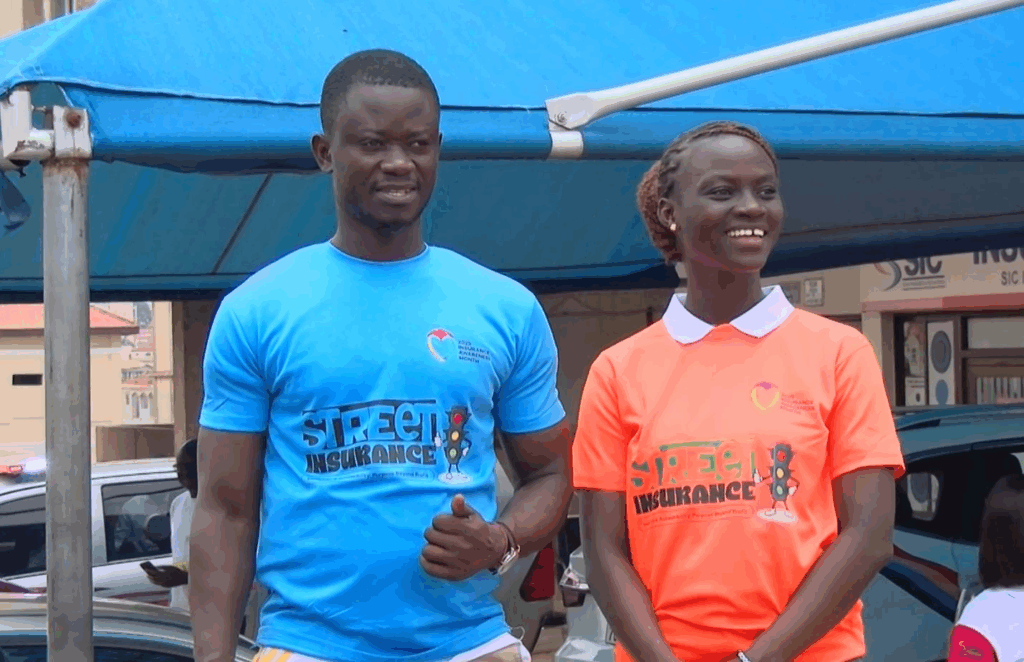

Insurance institutions in Kumasi, as part of the Insurance Awareness Month, have joined forces for a public walk aimed at promoting the benefits of insurance, encouraging inclusivity and building public trust in the industry.

The walk, which brought together key players from Ghana’s insurance space, emphasised the critical need for Ghanaians to understand their rights and options when engaging insurance companies, especially regarding claims.

Ashanti Regional Manager of the National Insurance Commission (NIC), Farouk Dramani, underscored the regulator’s commitment to protecting policyholders, referencing the legal framework backing that responsibility.

“Section 2 of the Insurance Act mandates the Commission to make sure that policyholders are protected. That is the main reason why insurance all over the world has been established,” he said.

Mr. Dramani further expressed concern over Ghana’s low insurance penetration rate.

“Currently, we have the insurance penetration rate hovering around 1% of the GDP. That is quite low, because the average in the West African subregion is around 3% and in other parts of the world 7%. The insurance coverage is hovering around 45%, so you can just imagine, 45% coverage against 1% penetration. It means we have to do a lot more to increase that rate,” he explained.

One of the major barriers to trust in the industry has been the delay or non-payment of claims. To address this, the NIC has implemented strict guidelines – once all required documents are received, insurance companies must settle claims within a month or face penalties.

To further strengthen accountability, the Ghana Insurers Association (GIA) has introduced the Complaint Management and Advice Bureau a customer-focused initiative that allows the public to report unresolved claims at no cost.

Ernestina Amankrah, Head of Technical at GIA, explained, “We handle claims and complaints from the industry and the public. Anyone who has any claim issues that have not been settled should come to GIA or call us and we will attend to you. It is at no cost.”

With renewed regulatory commitment and increased public outreach, stakeholders hope these efforts will increase insurance adoption and foster greater confidence in insurance companies among Ghanaians.

Latest Stories

-

Offinso MP blames Mahama gov’t for cocoa sector challenges

7 minutes -

Baba Jamal’s recall not targeted, decision based on allegations – Kwakye Ofosu

8 minutes -

Ayawaso Zongo chiefs caution NDC against cancelling Ayawaso East primary

11 minutes -

COCOBOD failed to deliver over 330k tonnes of cocoa in 2023/24 season – Randy Abbey

14 minutes -

Baba Jamal denies vote-buying claims, cooperates with NDC probe into Ayawaso East primary

15 minutes -

COCOBOD in its most fragile state in nearly eight decades — CEO Randy Abbey

25 minutes -

The dichotomy of living with mental and chronic illnesses

31 minutes -

Offinso MP urges COCOBOD to be frank with farmers over cocoa sector challenges

40 minutes -

Ghana shifts debt strategy towards multilateral, bilateral funding in 2025

45 minutes -

Projects with extractive-sector funding: Civil society groups raise alarm

50 minutes -

Mahama charges envoys to articulate a Ghanaian voice that speaks with clarity

59 minutes -

Nogokpo community rekindles spirit of communal labour

1 hour -

Local Gov’t Ministry hands over cleaning tools to MMDAs in Accra

1 hour -

Mahama installed as patron of the West African College of Surgeons

1 hour -

2027 Elections: We need leader who can die for Nigeria – Omotola

1 hour