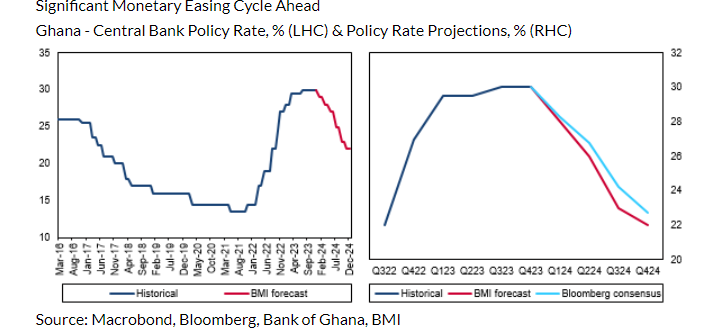

The Bank of Ghana will cut the policy rate by another 100 basis points to 28.00% at the next Monetary Policy Committee meeting in March 2024, Fitch Solutions has predicted.

This will be the second consecutive time if the Central Bank goes ahead to reduce the policy rate.

It disclosed this in its latest article dubbed “More Interest Rate Cuts On The Way In Ghana, Following Cautious Start Of Easing Cycle”. Here is a report.

“We expect that the BoG will cut the policy rate by another 100bps to 28.00% at the next MPC meeting in March. Inflation will remain on a downward trend over the coming months, in part driven by statistical base effects and the lagged impact of monetary tightening”.

Already, the UK-based firm is predicting an 800 basis points decline in the monetary policy rate to 22.0% in 2024.

It pointed out that the disinflation process will continue throughout 2024, supported by base effects.

Moreover, a gradual improvement in investor sentiment and a $600 million International Monetary Fund disbursement will keep the exchange rate stable at roughly GH¢12.00 to a dollar on the interbank market throughout quarter one of 2024.

As such, it alluded that the price pressures stemming from imported goods and services will remain limited over the coming months, supporting the ongoing disinflationary trend.

The Bank of Ghana cut its policy rate to 29.00% on January 29, 2024.

This Fitch Solutions said was in line with its expectations of a monetary easing cycle in January prompted by a significant slowdown in inflation.

“We believe that the Bank of Ghana (BoG) will cut the benchmark interest rate by another 700 basis points (bps) to 22.00% by year-end, following a 100bps cut to 29.00% on January 29. In line with our expectations, the BoG kicked off a monetary easing cycle in January, prompted by a significant slowdown in inflation, which fell from 35.2% y-o-y in October to 23.2% in December”.

Latest Stories

-

FIFA Club World Cup 2025: Sundowns, Esperance join Al Ahly and Wydad as CAF representatives

2 hours -

CAFCL: Al Ahly set up historic final with ES Tunis

3 hours -

We didn’t sneak out 10 BVDs; they were auctioned as obsolete equipment – EC

6 hours -

King Charles to resume public duties after progress in cancer treatment

7 hours -

Arda Guler scores on first start in La Liga as Madrid beat Real Sociedad

7 hours -

Fatawu Issahaku’s Leicester City secures Premier League promotion after Leeds defeat

7 hours -

Anticipation builds as Junior Speller hosts nationwide auditions

8 hours -

Etse Sikanku: The driver’s mate conundrum

8 hours -

IMF Deputy Chief worried large chunk of Eurobonds is used to service debt

9 hours -

Otumfuo Osei Tutu II celebrates 25 years of peaceful rule on golden stool

9 hours -

We have enough funds to pay accruing benefits; we’ve never missed pension payments since 1991 – SSNIT

9 hours -

Let’s embrace shared vision and propel National Banking College – First Deputy Governor

10 hours -

Liverpool agree compensation deal with Feyenoord for Slot

10 hours -

Ejisu by-election: There’s no evidence of NPP engaging in vote-buying – Ahiagbah

10 hours -

Ejisu by-election: Independent ex-NPP MP’s campaign team warns party against dubious tactics

10 hours