Audio By Carbonatix

The managers for the Anidaso Mutual Fund, regulated by New Generation Investment Services, is confident of a positive economic outlook for 2025.

Following the recent ease in economic and inflationary pressures, the investment fund witnesses a positive increase in shares, growing by 13.26% for 2024.

Despite recording a reduction in investment in-flows, the company is anticipating a continuous positive trajectory for the year with prudent fiscal measures from the government.

Ghana’s economic growth, in the last two years, hit a snag, impacting the financial investment sector.

Following a significant economic recovery, the financial sector is bouncing back from the external shock.

The Anidaso Mutual Fund, a local investment package of the New Generation Investment Services, is seeing significant gains.

Debt Exchange impacts

Despite the positive gains, the Fund's gross investment income saw a reduction of 17.31%, declining from 553,837 cedis in 2023 to 457,916 cedis in 2024.

This decrease was essentially influenced by marginal decreases in interest rates on money market instruments, which reduced asset returns.

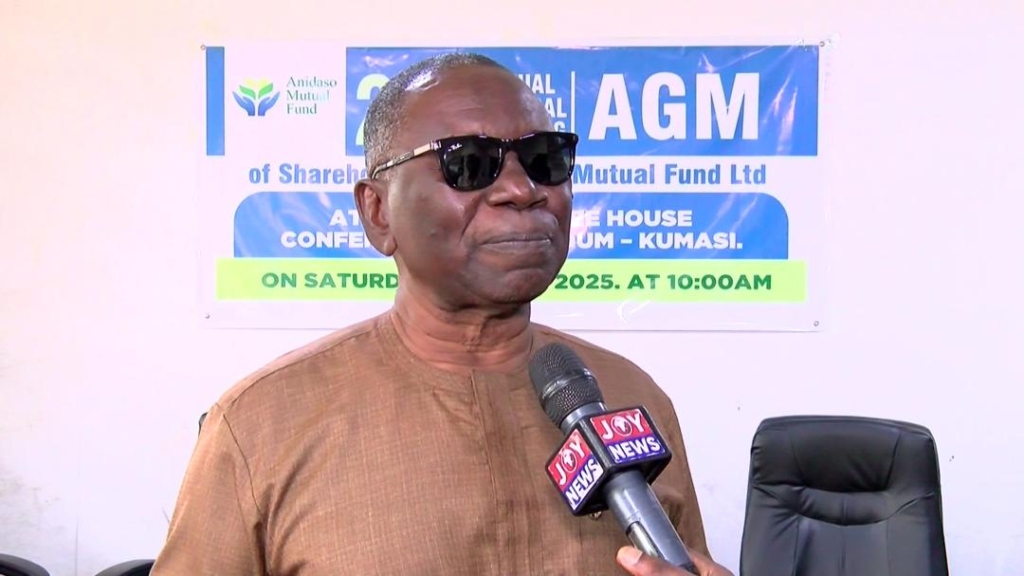

Fund manager of New Generation Investments Services, Edward Asamoah says management is adopting strategies to diversify and secure the inflows in alternative instruments.

“The DDEP will continue for at least five years. We needed to diversify the investments so that the impacts of the program will not huge on us,” he said.

The investment company held its

annual general meeting of the shareholders of the fund.

Financial Performance

The Fund’s total liabilities saw a significant improvement for the year, amounting to 54,669 cedis - a 42.84% reduction from the previous year which recorded 95,649 cedis.

Despite the decline in liabilities, the redemption of shares increased by 10.91% - from 450,096 cedis in 2023 to 499.206 cedis in 2024.

The investment service’s shares saw a significant uptick, rising by 90.54% from 411,009 cedis in 2023 to 784.309 cedis in 2024.

Managers of the fund surmises the surge in shares purchase likely reflects greater investor confidence.

“The bulk of the Fund's assets are concentrated in fixed income/money market instruments, representing a stable and liquid portion of the portfolio, while equities account for a smaller, but still significant portion of the Fund's total investments,” Mr. Brobbey, the Vice Chairperson of the fund, noted.

Outlook for 2025

With Ghana's economic growth is expected to pickup this year, the fund management are anticipating potential fiscal growth.

The investment climate is also projected to improve as debt restructuring stabilizes the economy.

This would this allow investors to become more confident in the country's prospects, with a focus on sectors like infrastructure, energy, and finance.

“Ghana's long-term economic prospects are generally positive, especially if it successfully navigates its debt issues and continues efforts to diversify its economy. With investments in infra-structure, education, and energy, the country could lay the groundwork for sustainable development beyond 2025 to benefit the Fund,” Mr. Brobbey noted.

Latest Stories

-

Ayawaso East primary: OSP has no mandate to probe alleged vote buying – Haruna Mohammed

10 minutes -

Recall of Baba Jamal as Nigeria High Commissioner ‘unnecessary populism’ – Haruna Mohammed

14 minutes -

Presidency, NDC bigwigs unhappy over Baba Jamal’s victory in Ayawaso East – Haruna Mohammed

45 minutes -

Africa Editors Congress 2026 set for Nairobi with focus on media sustainability and trust

53 minutes -

We are tired of waiting- Cocoa farmers protest payment delays

1 hour -

Share of microfinance sector to overall banking sector declined to 8.0% – BoG

2 hours -

Ukraine, global conflict, and emerging security uuestions in the Sahel

3 hours -

Either defer new royalty regime or abolish Growth and Sustainability Levy – Chamber of Mines to government

3 hours -

The Suit is a shroud ; the fugu is our resurrection

3 hours -

NDC appoints Inusah Fuseini as Ayariga steps down from Ayawaso East primary probe committee

4 hours -

T-bills auction: Government exceeds target by 246%; interest rates fall sharply to 9.9%

4 hours -

Lands Minister arrives in South Africa for annual African mining investment conference

4 hours -

Frank Quaye Writes: Nullify Ayawaso East primary to protect NDC’s integrity and goodwill

4 hours -

Medeama survive Samartex test to reach FA Cup last eight

4 hours -

Vote- buying, party reform, and the unfinished business of internal democracy in the NDC

4 hours