Audio By Carbonatix

The International Monetary Fund (IMF) has commended the introduction of Ghana’s Domestic Gold Purchasing Programme (DGPP), citing its positive impact on economic stability during a period of severe financial distress.

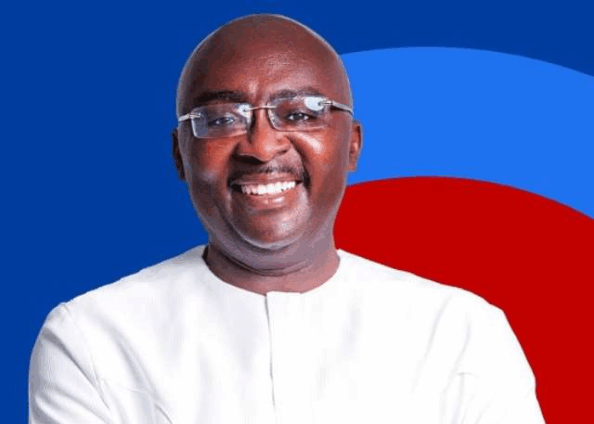

The DGPP, a brainchild of former Vice President Dr Mahamudu Bawumia, was introduced in 2022 at a time when Ghana’s economy was reeling from the effects of the global economic crisis. The downturn led to a sharp depreciation of the cedi, rising fuel prices and high inflation.

Amid the crisis, Dr Bawumia proposed the Domestic Gold Purchasing Programme to the Bank of Ghana as a means of shoring up the country’s gold reserves. The strategy was designed to provide a buffer against exchange rate volatility and help contain escalating fuel costs.

The policy yielded swift results, with Ghana’s gold reserves increasing significantly from about eight tonnes to 30 tonnes within two years. This development contributed to relative currency stability, with the cedi strengthening from nearly GH¢17 to around GH¢14 by 2024, alongside a reduction in fuel prices.

Speaking at a press briefing in Washington, the IMF noted that the DGPP played a significant role in stabilising Ghana’s economy during the crisis period.

Director of Communications at the IMF, Julie Kozack, acknowledged that the programme helped bolster international reserves and ease pressure on the foreign exchange market.

“On the benefit side, what we see is a contribution to a build-up of international reserves and reduced pressure on the foreign exchange market during a difficult period for Ghana,” she said.

While commending the programme’s overall impact, Ms Kozack also raised concerns about recent losses associated with the initiative and called for enhanced transparency and stronger risk management measures going forward.

Latest Stories

-

Burma Camp Tennis Club hosts successful 12th Ghana–Nigeria Independence Day Tennis Tournament

10 minutes -

Rights, justice and action for all women and girls must include women and girls with disabilities

11 minutes -

The Lover and the Fighter: China, the west, and Africa’s geopolitical awakening

34 minutes -

UCC student dies in tragic road accident on campus

55 minutes -

Health Ministry establishes committee to probe death of hit-and-run victim

56 minutes -

RTI Commission, NACOC explore collaboration to promote transparency and accountability

1 hour -

Three dead as truck overturns near Asenema Waterfalls

2 hours -

Four Ghanaian UN peacekeepers recovering after Lebanon missile attack — Defence Ministry

2 hours -

Police restore calm at Twifo Bimpong-Agya after youth clash kills one

3 hours -

US court hears how Ghanaian scammer made over $10m posing as fake romantic partner

3 hours -

Pakistani man found guilty in Iran-backed plot to kill US politicians

3 hours -

Footage shows US citizen shot by ICE agent in Texas traffic stop

3 hours -

Canada’s PM calls for Andrew to be removed from line of succession

3 hours -

Ghana@69: Ghana mature enough for self-sufficiency — Kwadaso MCE

4 hours -

Opoku Mensah pushes back at Haruna Iddrisu, praises Akufo-Addo’s free SHS infrastructure expansion

4 hours