Audio By Carbonatix

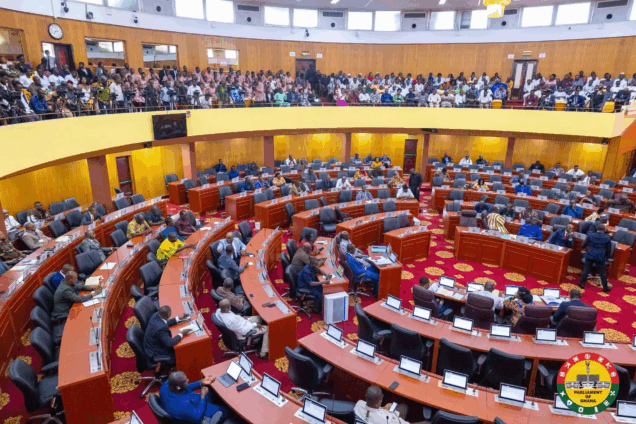

Parliament has approved the Value Added Tax (VAT) Bill, 2025, marking a major step toward overhauling Ghana’s VAT regime to improve clarity, consistency and legal certainty.

The new law replaces the existing flat-rate system with a unified structure designed to simplify the tax framework. It also raises the registration threshold for VAT-eligible businesses — a change expected to exempt many micro and small enterprises from VAT obligations altogether.

But during the debate, Minority Leader Alexander Afenyo-Markin warned that the revised framework could result in additional tax liabilities for businesses and increase the financial burden on the general public.

Deputy Finance Minister Thomas Nyarko Ampem dismissed these concerns, arguing that the reforms will make compliance easier, not harder, and will not introduce new tax burdens on businesses or consumers.

Latest Stories

-

GSFP conducts monitoring exercise in Volta, Bono and Bono East regions

3 minutes -

Full text: President Mahama’s speech at World Governments Summit 2026

6 minutes -

Africa deserves climate justice, not just climate action – Mahama

9 minutes -

NAPO, Kwabena Agyepong, Adwoa Safo among those lobbying to be Bawumia’s running mate — Akrofuom MP claims

10 minutes -

Iran’s president says it is ready to negotiate with the US

12 minutes -

FDA safely disposes 100,000 worth of seized goods in Western Region

20 minutes -

Mahama calls for ethical global governance of AI and digital systems

24 minutes -

Dr Kofi Amoah challenges political parties to offer real solutions beyond primaries

27 minutes -

What ‘Low-Entry’ digital services reveal about changing consumer habits

35 minutes -

Parliament resumes with over 600 pending bills

43 minutes -

Interior Minister presents 10 vehicles to NACOC

45 minutes -

Confederation Cup: CAF appoints Daniel Laryea for Kaizer Chiefs vs Al Masry clash

47 minutes -

New alliances with Africa must add value to natural resources – Mahama

47 minutes -

Integrate entrepreneurship into education to boost economic growth – Kwame Sowu Jnr

60 minutes -

GCB Bank marks annual thanksgiving with interfaith services

1 hour