Audio By Carbonatix

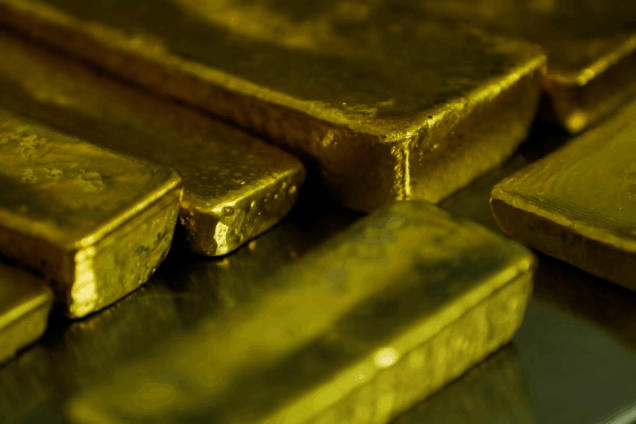

Ghana produced a record 6 million ounces of gold in 2025, according to provisional data, with large‑scale mines contributing 2.9 million ounces, unchanged from last year, an association of multinational and local mining companies told Reuters on Thursday.

However, the industry cautioned that next year's projected 6.5‑million-ounce output is at risk, citing concerns over Ghana's planned overhaul of mineral royalties, which could delay new projects and expansions that underpin 2026 production.

The Ghana Chamber of Mines CEO, Kenneth Ashigbey, said 2025 production exceeded its target, driven by artisanal and small‑scale mining (ASM), which rose to about 3.1 million ounces.

SURGING GOLD PRICES, REFORMS DRIVE OUTPUT

Record-high bullion helped divert more artisanal gold supply into formal channels under recent reforms, Ashigbey said on the sidelines of the African mining conference, Mining Indaba.

Africa's top gold producer plans to replace its fixed royalty rate with a sliding‑scale of 5% to 12% tied to gold prices.

Ghana, like many other African countries, is raising mining royalties as governments seek to capture more revenue from their natural resources amid surging commodity prices.

Reuters previously reported that Ghana agreed to reduce an existing levy to facilitate passage of the reform, but mining companies say the proposed rate remains too steep and have proposed lower rates.

The new regime could take effect this month unless amended or withdrawn.

"We stayed almost flat in 2025, but the concern is 2026," Ashigbey said. "The royalty increase will hit new projects immediately — the ones meant to lift next year’s production."

The industry body said stable large-scale 2025 output reflects production ramp-ups at Shandong Mining's Cardinal Namdini and Newmont’s Ahafo North against declining grades at older mines, including Gold Fields’ Damang.

Artisanal supply, which is hardly levied, was steadier after Ghana’s gold-buying programme reduced smuggling, Ashigbey said.

HIGHER ROYALTIES THREATEN JOBS

Miners argue that the proposed scale would squeeze cash flow, force them to process only high-quality ore, and shorten mine lives.

A chamber position paper seen by Reuters shows that lifting royalties from 5% to 7% at a realized price of $2,044/oz would cut net present value of AngloGold Ashanti's Obuasi mine by 8% under the new scale — enough to drop it below typical hurdle rates — while Perseus Mining’s planned $170 million expansion of the Edikan mine's pit would become uneconomic.

Together, the two projects account for 1,344 jobs and more than $800 million in future royalties and taxes.

Adamus Resources and Asante Gold will also be hit hard, Ashigbey said.

Perseus, AngloGold Ashanti, Adamus and Asante Gold did not immediately respond to requests for comment.

Latest Stories

-

Golden Jubilee Sports Festival opens with call for discipline, unity

33 minutes -

Land guards take over Tuba irrigation farm as farmers protest

33 minutes -

Police arrest 2 cybercrime suspects, rescue kidnapped victims in Tema

36 minutes -

Women’s Development Bank rollout at advanced stage – Vice President

38 minutes -

Cocoa reforms will safeguard farmers’ interests – Ato Forson assures

44 minutes -

Be patient; not everyone can be appointed – Asiedu Nketia to NDC faithful

50 minutes -

NAIMOS arrests 3 Chinese nationals, a Ghanaian in Mpohor galamsey swoop

58 minutes -

We must work to achieve a Navy that is robust, globally respected – CNS

1 hour -

Community leaders in Ayawaso East urged to act responsibly, safeguard public peace

1 hour -

Parliament launches five-year corporate strategic plan

1 hour -

Water crisis tops concerns of residents at NCCE forum in Tamale

1 hour -

Sky Train Project was never approved- Ex-GIIF Board Secretary

1 hour -

GACL MD calls for stronger international connectivity to position Accra as West Africa’s aviation hub

2 hours -

Airlines, travel consultants pledge support for growth at 5th AviationGhana Breakfast Meeting

2 hours -

Mrs Esther Ami Mensah-Abbey, aka Daavi

2 hours