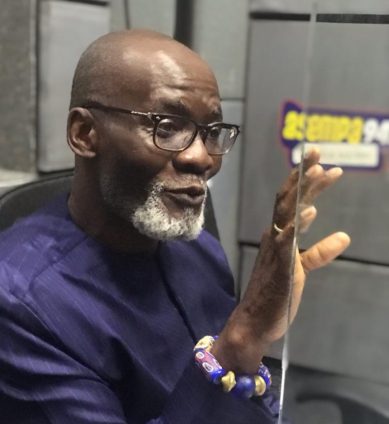

A leading member of the New Patriotic Party (NPP), Gabby Otchere-Darko, has disclosed that the Electronic Transactions Levy (e-levy) has generated less than ¢60 million, close to two months of its implementation.

He said the levy has failed to live up to the expectations of the government.

“What options are open to the government? The question should rather be: what option, if adopted, will re-inject investor confidence in our economy? Even if we find the $3-5 billion required, will that help? E-levy which was to have given us some 600m by now has done less than 60m,” he said in a tweet on Monday, June 27.

What options are open to government? The question should rather be: what option, if adopted, will re-inject investor confidence in our economy? Even if we find the $3-5 billion required, will that help? E-levy which was to have given us some 600m by now has done less than 60m.

— Gabby Otchere-Darko (@GabbyDarko) June 27, 2022

This particular tweet follows several others from him on whether the government should seek support from the International Monetary Fund (IMF).

Although, Otchere-Darko said he is not against a move to the IMF, he is opposed to them offering “peanuts” to the country which comes with harsh conditions.

“I am not for an IMF program that throws peanuts at us but imposes conditions that will end up hurting the poor, jobs and businesses more. Covid-19 and War in Ukraine are not of Africa’s doing but more to our doom. A program that pretends it is all our doing is doomed to fail.”

“We do something that will inject confidence in our capacity to ride this heavy storm, and that something should happen pretty quickly. Are you against an IMF program?”

Following the implementation of the e-levy on May 1, most Ghanaians are said to have changed their behavior toward the electronic transfer of funds.

According to a study, 83% of the populace felt compelled to do so in order to adjust to the limits introduced by the said levy as far as their livelihoods are concerned.

These were part of research findings on the effect of the new tax slapped on citizens, geared towards shoring up revenue for the government.

The e-Levy is 1.5% on all electronic transfers.

It was rolled out by the Ghana Revenue Authority (GRA) on May 1, after the E-levy Bill was passed by Parliament and subsequently assented to by President Akufo-Addo.

The implementation of the levy was initially greeted with displeasure from the public domain, with panic withdrawals hitting various mobile money vending stations.

Others also complained about wrongful deductions which resulted from transactions that were exempt, but the Authority has been refunding those deductions.

Again, the GRA, in collaboration with the Ghana Chamber of Telecommunications and other stakeholders, heightened sensitisation on the tax measure to assuage the public’s fears and restore their confidence in the usage of electronic wallets.

Latest Stories

-

All payments received from our contract with GRA are performance-based, says SML

33 seconds -

Marrakech 2024: Ghana’s para-athlete Zinabu Issah wins Gold

2 mins -

Our contract with GRA followed due process; ignore contrary reports – SML

3 mins -

SML is just Agyapa in suit and tie – Bright Simons

38 mins -

Domelevo condemns selection of KPMG to audit GRA/SML contract as illegal and unprofessional

51 mins -

SML/GRA contract: OSP should have released its report by now – Inusah Fuseini

2 hours -

KPMG report exonerates us – SML

2 hours -

Works and Housing Ministry seeks lasting solutions to challenges with stakeholders engagement

2 hours -

President’s statement on GRA-SML contract underlines Fourth Estate’s revelation – MFWA

2 hours -

Our services are one of a kind, not done by NPA – SML insists

2 hours -

We operate legally and collaborate with world-class partners – SML

2 hours -

Director urges parents to protect children from abuse

3 hours -

Imani-Ghana criticises Akufo-Addo for not lauding Fourth Estate’s contribution to social development

3 hours -

Man remanded for allegedly stabbing businessman with broken bottle and screwdriver

3 hours -

Population in Kumasi Central Prison surges to 1800, threefold exceeding capacity

3 hours