An Associate Professor of Finance, University of Ghana Business School says the citizenry is going to bear the brunt should government consider debt restructuring that would affect the banks.

According to Prof. Elikplimi Komla Agbloyor, financial institutions will be forced to hoard their liquidity if any move implemented threatens their financial stability.

This, he expressed, will transcend to affect their populace, particularly businesses that would need loans for the growth of their business.

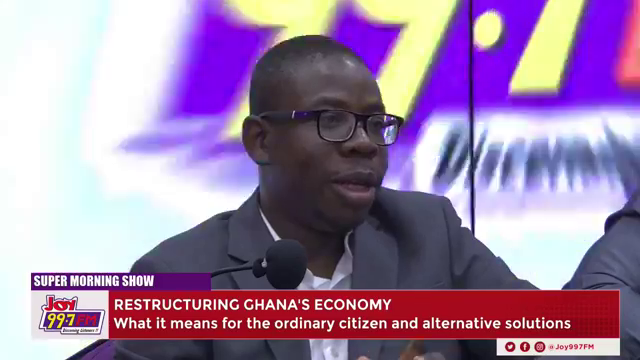

Prof Agbloyor made this projection while contributing to Ghana’s debt sustainability topic on Joy FM’s Super Morning Show.

“Debt restructuring can affect the banks and once this happens they will be in a shaky financial position so they will hoard liquidity.

“Meaning instead of they giving out loans they will hold onto their money and that would then affect businesses, individuals and that can translate into reducing the growth of the economy,” he said.

The country’s debt sustainability resurfaced in the limelight after the International Monetary Fund (IMF) announced that its economic programme with Ghana will focus heavily on that sector.

The IMF also added that the programme will support the credibility of government policies, restore confidence in the central bank’s ability to manage inflation and accumulate foreign exchange reserves to help the local currency withstand headwinds.

To avert a financial crisis, Prof Agbloyor urged government to be transparent with its decisions concerning economic intervention.

“I think they [government] should come out with indicative restructuring scenario which tells investors what the government would want to do when it comes to the debt restructuring.

“Are they going for maturity extension, reduction interest rates or haircut? And if so, how much of the debt will be restructured?”

Latest Stories

-

NPP must win back Adentan seat in 2024 polls – Obeng Fosu

3 mins -

PPA Clarification: The dark side of the World Bank’s ‘giveaways’ in Ghana by Bright Simons

1 hour -

Blinken says China helping fuel Russian threat to Ukraine

2 hours -

MHA declares May as Purple Month for Mental Health Awareness

2 hours -

WAEC arrests former headmaster over illegal students registration

2 hours -

MeToo founder Tarana Burke defiant after Harvey Weinstein ruling

2 hours -

Be alert, insist on decent messages – Dwumfour tells media

3 hours -

Father jailed 10 years for burning daughter’s genitals with hot cutlasses

3 hours -

I aim to help Ghana produce world-class athletes – Asamoah Gyan

3 hours -

Ashanti Regional Minister alleges sabotage in electricity supply

3 hours -

2024 Elections: Dampare urges Ghanaians to prioritise patriotism and display maturity

3 hours -

‘Let it rot’ campaign hits fish prices in Egypt

3 hours -

Otumfuo chalks 25 years on Golden Stool today

3 hours -

Saudi could get first Miss Universe contestant this year

4 hours -

Ghana Shippers’ Authority initiates steps to sign Service Level Agreements with stakeholders

4 hours