Audio By Carbonatix

Coronation Insurance Ghana has unveiled its new Pay-As-You-Earn motor insurance, a flexible, digital-first policy aimed at improving affordability, convenience, and insurance penetration in the country.

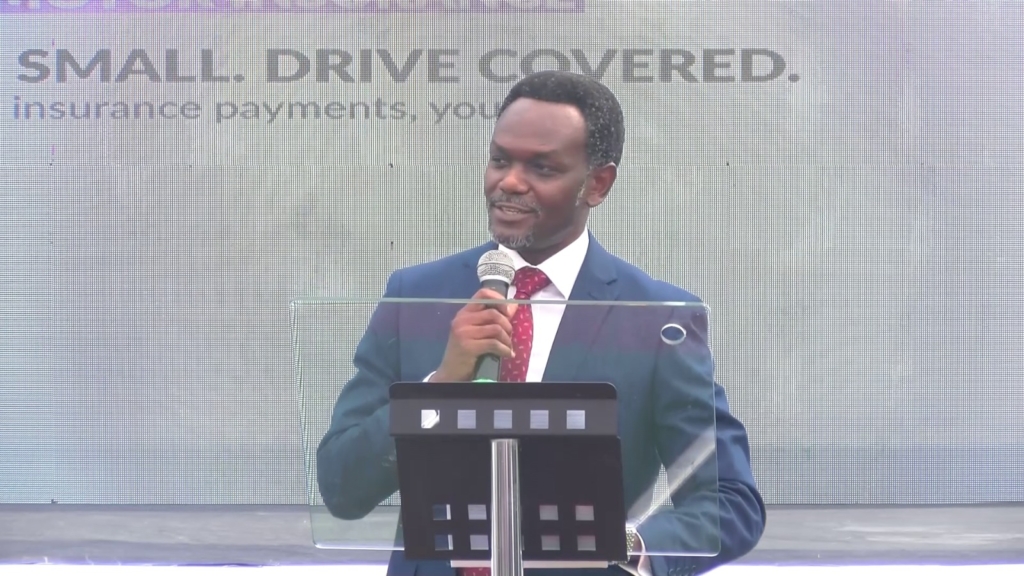

Speaking at the launch, Dr. Yaw Adom-Boateng, Managing Director of Coronation Insurance Ghana, said the innovative product allows customers to pay premiums monthly, quarterly, or up to six months, instead of making a one-time annual payment.

“The flexibility makes this product completely different from traditional insurance, which requires upfront payment. Customers can now buy coverage for shorter durations that suit their cash flow,” Dr. Adom-Boateng said.

He added that the product is available exclusively through the company’s digital platform, eCoronation.com, where customers can complete their purchase online and immediately receive their insurance stickers, certificates, and receipts via email or text.

“Beyond affordability and convenience, every vehicle insured under this scheme contributes 50 Ghana pesewas to the National Road Safety Authority, promoting safety on our roads,” Dr. Adom-Boateng added.

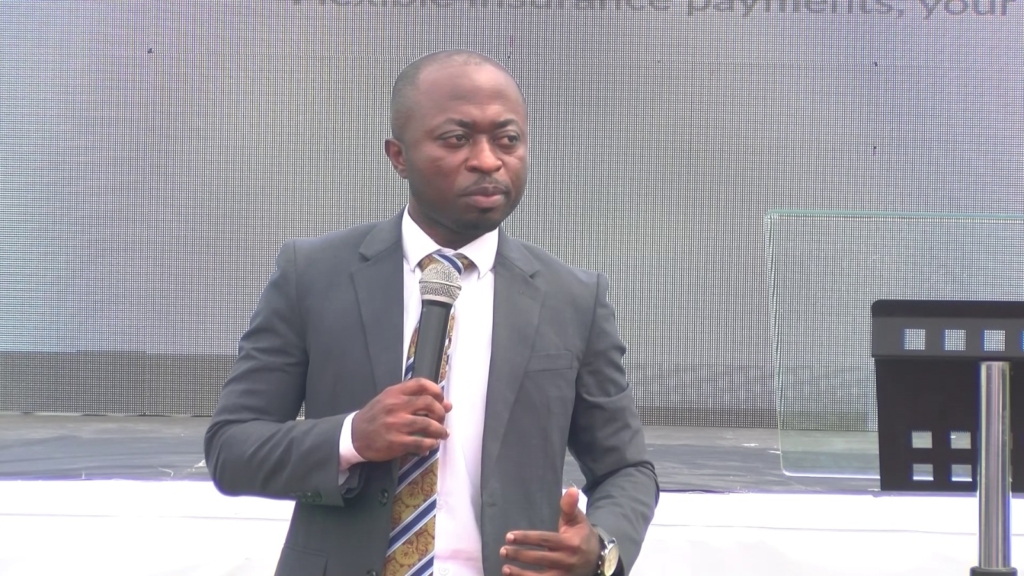

Felix Boateng Manu, Head of Underwriting and Product Development at Coronation Insurance, highlighted the market need for flexible payment options.

