Audio By Carbonatix

The Ghana National Chamber of Commerce and Industry (GNCCI) is warning businesses will be forced to flee the country due to the unbearable tax environment.

This warning follows the passage of three controversial taxes into law by parliament last Friday.

The taxes namely; the Income Tax Amendment Bill, the Excise Duty Amendment Bill, and the Growth and Sustainability Amendment Bill are expected to generate about GH¢4 billion annually.

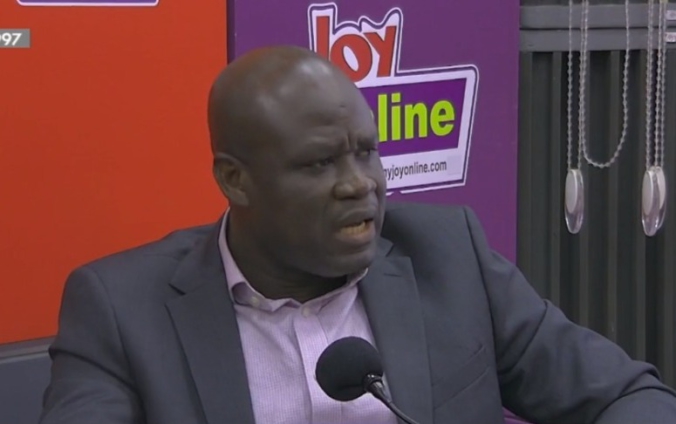

Speaking on JoyNews’ AM Show on Monday, Chief Executive of GNCCI, Mark Badu-Aboagye said businesses will leave the country due to the continuously growing tax burden.

According to him, the businesses will settle in countries that have a conducive environment for their businesses to thrive.

He stated that the passage of the taxes will result in the collapse of businesses and downsizing in some cases.

“Businesses that will not be able to survive here [Ghana] will relocate to other countries and we have seen some of them relocating. Some of them are closing down and going to the neighbouring countries because the business environment is conducive. You are losing taxes on those people that you want to get revenue from,” he pointed out.

Mr Badu-Aboagye also doubted the government's capability to realise the earmarked four billion cedis from these taxes, arguing that there will also be a high incidence of tax avoidance.

“The incidence of these taxes is on businesses and the incidence of these taxes is on consumers of products of the businesses. Now, while the taxes that they have passed, businesses are supposed to pay and as I have said earlier, you can only tax me when I make profit … if I don’t make profit how do you tax me?” he questioned.

In a related development, the Ghana Union of Traders Association (GUTA) has also reacted furiously to the passage of the taxes, insisting Parliament has failed Ghanaians.

This the PRO of GUTA, Joseph Padi explained, is because the timing for the passage of the three taxes is bad.

“In fact, Parliament has failed us, we thought they were working for us rather they were working for themselves,” he said.

According to him, the money sought by the country from the International Monetary Fund was obtained during the Covid period, and if the requested fund is the only way and must be generated internally, there are other options.

He proposed that “the leakages in the system should be closed” rather than introducing new taxes.

Latest Stories

-

Bole MP donates GHS200,000 to support teacher training college establishment

14 minutes -

Danyame Old Town residents face eviction on a land occupied for 200 years

17 minutes -

60% of our water bodies are polluted – Minority Chief Whip pushes Ecocide Law

18 minutes -

Gov’t distributes seized ‘galamsey’ water pumps to farmers to boost irrigation – Dumelo

24 minutes -

MC Abeiku Sarkcess ignites Sarkodie’s Rapperholic UK with high-energy command

29 minutes -

Photos: Jonina Ladies record 3-0 win over Halifax Queens

29 minutes -

Government to establish over 250 Farm Service Centres in four years – John Dumelo

35 minutes -

Full text: Statement by Frank Annoh-Dompreh, Minority Chief Whip and Nsawam-Adoagyiri MP on Legislation on Ecocide in Ghana

37 minutes -

Savannah Shooting: Death toll rises to 10 as Police search for more bodies

40 minutes -

Yes to life! No to drugs

48 minutes -

Ghana must adopt ‘push-pull’ farming to boost production – FAGE President

50 minutes -

Fourth edition of SBE Cup set to uncover Ghana’s next football stars on March 16

54 minutes -

Doctor raises concern over rising UTI cases among children from affluent homes

54 minutes -

Regular check-ups key to early diagnosis of medical condictions – Little Angels Trust founder

57 minutes -

Four injured Ghanaian soldiers responding to treatment, likely to be managed in Lebanon — GAF

1 hour