Audio By Carbonatix

The Ghana Chamber of Mines has called for broader stakeholder engagement before government proceeds with a proposed Legislative Instrument (LI) to introduce a new sliding-scale mineral royalty regime, warning that the draft policy could undermine the competitiveness and long-term sustainability of the country’s mining sector.

In a position paper on the draft LI, the Chamber said while it is not opposed in principle to a sliding-scale royalty system, the structure and rates being proposed risk pushing Ghana’s mining fiscal regime to one of the highest globally, with adverse consequences for investment, jobs and future government revenue.

The Chamber noted that Ghana’s mining fiscal framework already draws revenue from both gross income and profits, through instruments such as mineral royalties and the Growth and Sustainability Levy (GSL), alongside corporate income tax and dividends.

It cautioned that taxes imposed on gross revenue, such as royalties and the GSL, tend to be distortionary because they apply regardless of profitability and can discourage investment, especially during downturns. Profit-based taxes, the Chamber argued, are more progressive and allow the state and investors to share risk more equitably.

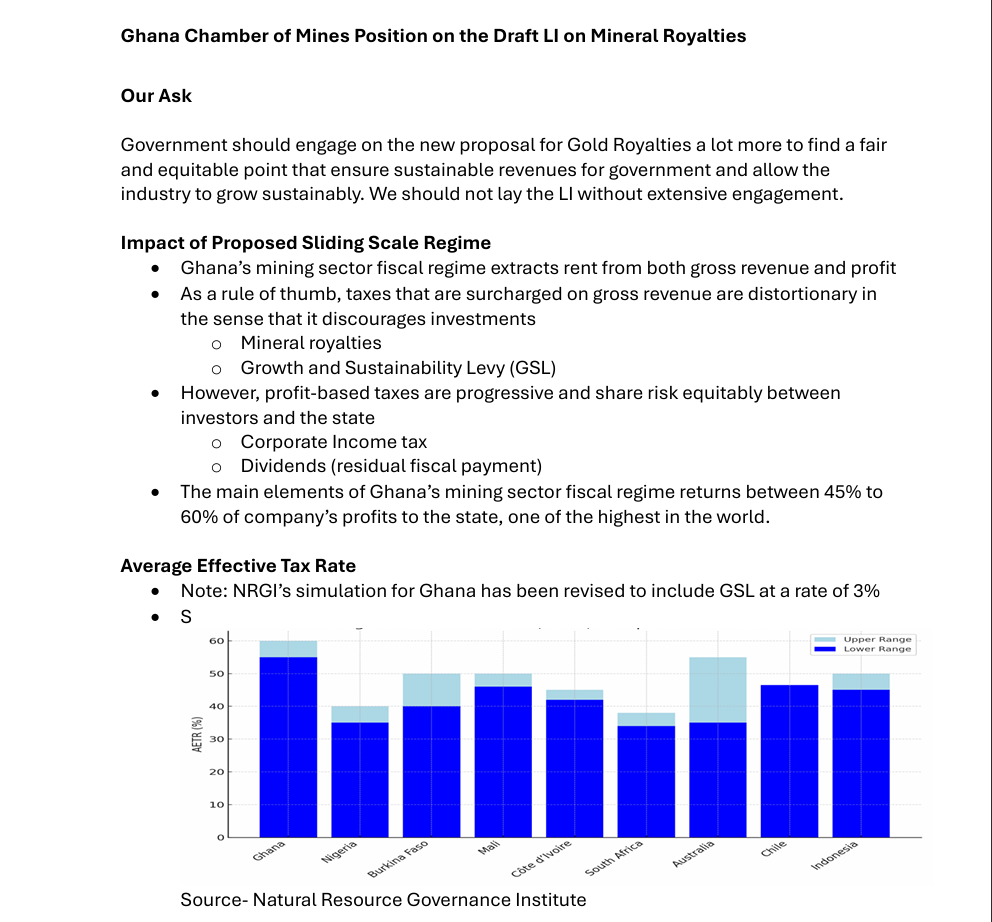

According to the Chamber, existing fiscal measures already result in the state capturing between 45 and 60 per cent of mining company profits—among the highest effective tax burdens in the global mining industry.

