Audio By Carbonatix

The Chair of the Research Committee of Tesah Capital, Professor Elikplimi Komla Agbloyor is calling for property tax payment to be embedded into electricity bills, rather than relying on courts or inspectors.

According to him, this is one of the most efficient methods to boost property tax collections.

He disclosed this in an article dubbed “Changing the Narrative: From Persistent Fiscal Deficits to Fiscal Surpluses Part II: Property Taxes”.

He explained that electricity already has near-universal coverage and established enforcement mechanisms, highlighting that ultimately, property owners are responsible for electricity accounts, even when tenants occupy the property.

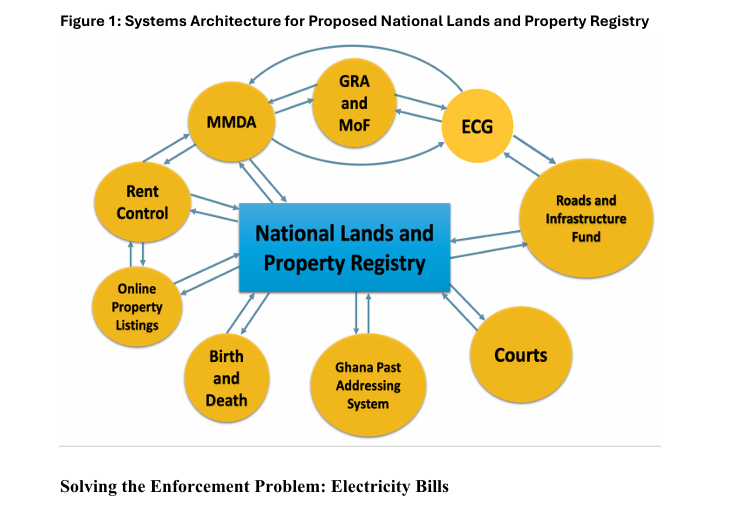

Under this system, Professor Agbloyor, who is also a Professor of Finance and Risk Management Department of Finance, University of Ghana Business School, said the property tax component is added to the electricity bill, payments are automatically split between Electricity Company of Ghana (ECG) and tax accounts as well as revenue is apportioned between central government and Metropolitan, Municipal, Department and Agencies (MMDAs). “This transforms property tax from a legal enforcement problem into a routine billing process”.

“If we fix the number of properties and rental rates, the compliance rate and the efficiency of collection by ECG or any other means of collection becomes critical. I’m aware of the operational inefficiencies of ECG which can directly impact the realised property tax revenues. Consequently, improving the operational efficiency of ECG is critical. Fortunately, the various stakeholders have a direct interest in ECG operating efficiently and could consequently push for more efficiency at ECG which benefits the entire country”, he added.

Sharing Revenue and Restoring Trust

To align incentives, Professor Agbloyor said property tax revenue should be shared.

These are 60% to MMDAs and 40% to central government.

According to him, the central government’s share should be ring-fenced into a Roads and Infrastructure Fund.

“One reason citizens resist taxes is the perception that revenues disappear into general budgets and that the funds may be siphoned away by corrupt politicians. Visible earmarking for roads and local infrastructure can help rebuild trust in the fiscal social contract”, he mentioned.

Using conservative assumptions, he pointed out that baseline estimates suggest annual property tax revenue of approximately GH¢14.5 billion.

“Region-level estimates based on the number of housing units and conservative rental benchmarks show that Greater Accra and Ashanti dominate, as expected, but every region contributes meaningfully.”, he added.

Latest Stories

-

India’s top court angry after junior judge cites fake AI-generated orders

53 minutes -

New charges for son of Norway’s crown princess on trial for rape

1 hour -

OpenAI changes deal with US military after backlash

1 hour -

Mexican drug lord ‘El Mencho’ buried in golden coffin

1 hour -

Building gold reserves, losing hospitals? – Finance professor flags 1% GDP cost

2 hours -

Those months in Nigeria added to my experience – Ayawaso East MP-elect Baba Jamal

4 hours -

‘The reset starts now’ – Baba Jamal promises Ayawaso East revival

4 hours -

My mother’s prophecy fulfilled – Baba Jamal as he heads back to Parliament

5 hours -

Trump ‘does not care’ if Iran play at World Cup

5 hours -

Burna Boy’s associate, Rahman Jago confirms singer converted to Islam

5 hours -

Amazon says drones damaged three facilities in UAE and Bahrain

5 hours -

NDC’s Baba Jamal wins Ayawaso East by-election

5 hours -

Integrity over individuals: Economic Fighters League maintains vote-buying stance in Ayawaso East

5 hours -

How to follow European football

6 hours -

A new dawn: Formula One charges into an unpredictable 2026

6 hours