Audio By Carbonatix

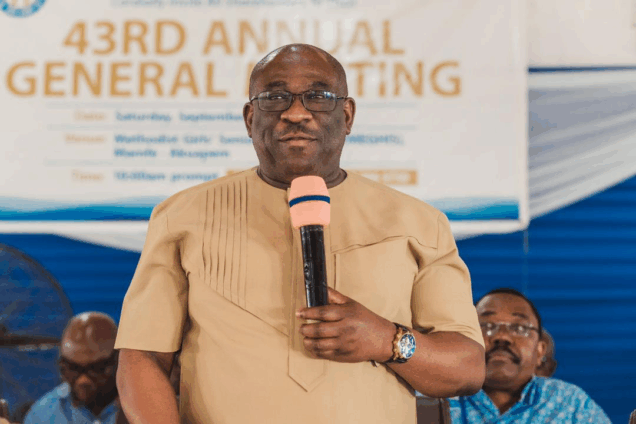

The Managing Director of the Agricultural Development Bank (ADB) PLC, Edward Ato Sarpong, has commended Akuapem Rural Bank PLC for its strong focus on empowering women through credit financing.

This he described as a key driver of financial inclusion and sustainable banking.

Speaking as the Guest of Honour at the Bank’s 43rd Annual General Meeting (AGM), Mr Sarpong praised the institution’s Credit with Education (CwE) programme, which has consistently directed about 50 per cent of annual loan disbursements to women.

He noted that in 2024 alone, the Rural Bank advanced GH¢60.33 million, representing 49.93 per cent of total loan disbursements, to 5,267 women.

This marked a 23 per cent increase over the previous year, with an impressively low non-performing loan ratio of 0.13 per cent.

“This achievement is not only commendable but also aligns with the Sustainable Development Goal of poverty alleviation, given its direct impact on households and communities”, he mentioned.

Mr Sarpong encouraged the Bank to deepen its investment in the CwE programme while also strengthening risk management systems and incorporating technology to expand outreach and enhance financial inclusion.

He further applauded the overall performance of the Rural Bank, attributing it to strong governance, quality leadership, and the support of shareholders.

“The quality of your Board is evident in the results achieved, and I urge shareholders to continue backing them to ensure further growth,” he noted.

The bank’s post-tax profit increased by 186% from GH¢1.35million in 2023 to GH¢3.85 million in 2024, and total assets grew from GH¢156 million in 2023 to GH¢208million in 2024.

The Board Chairman of the bank, Dr Ernest Obuobisa-Darko noted deposit growth of 30.77% (from 137.1million in 2023 to 179.3million in 2024), loan growth of 29.01% and investment growth of 33.15% which all contributed immensely to the overall growth in profitability and assets.

He expressed gratitude to Management and staff for their hard work in achieving growth in all of its key financial indicators in 2024.

The 43rd AGM brought together shareholders, board members, management, and invited guests.

Latest Stories

-

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

9 minutes -

Trump threatens strong force if Iran continues to retaliate

24 minutes -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

2 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

3 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

3 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

4 hours -

Free-scoring Semenyo takes burden off Haaland

5 hours -

Explainer: Why did the US attack Iran?

5 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

6 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

6 hours -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

7 hours -

Over 50 students hospitalised after horror crash ends sports tournament

7 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

8 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

8 hours -

Kane scores twice as Bayern beat rivals Dortmund

9 hours