Audio By Carbonatix

The Electricity Company of Ghana (ECG) has failed to comply with the Cash Waterfall Mechanism (CWM) again after briefly adhering to it earlier this year, further exacerbating the energy sector’s mounting debt.

Following a two-month delay in the release of the Cash Waterfall validation reports by the Public Utilities Regulatory Commission (PURC), the reports for May, June, and July 2024 have finally been published.

The May and June reports reveal that ECG made only partial payments to three of the six Independent Power Producers (IPPs) and the West African Gas Pipeline Company (WAPCo). However, three key IPPs—Karpower, Cenit, and Asogli—did not confirm the amounts they received for these months, leaving significant questions unanswered.

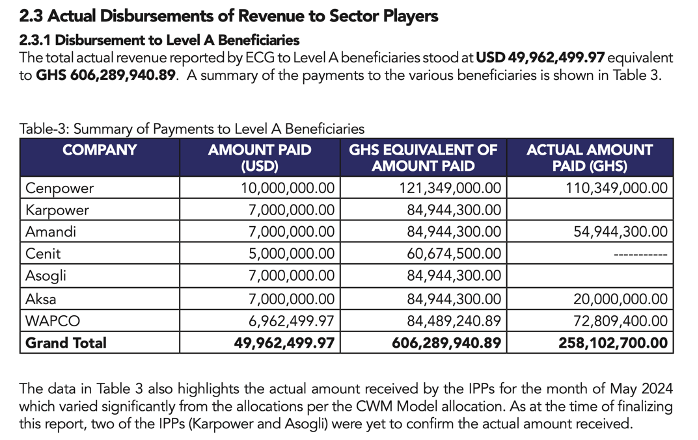

May 2024: Partial Payments, Major Shortfall

In May, ECG was obligated to pay GHS 606 million to the six IPPs and WAPCo. However, only GHS 258 million was paid, leaving a staggering shortfall of over GHS 348 million. Notably, Karpower and Asogli failed to confirm the amounts received.

“The Commission has validated payments and receipts from some stakeholders along the energy value chain and wishes to state that ECG did not comply with the approved payment to Level A,” the PURC stated.

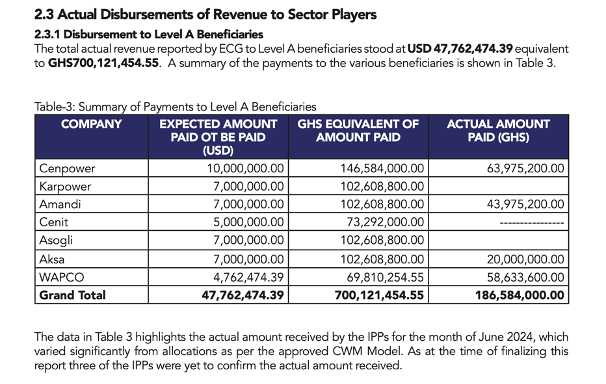

June 2024: Worsening Situation

The situation deteriorated in June, with ECG’s shortfall growing even larger. While partial payments were made again to three IPPs and WAPCo, the deficit ballooned to GHS 513 million.

“The Commission has validated payments and receipts from some stakeholders along the energy value chain and wishes to state that ECG did not comply with the approved payment to Level A,” PURC reiterated.

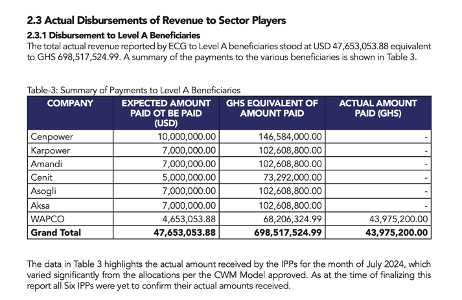

July 2024: No Confirmation from IPPs

In July, none of the IPPs confirmed receipt of any payments, while WAPCo reported receiving GHS 25 million less than what was due. The absence of confirmation from the IPPs casts doubt over ECG’s compliance with the CWM for that month.

Despite the lack of confirmation from the IPPs for July, it is clear that ECG did not meet its obligations for May and June, deepening the energy sector’s financial challenges.

Latest Stories

-

Ghana shines in GSMA DNSI and DPRI 2025 report due to E-Levy repeal and tech neutrality

44 minutes -

NJA College of Education inducts 379 students amidst infrastructure gains and calls for professional discipline

45 minutes -

GJA President, executives join Sammy Gyamfi to observe One-Week memorial of father-in-law

55 minutes -

FDA bans mixed alcoholic energy drinks: VAST-Ghana demands ‘Name and Shame’ list for public safety

1 hour -

Police probe deaths of teacher and farmer in Assin Fosu

1 hour -

Gov’t reaffirms commitment to safeguard Ghana’s energy supply amid Middle East crisis

1 hour -

What is wrong with us? When containers become our urban plan

2 hours -

Afenyo-Markin referred to Privileges Committee over security recruitment allegations

2 hours -

President Mahama backs private sector push to expand Ghana Wheat Initiative to cut imports

2 hours -

Ghana to declare 21 communities Marine Protected Areas, starting with Cape 3 Points

2 hours -

Women of Valour: I had to save myself from abusive marriage – Diana Hopeson

2 hours -

Women of Valour 2026 Conference sells out ahead of London event

2 hours -

ECG assures the public of meter accuracy amid billing concerns

3 hours -

BBNJ Has Finally Arrived: What next for the world’s oceans?

3 hours -

Low turnout in Ayawaso East by-election won’t change outcome – Mussa Dankwah

3 hours