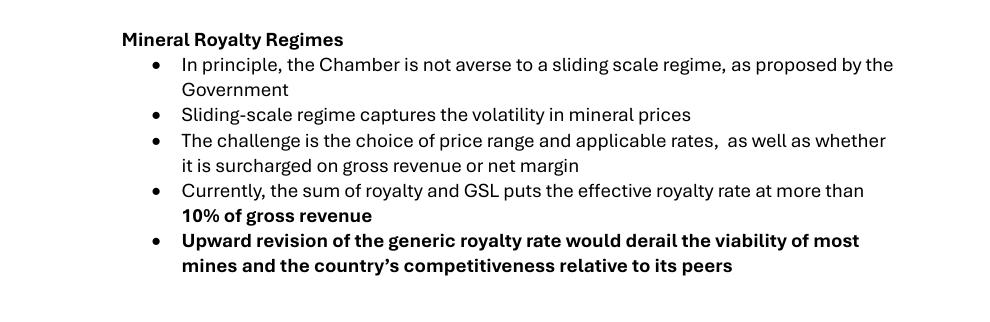

Government’s proposal seeks to replace the current flat 5 per cent royalty on gold with a price-linked sliding scale. While acknowledging that such regimes can help governments benefit from commodity price volatility, the Chamber said the challenge lies in the choice of price bands, the applicable rates and whether royalties are levied on gross revenue rather than profit margins.

It warned that when combined with the GSL, the current structure raises Ghana’s effective royalty rate to over 10 per cent of gross revenue, already making the country less competitive than peer mining jurisdictions in Africa and beyond.

A comparative survey cited by the Chamber shows that several mining countries, including South Africa, Chile, Peru and Canada, rely on hybrid or profit-based royalty systems that adjust payments according to margins, rather than imposing high charges on gross output.

The Chamber cautioned that a sharp upward revision of royalties could render many mines economically unviable, particularly mid-tier and mature operations, leading to reduced investment, higher cut-off grades, job losses and lower community development spending over time.

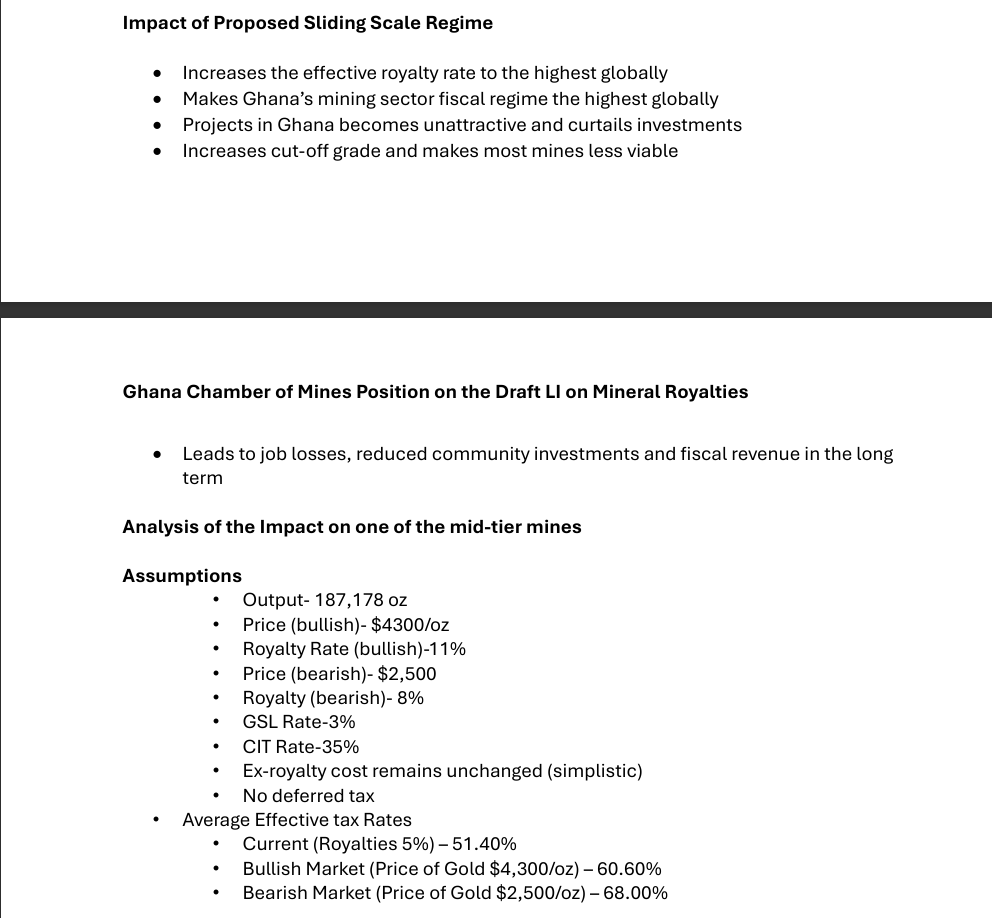

Using a model of a mid-sized gold mine, the Chamber projected that the average effective tax rate could rise from about 51 per cent under the current regime to over 60 per cent in a bullish gold price environment and nearly 70 per cent in a bearish scenario under the proposed system.

It also warned against basing permanent fiscal changes on what it described as a cyclical and short-term surge in gold prices, noting that many mines are unable to immediately benefit from price spikes due to fixed mine plans, capacity constraints and rising input costs.

