The comprehensive report by the renowned auditing and advisory firm KPMG, has revealed concerning findings regarding the data provided by Strategic Mobilisation Ghana Limited (SML) to the Ghana Revenue Authority (GRA).

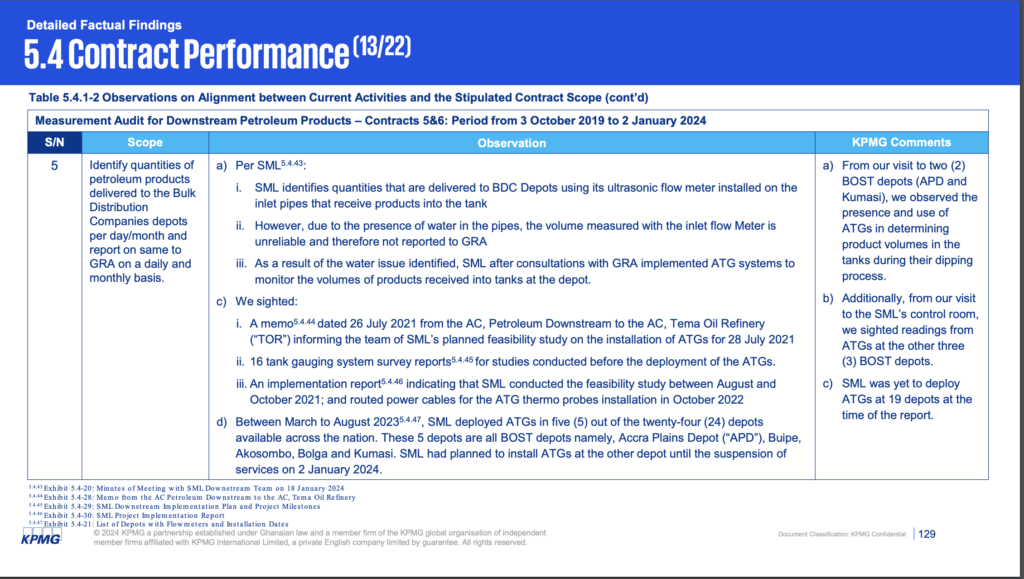

The audit firm stated that the volumes of products measured by SML were unreliable and, therefore, could not be reported to the GRA.

The unreliability was attributed to the presence of water in the pipes used by SML.

In the full KPMG report, released by President Akufo-Addo on Wednesday, May 22, it was disclosed that SML, in consultation with the GRA, had implemented the Automatic Tank Gauging (ATG) system to address this issue.

However, KPMG highlighted on page 129 of its report that, at the time of its issuance, ATGs had not been deployed at 19 depots.

The audit added that the delay in the deployment of these ATGs presented challenges in ensuring accurate and reliable data reporting by SML.

"However, due to the presence of water in the pipes, the volume measured with the inlet flow Meter is unreliable and therefore not reported to GRA."

"As a result of the water issue identified, SML after consultations with GRA implemented ATG systems to monitor the volumes of products received into tanks at the depot," the report said.

Meanwhile, the report also indicated that SML owed the Ghana Revenue Authority (GRA) GH¢31.88 million in unpaid taxes for eight months of service provision.

This outstanding amount includes accrued interest, estimated at GH¢18.50 million as of January 31, 2024.

According to the accounting and advisory firm, SML has failed to fulfill its statutory obligations by neglecting to file its tax returns or remit the owed taxes to the GRA.

This deviation from standard practice occurred between June 1, 2020, and August 31, 2023, during which the GRA typically deducts taxes for payments made to SML.

"During the period from 1 September 2020 to 30 April 2021, a bulk payment to SML covering invoices for an eight (8) month period, did not have VAT and WHT deductions, amounting to GH¢13.38 million. This contradicts GRA's standard practice of deducting such taxes for payments to SML between 1 June 2020 and 31 August 2023."

"Additionally, SML failed to fulfil its statutory obligations by neither filing returns nor remitting these taxes to GRA. Pursuant to Section 71(1) of the RA Act, the accrued interest on the tax liability is estimated at GH¢18.50 million owed by SML to GRA as of 31 January 2024. Consequently, the total liability incurred by SML amounts to GH¢31.88 million."

"At the time of our review, we noticed the discrepancy and informed GRA, leading to their subsequent communication with SML, demanding a settlement of the outstanding amount," an excerpt of the report said on page 14.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

9 hours