Audio By Carbonatix

The Ghana Chamber of Mines has praised government for scrapping Value Added Tax (VAT) on exploration activities, calling the move timely, strategic, and crucial for sustaining the country’s long-term mineral potential.

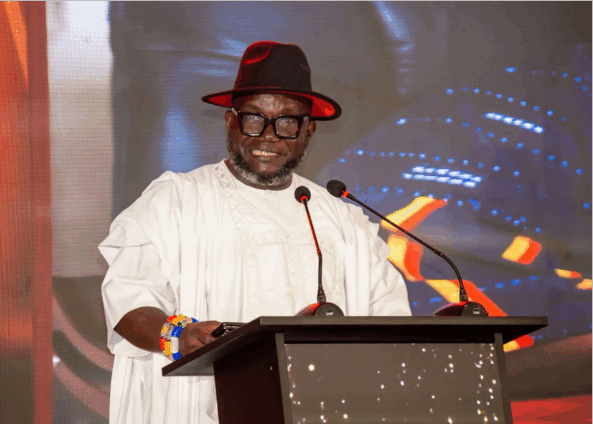

The announcement came during the 11th Ghana Mining Industry Awards (GMIA) at the Mövenpick Hotel, where Dr Kenneth Ashigbey, Chief Executive Officer of the Chamber, described the policy as a bold commitment to strengthening Ghana’s competitiveness as a mining investment destination.

Speaking at the event, Dr Ashigbey said the removal of VAT on exploration in the 2026 Budget is more than a fiscal adjustment.

“This intervention is not just an administrative adjustment; it is a bold commitment to attracting new investments,” he said. “It will sustain Ghana’s mineral reserves and reinforce the country’s competitiveness as a mining destination.”

He added that the Chamber hopes the same collaborative spirit that informed this decision will guide ongoing discussions on the mining royalty regime, ensuring a policy framework that benefits both Ghana and the industry.

Michael Edem Akafia, President of the Ghana Chamber of Mines, also commended the government for the VAT exemption, describing it as a strategic move to secure the future of the mining sector.

He acknowledged President John Mahama, Minister for Lands and Natural Resources Emmanuel Armah-Kofi Buah, and Minister of Finance Dr Ato Forson for their support in advancing the pro-investment measure.

Industry analysts have long argued that VAT on exploration activities imposes unnecessary financial pressure on mining companies, particularly in early-stage exploration where commercial viability is uncertain. Its removal is expected to boost investor interest, expand geological exploration, and accelerate the discovery of new mineral resources.

Dr Ashigbey also highlighted the broader impact of such progressive policies, noting that exploration-led investments ultimately translate into more jobs, stronger local economies, and expanded community development initiatives across mining regions.

The mining sector remains one of Ghana’s economic pillars, contributing significantly to export earnings, government revenue, and employment. Industry leaders say the VAT exemption positions Ghana to attract global exploration firms and unlock new value in its mineral-rich terrains.

Both Dr. Ashigbey and Mr. Akafia reaffirmed the industry’s commitment to partnering with government to develop policies that promote investment, transparency, and sustainable growth.

The awards ceremony also honoured outstanding contributors to the industry. AngloGold Ashanti Iduapriem Mine was crowned Mining Company of the Year, while Dr Catherine Kuupol Kutor, General Manager of Gold Fields Tarkwa Mine, received the prestigious Mining Personality of the Year award.

The late Kwame Addo-Kufuor was honoured posthumously with the Lifetime Achievement Award for his contribution to the sector.

The 11th Ghana Mining Industry Awards was proudly sponsored by Gold Fields, AngloGold Ashanti, Zijin Golden Ridge, Newmont, Newcore/Cape Coast Resources, Perseus Mining Ghana Limited, UMA, Sandvik Ghana, Interplast, and Stanbic Bank, with additional support from SMT Ghana, Asanko Gold Ghana, DRA, Mining Tools Ghana, Carmeuse Lime Products, and Liebherr.

Latest Stories

-

GACL MD calls for stronger international connectivity to position Accra as West Africa’s aviation hub

6 minutes -

Airlines, travel consultants pledge support for growth at 5th AviationGhana Breakfast Meeting

12 minutes -

Mrs Esther Ami Mensah-Abbey, aka Daavi

22 minutes -

Mrs Theresa Ata Bosomefi Ayansu

28 minutes -

A seat at the table or on the menu? Africa grapples with the new world order

33 minutes -

Kenya’s border with Somalia set to re-open after almost 15 years

43 minutes -

Manchester United fans have say on owner’s immigration claims

53 minutes -

Ratcliffe sorry language ‘offended some’ after immigration comments

1 hour -

Trump revokes landmark ruling that greenhouse gases endanger public health

1 hour -

Kim Jong Un chooses teen daughter as heir, says Seoul

1 hour -

Morocco to spend $330m on flood relief plan

2 hours -

Samini’s ORIGIN8A storms Apple Music Ghana charts at No. 7

4 hours -

Ghana’s gold output hits record 6 million ounces in 2025, industry group says

4 hours -

‘I’m a lover boy, not womaniser’ – 2Baba on fatherhood, marriage to Natasha

5 hours -

Tems becomes first African female artist to have 7 entries on Billboard Hot 100

5 hours