Audio By Carbonatix

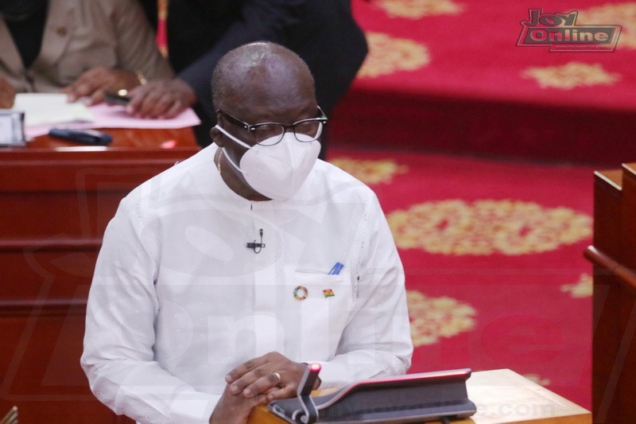

Finance Minister, Ken Ofori Atta has tasked the newly formed board of the Minerals Income Investment Fund, to appropriately address concerns raised by critics and stakeholders of the Agyapa Royalty Deal before it is submitted to Parliament.

This he said, is to make the deal operational and fit for purpose.

The Finance Minister made the call when he inaugurated the Board in Accra on Tuesday, October 12, 2021.

“…address and overcome all the concerns against the Agyapa transaction, so we can go to the market and create the first mineral royalty company in Ghana and in Africa because it is good for Ghana.”

He charged them to continue with the work that has been done in fulfillment of the theme of the 2021 budget, ‘Continuity, Consolidation and Completion’ in order to launch the Deal on the international market as soon as possible.

According to the Minister, “I’m unequivocal that it is the way to go in terms of monetizing our minerals and finding a way to leverage it to reduce the level of debt of the country and move it into equity. And with the concerns that were raised, we should be able to address them and move forward.”

The Agyapa Royalties deal, was approved by Parliament but was withdrawn by government following a Corruption Risk assessment by the former Special Prosecutor, Martin Amidu.

The Corruption Risk Assessment revealed that there was reasonable suspicion of bid-rigging and corruption activity in the selection process of the deal.

It was also discovered that the transaction was embroiled in infractions regarding relationships and conflict of interest.

Background

On August 14, 2020, Parliament approved the Agyapa Minerals Royalties Investment Agreement and four related documents to allow for the monetisation of Ghana’s future gold royalties.

Under the agreement, Agyapa Mineral Royalties Limited has been incorporated in Jersey near UK to receive and manage royalties from 16 gold mining leases over the next 15 years or so.

In exchange, the firm will list on the London and Ghana Stock Exchanges (GSE) and raise at least $500 million for government to invest in infrastructure, health and education.

The listing will allow private people to buy a 49 per cent stake in the firm.

However, some 22 civil society organisations called for a suspension of the deal, insisting it was not in the interest of Ghana.

Latest Stories

-

First Lady champions ‘Give to Gain’ spirit for International Women’s Day

28 minutes -

See the areas that will be affected by ECG’s planned maintenance today, March 8

43 minutes -

Ghana@69: Ghana mission in Canada promotes investments and partnerships

53 minutes -

Lebanon condemns ‘grave breach’ as missiles strike Ghanaian UN base

1 hour -

Franklin Cudjoe demands urgent TOR overhaul as Middle East crisis threatens fuel security

1 hour -

10 injured in three-vehicle crash on Konongo–Kumasi road

2 hours -

UK aircraft carrier given five days to be ready to deploy

2 hours -

Ghana to replicate digital innovation success in Malawi

2 hours -

Iranian ambassador warns UK to be ‘very careful’ about further involvement in war

2 hours -

She Gives: The ripple effect of women who choose to give

3 hours -

Nadowli-Kaleo District observes 69th Independence Day with cultural exhibition and academic awards

3 hours -

Chambas Team of Red Alert, Narcotics Commission join forces to combat drug abuse

3 hours -

Tano North MCE launches 75 km road project under DRIP initiative

3 hours -

Galamsey Chemicals and Air Pollution linked to rising Diabetes risk in children

4 hours -

EduSpots celebrates a decade of digitalised community-led education and shares future vision

4 hours