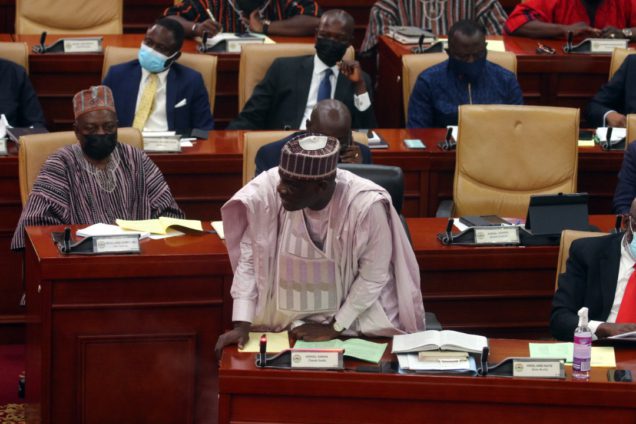

Minority Leader, Haruna Iddrisu, has accused the Majority Caucus of smuggling into the Order Paper the consideration of the controversial Electronic Transaction Levy (E-levy).

According to the Tamale South MP, E-levy was not enlisted in Parliament’s business statement for this week.

He questioned why the Majority will pull such a surprise on the opposition National Democratic Congress (NDC) legislators.

“We have time and again warned and cautioned that we never want to be taken by surprise on a major economic policy bill of government and we will not accept that culture.

“So when you [Majority Caucus] did not have the numbers, you were hesitant, you won’t come before the House [with the Bill] now that you think that you have some reasonable numbers then you say ‘go to the business of item 27’,” he fumed.

However, the Tamale South lawmaker said that the NDC MPs will not submit to the questionable attitudes of the Majority to get the Bill passed.

According to him, all the 137 representatives of the NDC will oppose the controversial tax policy.

“Mr Speaker, let them [Majority Caucus] be sure that we are ready for them. We will debate through and we will vote against it and not support it,” he said.

Some NDC Parliamentarians have also raised concern about what they described as an ambush of the Majority to pass the E-levy Bill.

With President Akufo-Addo marking his 78th birthday today, the Tamale North MP, Alhassan Suhuyini alleged that the President wants the controversial E-levy Bill passed as his birthday present.

“Our President doesn’t seem to be interested in a Black Stars victory as a birthday gift. I’m informed he requested the passage of the E-levy as a birthday gift. Almost all of his [NPP] MPs are here in the House. Well the Minority MPs are here too,” he wrote on Facebook.

Currently, the Finance Minister, Ken Ofori-Atta is in the chamber of Parliament and has moved the motion for the House to consider the Bill.

He noted that the earlier rate of 1.75% has been reduced to 1.5%.

The lawmakers have since been deliberating the issue.

E-Levy

Finance Minister Ken Ofori-Atta, presenting the 2022 budget on Wednesday, November 17, announced that the government intends to introduce an electronic transaction levy (e-levy).

The levy, he revealed, is being introduced to “widen the tax net and rope in the informal sector”. This followed a previous announcement that the government intends to halt the collection of road tolls.

The proposed levy, which was expected to come into effect in January, 2022, is a charge of 1.75% on the value of electronic transactions. It covers mobile money payments, bank transfers, merchant payments, and inward remittances. There is an exemption for transactions up to GH¢100 per day.

Explaining the government’s decision, the Finance Minister revealed that the total digital transactions for 2020 were estimated to be over GH¢500 billion (about $81 billion) compared to GH¢78 billion ($12.5 billion) in 2016. Thus, the need to widen the tax net to include the informal sector.

Although the government has argued that it is an innovative way to generate revenue, scores of citizens and stakeholders have expressed varied sentiments on its appropriateness with many standing firmly against it.

Even though others have argued in support of the levy, a section of the populace believe that the 1.75% e-levy is an insensitive tax policy that will deepen the already prevailing hardship in the country.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

4 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

5 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

6 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours