Audio By Carbonatix

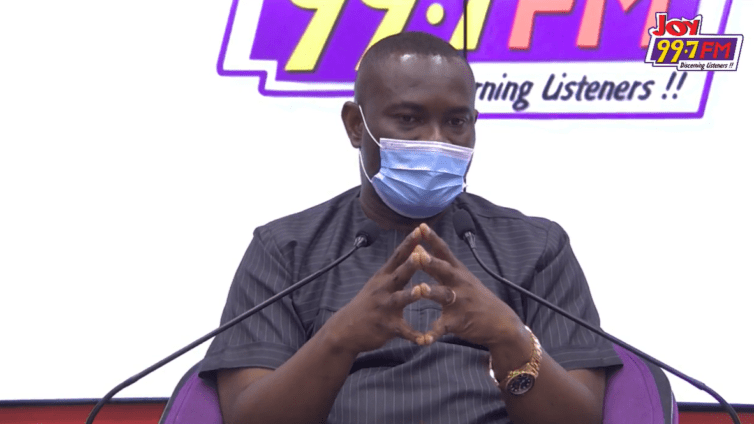

Deputy Finance Minister, Dr. John Kumah, says the government has provided a liquidity buffer for institutions to fall on during the debt exchange programme.

According to him, while the debt exchange programme was not targeted at individuals but rather institutions, some individuals will be affected due to their investing through certain institutions, for example pension funds.

He explained that with government recognizing the fact that some of these institutions will have to make payments to clients, it has created several buffers to provide support to such institutions should they come into difficulties.

Speaking on JoyNews’ PM Express, he said, “Institutions are made up of individuals, but in treating institutions they are separate personalities as far as the legal definition of institutions are concerned. So we want to deal with institutions. But of course we understand that some individuals may be affected by the institutional arrangement that we have done so we’ve provided buffers.

“And I heard you talk about the financial stability fund which is going to be a liquidity buffer from the Bank of Ghana to support such institutions that may face difficulty. So that is how we want to deal with the impact of how the debt exchange programme may have on these institutions. So these are banks, the pension funds, and any other institution that wants to take advantage of the FSF.”

He stated that the liquidity buffer is available for every other institution affected by the debt exchange programme.

“Yes, if you have to pay let’s say your customers or your beneficiaries and you’re facing challenges you can apply to the Bank of Ghana, make a case for it and then depending on the arrangements you’ll be considered,” he said.

Meanwhile, Ghana is inviting eligible holders to exchange GH₵137.3 billion of the domestic notes and bonds, including Energy Sector Levy Act Plc and Daakye Trust Plc, for a package of New Bonds to be issued by the country.

It said offers may only be submitted starting from December 5, 2022, and ending at 4:00 p.m. (Greenwich Mean Time (GMT)) on December 19, 2022.

However, Ghana may at its sole discretion extend the expiration date, including for one or more series of eligible bonds.

The invitation is available only to registered holders of eligible bonds that are not individual investors or that are otherwise authorised by the Government of Ghana, in its sole discretion, to participate in the Invitation.

Latest Stories

-

JoyFM’s Kojo Akoto Boateng attends Fruit Logistica in Berlin

47 seconds -

Bond market: Turnover rises 20.69% to GH¢6.39 billion.

4 minutes -

NPP Primary: Bawumia’s vote drop ‘expected’ due to fierce contest—Manhyia South MP

11 minutes -

ECG goes fully cashless, warns customers against payment scams

16 minutes -

Arthur Kennedy rates Mahama ‘B’ on economy, raises galamsey concerns

22 minutes -

Six young innovators receive INFoCAT grants to scale clean farming solutions

26 minutes -

Ghana earned less money from oil export in second half of 2025 – BoG

31 minutes -

Money has worsened divisions in politics – Arthur Kennedy

34 minutes -

Volta Region police intercept another vehicle with narcotics – Arresting team rejects GH¢120,000 from suspects

38 minutes -

Fisherfolk Sustainability Network donates life jackets to coastal communities in Keta

48 minutes -

‘Difficult to convince my sons to play for Ghana’ – CK Akonnor

50 minutes -

Dr Bawumia can unite this party – Awal Mohammed

1 hour -

There are no ‘Bawumia supporters’ now — Awal Mohammed calls for NPP unity after primary

1 hour -

CAGD confirms salary restoration for over 2,000 public workers after verification

1 hour -

NAPO was not a good running mate choice – Arthur Kennedy

1 hour