Veteran Actor, David Dontoh, who was part of the advocates selected to lead the campaign on annuities has urged people in the creative industry to take advantage of this product to save for a ‘rainy day'.

According to him, he believes the annuities would serve as a financial management tool for those in the creative sector when they retire from active service.

He made these remarks when the National Insurance Commission (NIC) as part of efforts to deepen the annuity market in the country, commenced a series of engagements aimed at educating the public on annuities.

An annuity is a contract between a person, usually a retiree, and an insurance company whereby the insurer makes a promise to make periodic payments to the owner of the product, starting mostly upon retirement.

An individual purchases an annuity either with a single payment or a series of payments called premiums.

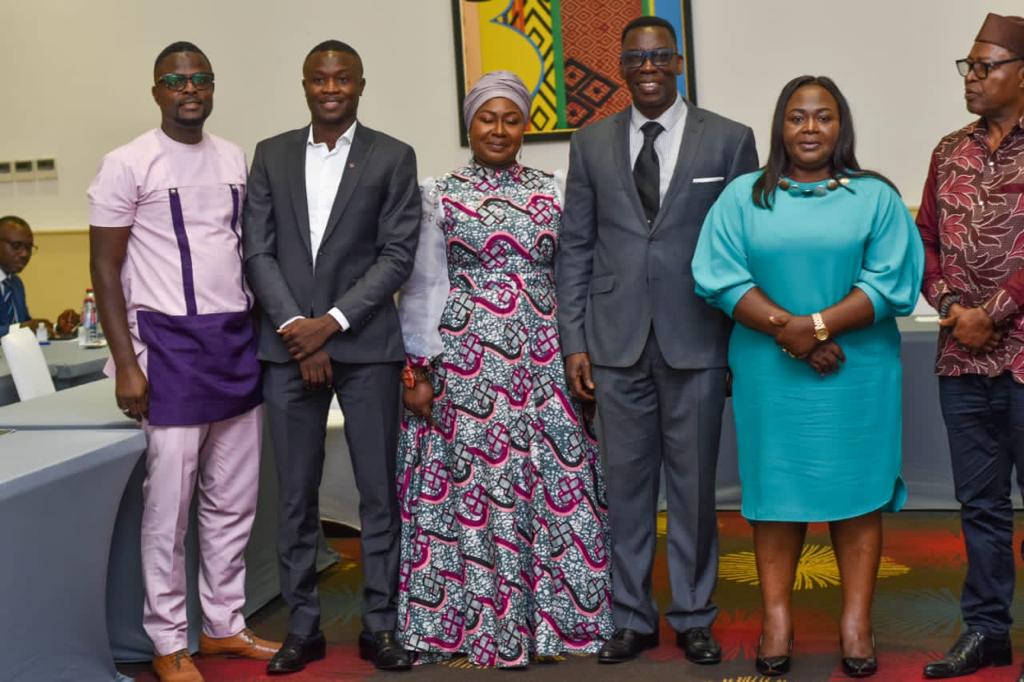

In his interaction with some key stakeholders in the media and entertainment industry who have been selected to lead the advocacy, the Commissioner of Insurance, Dr Justice Ofori, said most annuity arrangements provide a way to earn while still on retirement.

He said there was, therefore, the need for every individual to sign on to an annuity product since it guarantees living a stress-free life upon retirement.

This, he said would help the individual sustain a decent lifestyle and mitigate the impact of the rising costs of living that characterises retirement.

“This is an area that is largely unknown or not properly comprehended by many people, particularly in our part of the world.

“The campaign we intend embarking on with you as spearheads are therefore to raise awareness among the general public for the need to include protected lifetime income solutions such as annuities within a comprehensive retirement plan,” Dr. Ofori stated.

Other Advocates included Gyedu Blay Ambulley, Oheneyere Gifty Anti, Nana Yaa Konadu, Abeiku Aggrey (Santana) and Nana Adwoa Awindor. Others are Saddick Adams, Reggie Rockstone, Stephen Tetteh Charway and Alhaji Salifu Abdul-Daim!

