Audio By Carbonatix

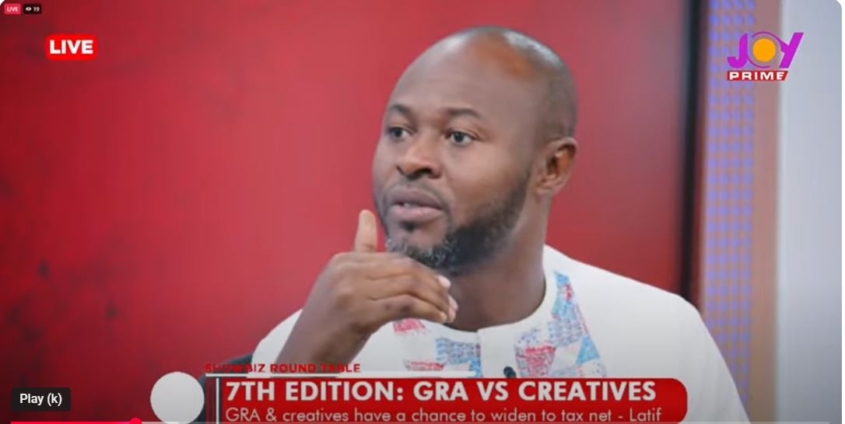

Playwright and Chief Executive of Globe Productions, Latif Abubakar, has urged the Ghana Revenue Authority (GRA) and the creative industry to work together to expand the country’s tax net, highlighting the enormous potential of the creative economy to boost Ghana’s Gross Domestic Product (GDP).

Speaking at the 7th edition of the Showbiz Roundtable on the theme “Taxation and the Future of Ghana’s Creative and Digital Economy” on Saturday, September 6, Mr. Abubakar stressed that the creative industry remains a largely untapped sector capable of contributing significantly to national revenue.

“I think one of the major things the GRA wants to do is to widen the tax net. Both the GRA and the creatives have an opportunity to widen the tax net. Globally, the creative economy contributes close to $4.1 trillion. In Sub-Saharan Africa, it is about 4% of GDP, roughly $58 billion. For Ghana, projections show the creative economy could contribute between $20 to $30 billion annually if we do things right,” he said.

However, he lamented the absence of reliable data on Ghana’s creative economy, which makes it difficult to determine its actual contribution to GDP. “We started processes to gather data some years ago, but without proper data, we cannot measure the true value of the industry,” he explained.

Mr. Abubakar also cautioned against taxation policies that cripple rather than support creatives. He narrated a case where a young playwright lost his company after being taxed on complimentary tickets issued during his debut production.

“For every production, you give out complimentary tickets so people can experience the arts. Unfortunately, after giving out tickets and losing money, GRA still demanded tax on them. The young man was slapped with nearly GH¢10,000 in taxes, on top of a GH¢30,000 loss. That was the end of his company,” he recounted.

He emphasized that while GRA has a mandate to mobilise revenue, the creative industry must be nurtured to grow and contribute sustainably.

“There’s an industry that can help widen the tax net. Stakeholders need to sit together and design policies that support both revenue generation and the growth of the creative sector,” he added.

Latest Stories

-

China executes 11 linked to Myanmar scam operations

1 minute -

Black Queens’ Evelyn Badu joins Canadian side Montreal Roses FC

2 minutes -

Ghana–India trade nears $5bn as bilateral partnership deepens

16 minutes -

Ghana set to exit IMF programme this year – Haruna Iddrisu

19 minutes -

Today’s Front pages: Thursday, January 29, 2026

1 hour -

More than 8,500 delegates to vote in NPP presidential primaries in Upper East

2 hours -

Bawumia is formidable and prepared candidate – Regional Campaign team member

3 hours -

KAIPTC launches inaugural Executive Travel Security Course

3 hours -

Ghana loses nearly 19 tonnes of gold in 3 months – BoG urged to explain

3 hours -

Bryan Acheampong claims nationwide campaign edge in NPP flagbearer contest

3 hours -

CAF dismisses Morocco protest to strip Senegal of AFCON title for misconduct during final

3 hours -

I almost lost hope along the way – Matthew Nyindam

3 hours -

The womb and the field: How colonialism turned African women into permanent infrastructure

3 hours -

Government committed to recapitalising BoG after DDEP losses – BoG Governor Asiama

4 hours -

Banks have started calling customers for loans, says BoG Governor

4 hours