“Over the years, clients have increasingly requested the ability to pay monthly or quarterly. This product allows customers to purchase motor insurance conveniently from anywhere, even while at home or at work, and receive all policy documentation instantly,” Felix Boateng Manu said.

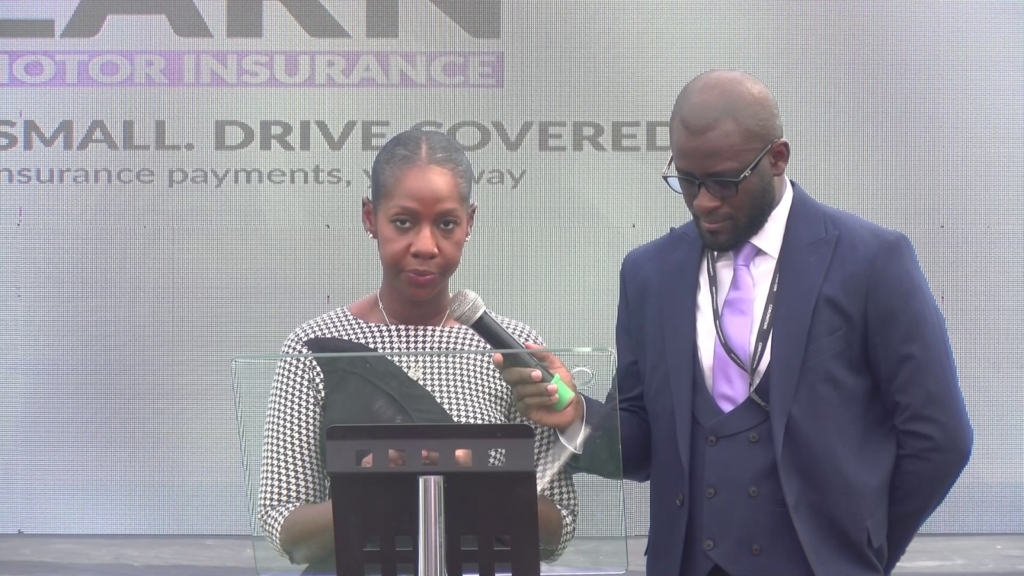

Boatemaa Barfour-Awuah, President of the Ghana Insurance Association (GIA), also commended the initiative.

“On behalf of the GIA, I extend warm congratulations to Coronation on this innovative solution that speaks to affordability, flexibility, and the growing role of digital platforms in expanding access to insurance. This initiative aligns strongly with our vision of an agile and inclusive insurance industry,” she said.

The Pay-As-You-Earn model is designed not only to improve insurance affordability but also to increase insurance penetration, which remains below 2% in Ghana. By enabling customers to maintain continuous protection through flexible payment options, the product seeks to expand coverage and deepen trust in the insurance sector.

Coronation Insurance says the launch marks a significant step toward modernising Ghana’s motor insurance market, making policies more accessible while supporting road safety initiatives and promoting a customer-centric approach to insurance.

Latest Stories

-

Kpasec 2003 Year Group hosts garden party to rekindle bonds and inspire legacy giving

57 minutes -

Financing barriers slowing microgrid expansion in Ghana -Energy Minister

1 hour -

Ghana’s Ambassador to Italy Mona Quartey presents Letters of Credence to Pres. Mattarella

1 hour -

KOSA 2003 Year Group unveils GH¢10m classroom project at fundraising event

1 hour -

Woman found dead at Dzodze

4 hours -

Bridging Blight and Opportunity: Mark Tettey Ayumu’s role in Baltimore’s vacant property revival and workforce innovation

4 hours -

Court blocks Blue Gold move as investors fight alleged plot to strip shareholder rights

4 hours -

Nana Aba Anamoah rates Mahama’s performance

4 hours -

Ghana selects Bryant University as World Cup base camp

5 hours -

Nana Aba Anamoah names Doreen Andoh and Kwasi Twum as her dream interviewees

5 hours -

Religious Affairs Minister urges Christians to embrace charity and humility as Lent begins

6 hours -

Religious Affairs Minister calls for unity as Ramadan begins

6 hours -

Willie Colón, trombonist who pioneered salsa music, dies aged 75

7 hours -

Ga Mantse discharged from UGMC following Oti Region accident

8 hours -

Guardiola tells team to chill with cocktails as Man City pile pressure on Arsenal

8 hours