Audio By Carbonatix

The Cash Waterfall Mechanism was implemented in April 2020 as part of the Energy Sector Recovery Programme (ESRP) to ensure fairness and transparency in distributing energy revenues among electricity distribution companies.

Its goal was to equitably distribute monthly revenue collections by ECG based on beneficiaries' invoices and their share of the PURC tariff. This initiative was essential for the government's efforts to reduce the energy sector deficit and prevent future shortfalls.

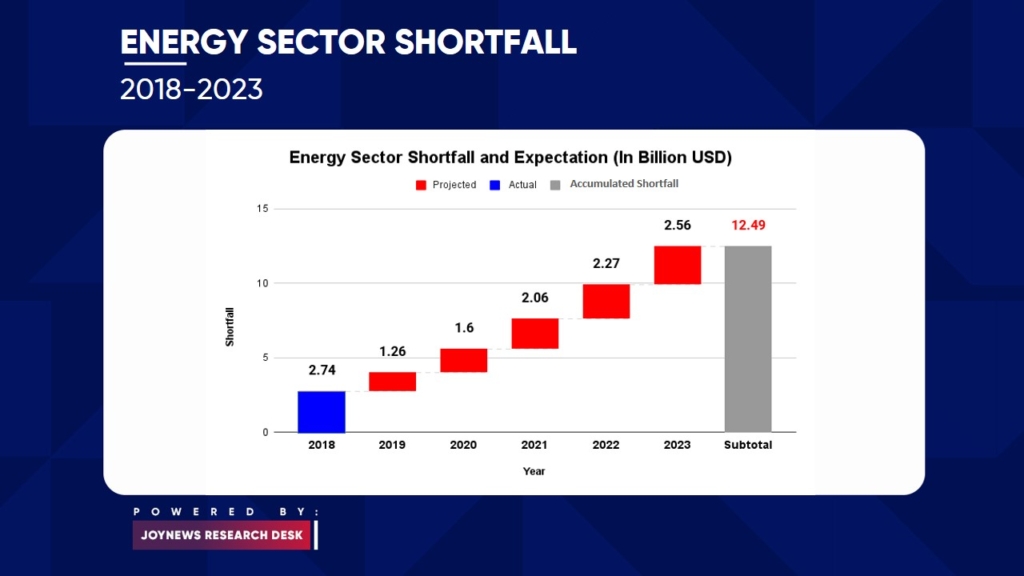

Before implementing this mechanism, a financial analysis conducted by the Ministry of Energy (MoEn) with support from the Power Africa Transactions and Reforms Program (PATRP) highlighted a significant "revenue shortfall" within the power sector, projected to exceed USD 12.5 billion by 2023.

The ESRP identified several key factors contributing to this shortfall, including excess power generation and gas supply, unpaid electricity bills from some MDAs, technical and commercial losses, inadequate electricity tariffs, delays in applying the Automatic Adjustment Formula (AAF), and delays in completing gas infrastructure projects.

In June 2023, the President, Nana Akufo-Addo, and Vice President Mahamadu Bawumia directed revisions to the Cash Waterfall Mechanism (CWM) under the Energy Sector Recovery Programme due to ECG's challenges in adhering to existing guidelines. The directive aimed to enforce CWM guidelines and enhance its effectiveness. As part of this, the PURC was tasked with appointing independent auditors for quarterly audits of ECG and NEDCo collections and disbursements to validate declared collections and ensure CWM compliance.

ECG was instructed to use CWM as the sole payment mechanism for customer revenues and operate a single holding account for collections. Quarterly audits of ECG's collections and disbursements were also mandated. PURC would validate revenue collections and payments according to CWM guidelines and reconcile quarterly with MoF and the CWM team to identify any payment shortfalls to be covered by the Finance Ministry.

