Audio By Carbonatix

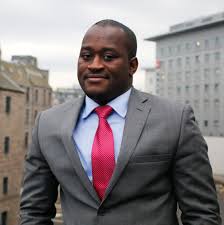

Dr Theo Acheampong, Technical Advisor at the Ministry of Finance, has highlighted the critical role the Ghana Gold Board (GoldBod) is playing in stabilising the cedi by channelling foreign exchange from the artisanal and small-scale mining (ASM) sector into formal banking channels.

Speaking on Channel One TV on Monday, January 5, Dr Acheampong said that before the introduction of the current policy framework, a significant portion of foreign currency generated from small-scale gold mining did not enter the official financial system.

“If you did a proper disaggregation and all the analytical work, I would think that the proportion of those hitherto gold dollars from the ASM sector that was coming into the formal banking channels was probably on a scale of 20 or 30 per cent,” he stated.

He explained that what has changed under the GoldBod arrangement is a deliberate policy decision to compel these inflows into the formal system.

“What is radically different this time is that you are, in essence, through policy, trying to force them to bring those dollars into your formal channels via GoldBod and ultimately to the central bank. This is why this is extremely very important,” Dr Acheampong said.

According to him, Ghana’s currency would have been far weaker if the country had relied solely on reforms under the International Monetary Fund (IMF) programme.

“If it was just the IMF reforms, I can tell you that the cedi would have been in a relatively worse shape than we are now. Your exchange rate would not have ended the year at GH¢10.45 or GH¢10.5; it may have moved from GH¢15 to around GH¢13,” he noted.

To buttress his argument, Dr Acheampong referenced the IMF’s own assessment of Ghana’s foreign exchange management. Quoting from the Fund’s report, he said: “In paragraph 33, the IMF notes that ‘the Bank of Ghana is actively managing the FX market while increasing its footprint. Since programme approval, the bank has taken an increasingly active role as an intermediary in the FX market on the back of stronger balance-of-payments inflows.’”

He added that the report further confirms that “the domestic gold purchase programme has been the key source of these inflows, alongside cocoa and repatriation,” underscoring GoldBod’s importance in sustaining cedi stability.

Latest Stories

-

Unlicensed betting firms face sponsorship ban

2 hours -

Police investigate ‘abhorrent’ racist abuse of players

2 hours -

FIFA wants injured players to stay off for one minute

2 hours -

Pacquiao and Mayweather agree professional rematch

2 hours -

Ghana intensifies U.S. investment drive with strategic California outreach

3 hours -

UK says ‘nothing is off the table’ in response to US tariffs

3 hours -

Netflix boss defends bid for Warner Bros as Paramount deadline looms

3 hours -

One Man, One Woman or Polygamy?

3 hours -

‘The end of Xbox’: fans split as AI exec takes over Microsoft’s top gaming role

4 hours -

Carney heading on trade trip as Canada seeks to reduce reliance on US

4 hours -

Trump threatens countries that ‘play games’ with existing trade deals

4 hours -

A Plus seals three-year partnership with MGL for Gomoa Easter Carnival

5 hours -

Parliament to probe SHS sports violence; sanctions to apply – Ntim Fordjour

5 hours -

Upholding parental choice and respecting the ethos of faith-based schools in Ghana

5 hours -

SHS assault: Produce students in 24 hours or we’ll storm your school – CID boss to SWESBUS Headmaster

6 hours