The Minority in Parliament has reiterated its opposition to the Electronic Transaction Levy Bill currently before the House.

This fresh opposition is coming at the time the Finance Minister and the Minister of State in charge of Finance, Charles Adu-Boahen are back in the House for the debate on the passage of the controversial Bill.

Speaker Alban Bagbin is also back in the House and presiding over the business of the day.

Addressing the House, Member of Parliament for Yapei Kusawgu, John Jinapor noted that the idea behind the E-levy is a lazy man’s economics.

“So far just in one year, Cocoa price has moved up, gold has equally moved up, crude oil has equally moved up, all our major exports, the prices have moved up and yet our net reserves where this money goes to, has dropped from GHC8billion to GHC5billion. Mr. Speaker, what is the true state of the Ghanaian economy today. Our deficit is the worst out of 40 African countries, our debt to GDP is 80.1%...having taken the people of Ghana through this difficulty why then do you want to take their little money they put in their mobile money wallet,” he said.

John Jinapor argued that government should rather think about measures to cushion Ghanaians instead of imposing taxes amid the current economic crisis.

He urged members of the Majority side who oppose the levy to be brave and vote against the Bill.

“I know some of you are not part of the insensitive group. I know some of you are concerned about your constituents. Be bold, stand up and be counted. I want to call on them, be bold, stand up and be counted,” John Jinapor noted.

The Yapei Kusawgu MP told the Finance Minister who was also present in the House, “Mr. Finance Minister managing this economy is not just about quoting Bible verses to us. Thank you very much for your Bible quotation but when you quote the Bible, you must follow that with action, principles, programmes and projects”.

Shortly after he had addressed the House, Speaker Alban Bagbin adjourned the house for thirty minutes.

It was then that the Minority MP’s chanted “Don’t tax MoMo! Don’t tax MoMo! Don’t tax MoMo!”

E-Levy

Finance Minister Ken Ofori-Atta, presenting the 2022 budget on Wednesday, November 17, announced that the government intends to introduce an E-levy.

The levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector”. This followed a previous announcement that the government intends to halt the collection of road toll.

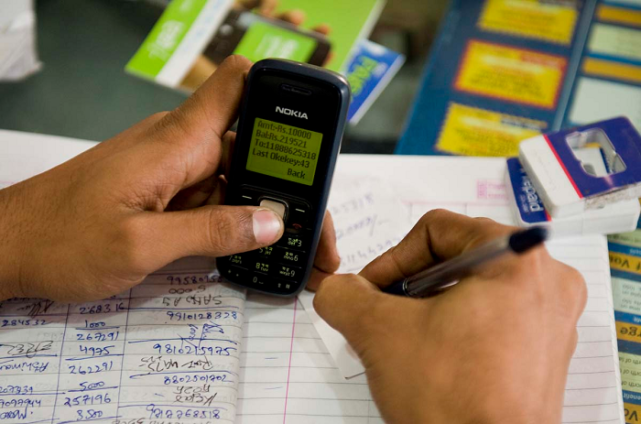

The proposed levy, which was expected to come into effect in January, 2022, is a charge of 1.75% on the value of electronic transactions. It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Explaining the government’s decision, the Finance Minister revealed that the total digital transactions for 2020 were estimated to be over GH¢500 billion (about $81 billion) compared to GH¢78 billion ($12.5 billion) in 2016. Thus, the need to widen the tax net to include the informal sector.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders have expressed varied sentiments on its appropriateness with many standing firmly against it.

Even though others have argued in support of the levy, a section of the populace believe that the 1.75% E-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

FIFA Club World Cup 2025: Sundowns, Esperance join Al Ahly and Wydad as CAF representatives

16 mins -

CAFCL: Al Ahly set up historic final with ES Tunis

33 mins -

We didn’t sneak out 10 BVDs; they were auctioned as obsolete equipment – EC

4 hours -

King Charles to resume public duties after progress in cancer treatment

5 hours -

Arda Guler scores on first start in La Liga as Madrid beat Real Sociedad

5 hours -

Fatawu Issahaku’s Leicester City secures Premier League promotion after Leeds defeat

5 hours -

Anticipation builds as Junior Speller hosts nationwide auditions

6 hours -

Etse Sikanku: The driver’s mate conundrum

6 hours -

IMF Deputy Chief worried large chunk of Eurobonds is used to service debt

7 hours -

Otumfuo Osei Tutu II celebrates 25 years of peaceful rule on golden stool

7 hours -

We have enough funds to pay accruing benefits; we’ve never missed pension payments since 1991 – SSNIT

7 hours -

Let’s embrace shared vision and propel National Banking College – First Deputy Governor

8 hours -

Liverpool agree compensation deal with Feyenoord for Slot

8 hours -

Ejisu by-election: There’s no evidence of NPP engaging in vote-buying – Ahiagbah

8 hours -

Ejisu by-election: Independent ex-NPP MP’s campaign team warns party against dubious tactics

8 hours