Some of them bemoaned the situation where a lot of people in the creative industry have the notion that they can earn royalties from their works even when they are no more.

“And that is why a lot of our creatives in their old ages look pitiful. This is because they didn’t have any insurance arrangements that helped them to plan towards a secure reliable future,” one of the advocates stated.

They were excited by the fact that annuity as has been described, would therefore go a long way to help the creatives save for a rainy day when they need to be up and going more.

Harnessing synergies

Dr Ofori said the development of the annuities market was part of efforts by the NIC to harness the synergies from the pensions market.

He said the Commission started taking these steps, having in mind the lump sums from tier 2 and tier 3, which are available to those eligible to retire under the New Pensions System.

“As stakeholder consultations have been significantly concluded, the NIC has already issued the requirements that life insurance companies desirous of writing annuities must meet.

“Our collaborations with the GIZ to organize capacity-building workshops on the design and sale of annuities had since been completed hence our being here today,” he stated.

Guarantee of constant income

In an interview with the media, Dr Ofori said the NIC had realised that a lot of people after retirement found it difficult to survive after they have received their lump sums from the tier 2 pension scheme and are therefore forced to rely on just the monthly payments from their social security contributions which mostly requires some backing from one’s own financial arrangement such as annuities.

He said annuity was therefore a guarantee of constant income over an individual’s lifetime.

“Instead of taking your lump sum and not knowing how to manage it, it is good to give it to a life insurance company that can manage the funds and guarantee you a monthly income for the rest of your life,” he stated.

He also assured the public that there were regulations to ensure that such monies were invested in secured investments so that there is no risk of losing the money.

“Annuities have strict guidelines which we always enforce and it is not any company that is allowed to sell annuity.

“Before you are allowed to do so, you have to undergo proper screening for us to be convinced that people’s future being put in your hands will be well protected,” he assured.

Planning towards retirement

“Everything you do in your earlier years as a creative, you get a lot of engagements but as you grow older, the engagements reduce to a point where you may do only one production in a year. Are you going to live on that one production?

“This is why it is necessary for all of us to see this as something that has come at a good point in time for us to prepare our future,” he said.

Living on annuities

Popular radio presenter, Abeiku Santana, also for his part said although annuities were very popular in the developed countries, the situation was different in this part of the world.

He said the NIC’s decision to create awareness of this product was a step in the right direction, as this would help people retire peacefully and live on their annuities.

“We should also demystify that notion that insurance annuity is for the formal public sector. People in the private and informal sectors must also take keen interest.

“A lot of people in the creative art industry when they are aging, they come out to solicit for funding to support their needs but in their hay days, if they knew about this product, they would have embraced it so it is important that we make noise about this product,” he added.

Latest Stories

-

Which will you vote for in 2024 Election: Honesty, Character, or Campaign Promises?

3 hours -

The ball is in Iran’s court after US pressure pays off

3 hours -

‘Japa’ sweeps Nigeria’s hospitals

4 hours -

Obuasi: Catholic Voices GH choral peace concert unites NPP, NDC

4 hours -

Lordina Supports NDC campaign in Ketu North with donation of medical equipment to Afife Health Centre

4 hours -

MTN Foundation delivers crucial technology tools to Eastern Regional Hospital

4 hours -

Galien Forum Africa: Enhaning African women’s role in climate and environmental crises

10 hours -

7th Galien Africa Forum ends with emphasis on health, innovation, and climate action in Africa

10 hours -

Ruthless Barcelona thrash Real Madrid to go 6 points clear

10 hours -

National Farmers’ Day scheduled for November 8

11 hours -

Samson’s Take: Why over 75% vote but only 5% join protests

12 hours -

Krachi East Chiefs applaud Bawumia for campaigning on issues with evidence

13 hours -

National Security Ministry dismisses Reuters’ claims that militants are using Ghana as logistical base

13 hours -

BOST and its CEO win big at 8th Ghana Energy Awards

14 hours -

Accused person in protest over alleged $3m BOST scandal discharged

14 hours