Audio By Carbonatix

Fresh data from the Bank of Ghana, tracked by JoyNews Research, show a sharp deterioration in Ghana’s oil export earnings in 2025.

By the end of October, oil exports stood at $2.2 billion, compared with $3.3 billion over the same period in 2024. That represents a decline of $1.12 billion.

The decline reflects a combination of weaker international oil prices and falling domestic production.

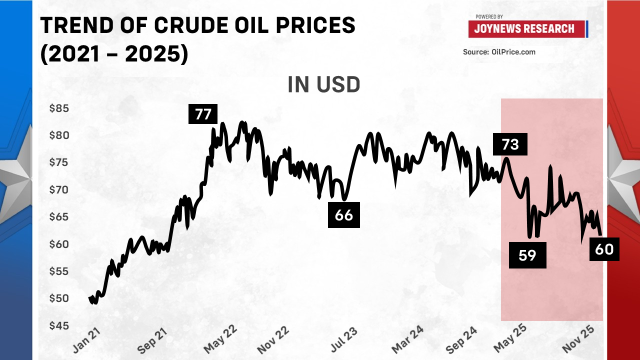

Oil entered 2025 trading slightly above $70 per barrel but prices have steadily declined since then, touching lows of about $59 and currently hovering around $60 per barrel.

This is well below the $70 to $80 range that prevailed through much of 2023 and 2024. The data suggest that average oil prices in 2025 are the lowest since the latter part of 2021, a trend that has weighed heavily on oil producing countries such as Ghana.

For Ghana, however, price weakness tells only part of the story. The revenue shortfall has been compounded by falling production volumes.

While some oil producers are able to cushion lower prices with higher output, Ghana’s production has been moving in the opposite direction.

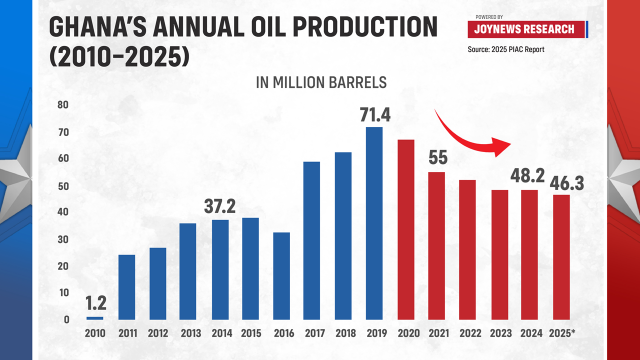

After peaking in 2019 at 71.4 million barrels, output has declined every year since.

In 2024, Ghana produced about 48 million barrels. The Public Interest and Accountability Committee estimates production of 46.3 million barrels for 2025, although that projection already appears optimistic.

In 2019, the Ministry of Finance had set a target of 500,000 barrels per day by 2024. In 2025, actual production stands at about 126,994 barrels per day, far below that ambition.

The slowdown is evident in recent production data. In the first half of 2025, Ghana produced 18.4 million barrels, compared with 24.8 million barrels over the same period in 2024. That represents a decline of 25.8%.

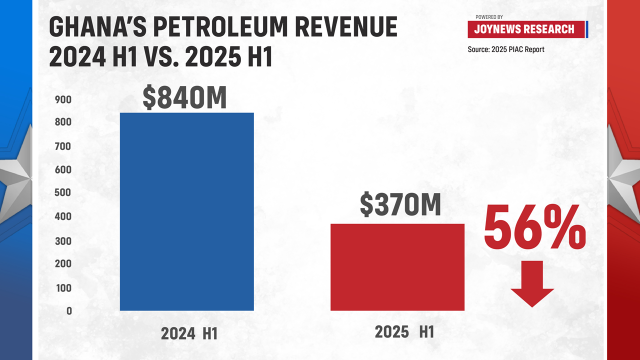

Government revenues have fallen even faster. Oil receipts dropped by 56%, from $840 million in the first half of 2024 to $370 million in the first half of 2025.

While export earnings have weakened, Ghana’s oil import bill has risen. Imports of refined petroleum products increased by about $500 million over the first ten months of 2025 compared with the same period in 2024.

This translates into monthly petroleum imports of roughly $430 million, up from about $390 million per month last year. The combination of falling export revenues and rising import costs has widened pressure on the balance of payments and increased demand for foreign exchange.

Behind these trends lie structural weaknesses in Ghana’s petroleum sector.

Policy missteps in the upstream industry and the lack of new petroleum agreements have made the sector less attractive to investors.

With no new wells coming on stream, production continues to decline, eroding government revenue and increasing reliance on imported petroleum products.

The growing domestic demand for refined petroleum strengthens the case for scaling up local refining capacity to meet domestic consumption and reduce the import bill.

Cutting petroleum imports, which now average about $400 million a month, would significantly ease pressure on the cedi and lower Ghana’s exposure to external shocks.

The Ghana Petroleum Hub Corporation aims to address this gap by positioning the country as a regional supplier of refined petroleum products, but progress will depend on sustained policy clarity and investment.

Without decisive action, Ghana risks remaining caught between declining oil production, weaker export earnings and rising import costs.

Restoring momentum will require renewed confidence in the upstream sector alongside faster progress in domestic refining.

Until then, oil will remain a growing vulnerability rather than a stabilising force for the economy.

Latest Stories

-

President Mahama commissions B5 Plus Steel Ball Mill and Manufacturing Plant to ignite industrial revolution

50 minutes -

This Saturday on Prime Insight: CJ’s ‘No Prima Facie’ ruling and Burkina Faso bloodshed

3 hours -

Trump says he is considering limited military strike on Iran

4 hours -

Strategic voices of the opposition: Miracles Aboagye’s field advocacy and Akosua Manu’s communication shape NPP’s path forward?

4 hours -

Trump plans new 10% tariff as Supreme Court rejects his global import taxes

5 hours -

Ghana can supply steel to entire West Africa if domestic steel industry thrives – Mahama

5 hours -

Gyakie appreciates media houses for continued support

6 hours -

Imprisonment isn’t hopelessness – Ahafo GTA Regional Director tells inmates

6 hours -

GH¢150m allocated for Black Stars’ 2026 World Cup preparations — Ernest Norgbey

7 hours -

Strong food policies will protect the Ghanaian consumer against Non-Communicable Diseases – Groups

7 hours -

JORVAGO marks 15 years in music with new single

7 hours -

The Republic of Uncompleted Dreams…

8 hours -

Gov’t will not bow to pressure to restore old cocoa producer prices – Mahama Ayariga

8 hours -

Ghana Medical Trust Fund saves ICT tutor’s life

8 hours -

Family of rescued baby demands justice as Odododiodio MP urges stronger security measures

9 hours