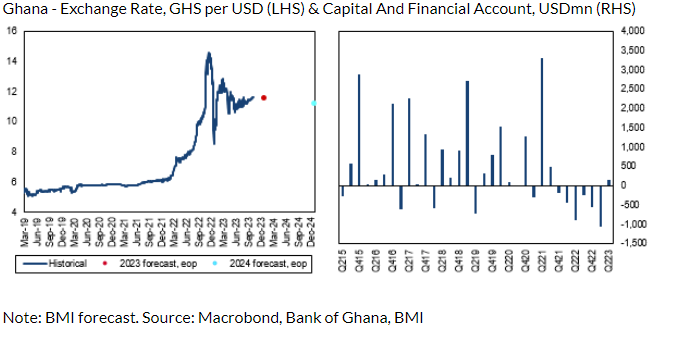

The Ghana cedi is expected to strengthen by roughly 1.0% to the US dollar in 2024, Fitch Solutions has disclosed in its latest Country Risk on Ghana.

This will make it one of the best-performing currencies in Africa during the period.

According to the UK-based firm, the government will make progress regarding the restructuring of Ghana’s external debt under the G20 Common Framework by the second quarter of 2024.

This it says will boost investor sentiment towards Ghanaian assets, drive capital inflows, and provide support to the cedi.

“We forecast that the exchange rate will strengthen by roughly 1% in 2024 as we believe that the authorities will make progress regarding the restructuring of Ghana’s external debt under the G20 Common Framework”.

“Indeed, we anticipate that a deal will be reached around quarter 2 2024-quarter 3 2024, which will improve investor sentiment towards Ghanaian assets, drive capital inflows and provide support to the cedi.

Last week, the cedi shed some marginal value against the US dollar, following increased domestic demand and the strengthening of the US dollar globally.

However, the timely announcement by the International Monetary Fund Mission Team to Ghana of a staff-level agreement reached with the government would boost investor confidence and strengthen the country’s balance of payment going forward The deal will culminate in another $600 million inflows.

The local currency is expected to end 2023 at a depreciation of 11.50% to the American greenback on the retail market.

This will be far lower than the about 40% depreciation it recorded in 2023.

Latest Stories

-

Premier League clubs vote in favour of spending cap plans

3 mins -

Nigeria’s fuel crisis brings businesses to a halt

5 mins -

King Promise impresses fans at sold out show in Singapore

9 mins -

CSOs and NGOs unite to push for priority demands at INC-4

22 mins -

Fuel tanker bursts into flames on Kumasi-Accra highway

28 mins -

EC’s stolen BVR kits, laptops: One granted bail, three still on remand

38 mins -

2 Things: Sista Afia releases first song off her upcoming album

55 mins -

GHS to embark on COVID-19 vaccination campaign starting May 4

1 hour -

CAF Confederation Cup: I’ve learned valuable lessons that will help future generations – Karim Zito

1 hour -

Create partnership with Ghanaian businesses – K.T. Hammond tells U.S. business leaders

1 hour -

5 dead, over 14 injured in gory accident near Obuasi

2 hours -

Without my approval, no road can be constructed in Ghana – Akufo-Addo

2 hours -

Cleaner to stand trial over Cashier’s death at Twumasiwaa Hospital

2 hours -

Bawumia pledges full Ghanaian ownership of natural resources if elected president

2 hours -

Global financial institutions call for comprehensive treaty to end plastic pollution

2 hours