Audio By Carbonatix

Banks in Ghana remain in a solid position despite Ghana’s challenging economic environment and the ongoing efforts of the Domestic Debt Exchange Programme (DDEP), Fitch Solutions has stated in its new report dubbed “Ghana’s New CRRs To Have Muted Impact On Loan Growth And Weigh On Profits”.

According to the London-based firm, the banking sector has reported strong growth in balance sheet items despite unfavourable conditions.

It added that capital levels, which had fallen close to the minimum requirement, are beginning to improve again, and banks are recording robust profits.

However, it explained that the recently introduced linking of banks’ cash reserve ratio (CRR) requirement to their loan-to-deposit ratio (LDR) will have several unfavourable consequences.

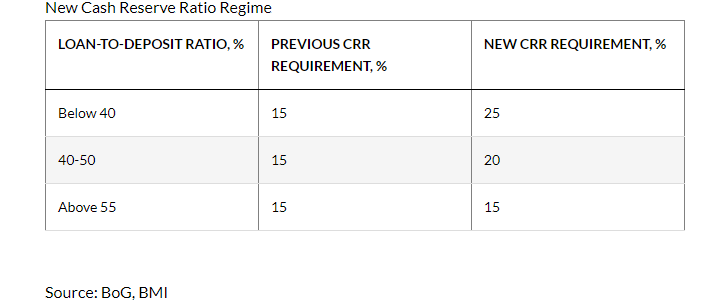

On March 25 2024, the Bank of Ghana (BoG) introduced a new regime aiming to boost lending and reduce excess local-currency liquidity to control inflation by linking the CRR to the LDR. “While we believe this will compel some banks to extend more credit, very poor loan quality will keep lending too risky for others, who will instead prefer to hold high cedi cash reserves at the central bank”, it stressed.

The table below shows the new requirements, which took effect at the end of April 204.

CRR to spur loan growth

Furthermore, Fitch Solutions said “We believe this new regime will support loan growth for some banks”.

Institutions with currently low ratios of non-performing loans (NPLs) to total loans, will have room to increase their lending and, therefore, their LDR, which will boost industry credit growth in 2024. For instance, Zenith Bank, Access Bank, and GTBank – the seventh, eighth, and ninth largest banks in Ghana, respectively – recorded NPL ratios between 2-4% in quarter one 2024.

It said, this will allow them to increase lending, with an average LDR of 20.2% for the same period.

The growth will be supported by an improving economic environment characterised by interest rate cuts, falling inflation, and strong economic growth, which will boost credit demand. Additionally, these diminishing headwinds will make it easier for households and businesses to repay their debts, improving banks' loan quality and incentivising further credit extension.

Latest Stories

-

Interior Minister receives Gbenyiri Mediation report to resolve Lobi-Gonja conflict

8 minutes -

GTA, UNESCO deepen ties to leverage culture and AI for tourism growth

22 minutes -

ECG completes construction of 8 high-tension towers following pylon theft in 2024

45 minutes -

Newsfile to discuss 2026 SONA and present reality this Saturday

53 minutes -

Dr Hilla Limann Technical University records 17% admission surge

1 hour -

Meetings Africa 2026 closes on a high, Celebrating 20 years of purposeful African connections

1 hour -

Fuel prices to increase marginally from March 1, driven by crude price surge

1 hour -

Drum artiste Aduberks holds maiden concert in Ghana

2 hours -

UCC to honour Vice President with distinguished fellow award

2 hours -

Full text: Mahama’s State of the Nation Address

2 hours -

Accra Mayor halts Makola No. 2 rent increment pending negotiations with facility managers

2 hours -

SoulGroup Spirit Sound drops Ghana medley to honour gospel legends

2 hours -

ECG reinforces ‘Operation Keep Light On’ in Ashanti Region

2 hours -

UK remains preferred study destination for Ghanaians – British Council

2 hours -

Ghana Medical Trust Fund: Maame Samma Peprah ignites chain of giving through ‘Kyerɛ Wo Dɔ Drive’

3 hours