Audio By Carbonatix

Kenya aims to carry out a pioneering $1 billion debt-for-food security swap by March next year, a finance ministry document showed on Tuesday, as the country looks to novel solutions to ease its hefty debt burden.

The plan is expected to work in a similar way as so-called debt-for-nature swaps carried out by several countries in recent years that offered lower interest rates in exchange for nature protection.

A debt-for-food swap would likely allow a country to replace costly existing debt with lower-cost financing on condition it channels the savings towards programmes to boost food security, finance experts say.

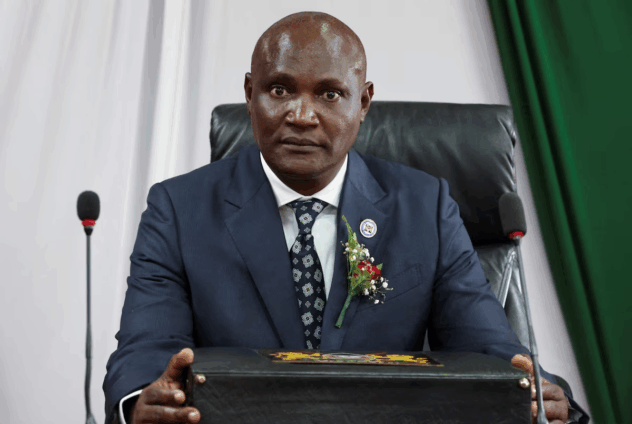

Officials at the Finance Ministry could not be reached for comment, but Finance Minister John Mbadi told a local television station earlier this year the government was in advanced discussions on a swap involving the World Food Programme's participation.

President William Ruto's government spends roughly one-third of its revenue on interest payments - one of the highest ratios in the world - and is eager to bring debt spending down.

Debt swap agreements with a focus on social or environmental benefits are becoming an increasingly popular financing tool in poorer parts of the world. Countries including Ecuador, Belize and Gabon have undertaken debt-for-nature deals in recent years.

Ivory Coast completed the first major evolution of the model last December with a debt-for-education swap with the help of a World Bank "credit guarantee". Guarantees are included to persuade creditors to lower borrowing costs.

Kenya, which is East Africa's biggest economy, had a total public debt equivalent to 67.8% of its GDP at the end of June this year, the Finance Ministry said in the document, which is called an annual borrowing plan.

The government also plans to borrow $500 million using sustainability-linked bonds by March 2026, a World Bank loan of $757 million by March next year and another loan of $457 million in June, the document showed.

It is also looking to cut its debt costs by turning to securitised debt and converting a $5 billion rail loan into the Chinese currency, it has said recently.

Latest Stories

-

Baba Jamal interrogated by Special Prosecutor over alleged vote-buying claims

7 minutes -

Hooked on survival: Human impact of climate-driven illegal fishing

19 minutes -

Agric economist demands end to political control in cocoa industry

42 minutes -

Speaker directs business committee to schedule anti-LGBTQ bill for parliamentary consideration

1 hour -

Inflation drop doesn’t mean prices have fallen – Oppong Nkrumah clarifies

1 hour -

Kenya to confront Russia over ‘unacceptable’ use of its nationals in combat

1 hour -

Running Ghana by elections, not by plans: Galamsey as the consequence

1 hour -

Israeli theatre scholar Prof Roy Horovitz brings cultural exchange to Ghana

1 hour -

Awula Serwaa slams Amansie Central Assembly over ‘Galamsey Tax’ defence

1 hour -

High airport infrastructure charges making Ghana’s aviation sector uncompetitive – stakeholders

2 hours -

Mining Indaba: African integration requires collective will – Armah-Kofi Buah

2 hours -

Drowning in hunger: Nawuni farmers struggle to survive amidst floods and climate change

2 hours -

15 women arrested in New Juaben South over human trafficking, sex work charges

2 hours -

Arrest officials issuing illegal mining licences, Ashigbey demands

2 hours -

Nyasabga’s women farmers bear the brunt of climate change and land degradation, others turn to smart agriculture

2 hours