Audio By Carbonatix

Sefwiman Rural Bank PLC has reported impressive growth in its financial performance for the 2024 fiscal year, despite immense macroeconomic challenges. The bank recorded 151% increase in its Profit Before Tax (PBT), reaching GH₵7,991,000 in 2024, compared to GH₵3,189,631 in 2023. The Profit After Tax (PAT), similarly saw substantial growth, surging by 138% from GH₵2,194,774 in 2023 to GH₵5,230,485 in 2024.

The bank's overall gross earnings grew by 68%, increasing from GH₵15,843,241 in 2023 to GH₵26,617,559 in 2024. However, the bank also saw a rise in interest expenses by 50%, from GH₵3,471,455 in 2023 to GH₵5,609,672 in 2024. This resulted in 84% increase in net interest income, which rose from GH₵10,059,199 in 2023 to GH₵18,538,470 in 2024.

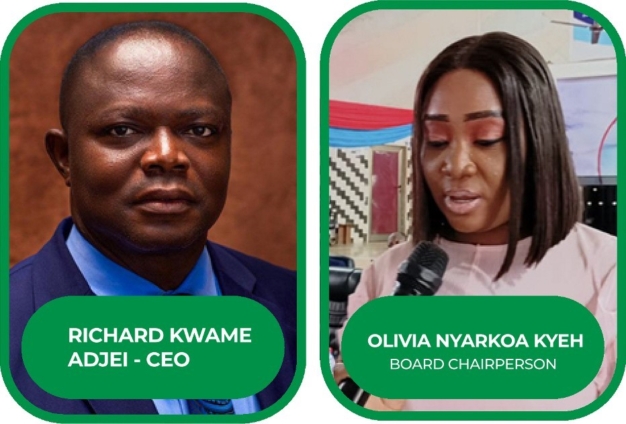

These financial achievements were disclosed by the Chairperson of the bank, Miss Olivia Nyarkoa Kyeh, during the 19th Annual General Meeting (ACM) held in Bibiani, in the Western North Region. Miss Kyeh attributed the bank's remarkable performance to its commitment to prudent risk management, strong corporate governance practices, and strict adherence to its strategic direction.

Strong Business Growth

Miss Nyarkoa Kyeh highlighted the significant expansion in the bank's total assets, which increased by 94% to GH₵162.47 million in 2024, up from GHC 83.79 million in the previous year. Additionally, loans and advances grew by 9%, rising from GH₵18.19 million in 2023 to GH₵19.87 million in 2024.

The bank's investment portfolio also saw impressive growth, increasing by 124% from GH₵51.31 million in 2023 to GH₵115.14 million by the end of 2024. Miss Nyarkoa Kyeh praised the Board, Management, and Staff for their dedication, which contributed to the bank's success and enhanced its reputation within the financial industry.

Furthermore, the Chairperson noted a significant increase in customer confidence, as demonstrated by a 103% rise in customers' deposits, from GH₵71.10 million in 2023 to GH₵144.116 million in 2024.

Support for Agricultural Development

In a move to support the agricultural sector, the Chief Executive Officer (CEO) of the Sefwiman Rural Bank, Mr. Richard Kwame Adjei, revealed that the bank has formed partnerships with institutions such as the African Development Bank's Social Investment Fund (AfDB/SlF), ARB Apex Bank, and Development Bank Ghana. Through these collaborations, the bank has rolled out agricultural products designed to enhance the livelihoods of farmers engaged in crops, poultry, and livestock. As part of this initiative, the bank has disbursed a total of GHC 4.662 million to over 144 farmers, enabling them to increase production and create additional employment opportunities.

The CEO further said the bank in its quest to deepen financial inclusion at deprived communities has disbursed GHC 6.5 million to its 1,437 MSMEs clients with 81 % being women.

Industry Recommendations

The Managing Director of ARB Apex Bank, Mr. Alex Kwasi Awuah, in a statement read on his behalf by Mr. Leonard N. Maasang, Regional Manager of ARB Apex Bank, Ashanti commended the Sefwiman Rural Bank for its strong performance. He highlighted the growth in profit after tax of GH₵5.2 million (2024) which represented 138% of the previous year's (2023) performance and also praised the Bank for the excellent growth in investments of over 125%.

The Board and Management were also advised to be optimistic yet cautious of investment of shareholders’ Funds while maintaining an aggressive outlook.

He also highlighted the need for the Bank to provide affordable and convenient online banking solutions to meet growing customer demands.

He impressed upon the Board and Management to increase its loan disbursement to support its teeming customers.

Dividend Declaration

The Board of Directors, recognizing the shareholders' loyalty and sacrifice, secured approval from the Bank of Ghana to pay a dividend of GH₵0.06 per share, amounting to a total payout of GH₵650,755.44.

The remarkable performance of Sefwiman Rural Bank in 2024 reflects its resilience and strong strategic direction amidst challenging economic conditions, solidifying its place as a leading rural bank in Ghana.

Latest Stories

-

Korle Lagoon Smart City Project to kick off soon as committee meets; Mayor signals fast-tracked action

5 minutes -

24-hour economy unnecessary – Minority opposes secretariat bill

5 minutes -

Why Amasaman High Court cut Agradaa’s 15-year sentence to 12 months

7 minutes -

Daily Insight for CEOs: Eliminating execution bottlenecks

10 minutes -

Transport Minister boosts collaboration to fix transport challenges

11 minutes -

President Mahama outlines Ghana’s economic recovery and invites Zambian investors

11 minutes -

Transport Minister unveils multi-sector plan to decongest roads

12 minutes -

CID, Defence Intelligence renew partnership on crime and security

17 minutes -

Clarion Clarkewoode returns with mew Afrobeats single, ‘AyƐ Kwa’

35 minutes -

GES concludes probe into Savelugu SHS feeding incident after viral video

39 minutes -

Victoria Ivy Obeng drops debut gospel EP dubbed ‘My Passion’

41 minutes -

Government lifts curfew on Binduri Township following return of calm

46 minutes -

DVLA publishes 2026 service fees to ensure transparency

47 minutes -

Daily Insight for CEOs: Maintaining leadership visibility during execution

50 minutes -

Aid workers missing after airstrikes hit South Sudan hospital

50 minutes