The Chamber urged the government to delay laying the LI and instead engage more extensively with industry stakeholders to arrive at a balanced framework that secures sustainable revenues for the state while allowing the sector to grow.

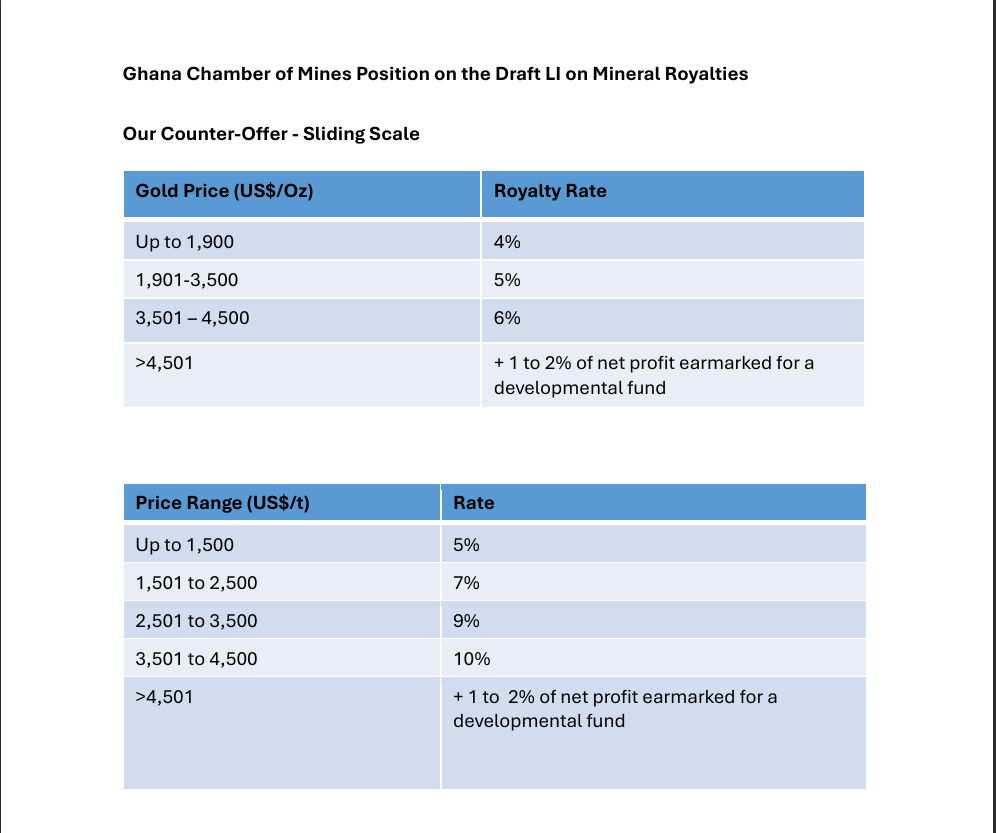

It also proposed an alternative sliding-scale model with more moderate royalty rates across different gold price bands, combined with a profit-based contribution to a development fund during periods of exceptionally high prices.

The Chamber further recommended the abolition of the Growth and Sustainability Levy to ease the cumulative fiscal burden on mining operations.

“The objective should be to optimise long-term, sustainable revenue for government while enabling the industry to invest, expand, create jobs and continue delivering value to communities and the national economy,” the Chamber said.

The government has yet to publicly respond to the Chamber’s position, but the debate comes amid renewed efforts to increase domestic revenue mobilisation and ensure Ghana derives greater benefit from its natural resources.

Below is the full position paper by the Chamber.

Latest Stories

-

We owe the youth a different example, says Fifi Kwetey on setting tough standard for NDC

35 minutes -

My political ambition can die, but Ghana must rise – Fifi Kwetey

58 minutes -

Reset means business as usual must end starting from the NDC – Fifi Kwetey

1 hour -

NDC must end the hypocrisy if we want to reset Ghana – Fifi Kwetey

2 hours -

Peru’s president impeached four months into term

2 hours -

Philippine VP Sara Duterte announces presidential run in 2028

3 hours -

We’re sitting on a time bomb with Otto Addo ahead of World Cup – Coach Nimley

3 hours -

Ghana first, NDC second, me last – Fifi Kwetey’s hardline loyalty doctrine

3 hours -

Guirassy stars as Dortmund dispatch Atalanta

5 hours -

Arsenal make Saka best-paid player with new deal

5 hours -

Arteta ‘respectful’ of fans but has felt ‘exposed’

6 hours -

Vinicius’ brilliant winner beats Benfica in match halted for alleged racism

6 hours -

Alcaraz wins ‘difficult’ first match since Melbourne win

6 hours -

Galatasaray hit 5 past Juventus in frenetic first leg

6 hours -

Substitute Desire Doue inspires PSG comeback at Monaco

6 hours