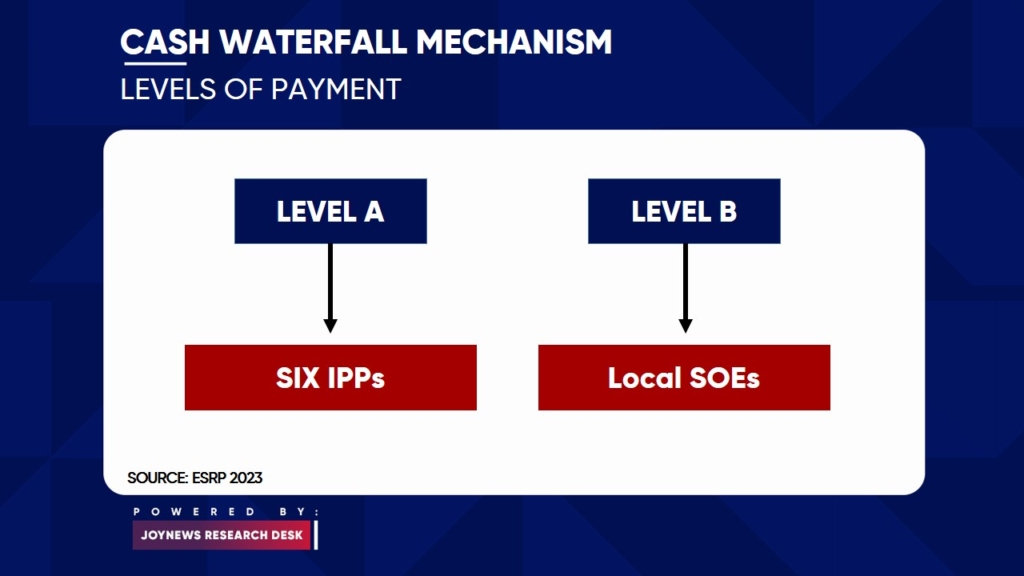

The Government restructured the CWM into two payment levels – Level A for six IPPs and Level B for local SOEs and other generators. Under ECG's renegotiation with IPPs, a monthly payment of US$43 million to six IPPs was agreed upon, with the remaining ECG collections distributed to SOEs and other generators using the CWM formula.

The CWM payments were to be made by ECG from the single holding account established for this purpose. ECG collections will be audited to show payments being made under CWM (monthly, etc.) and the balance to be catered for by MoF, which is expected to be the balance after the ECG/CWM payment of the flat rates on IPP invoices.

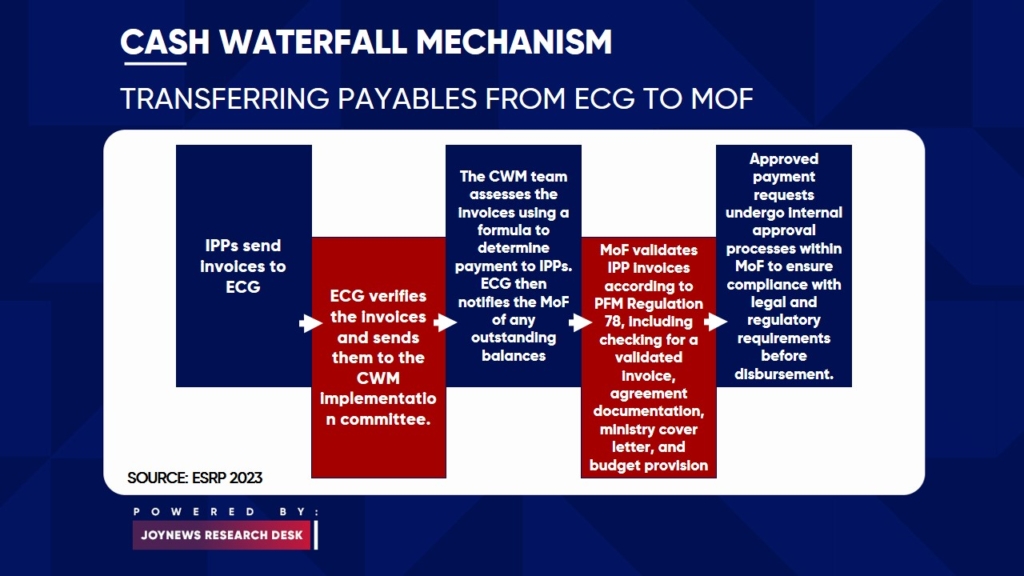

Process of transferring payables from ECG to MoF

- IPPs send invoices to ECG.

- ECG verifies the invoices and sends them to the CWM implementation committee.

- The CWM team assesses the invoices using a formula to determine payment to IPPs. ECG then notifies the Ministry of Finance (MoF) of any outstanding balances.

- MoF validates IPP invoices according to PFM Regulation 78, including checking for a validated invoice, agreement documentation, ministry cover letter, and budget provision.

- Approved payment requests undergo internal approval processes within MoF to ensure compliance with legal and regulatory requirements before disbursement.

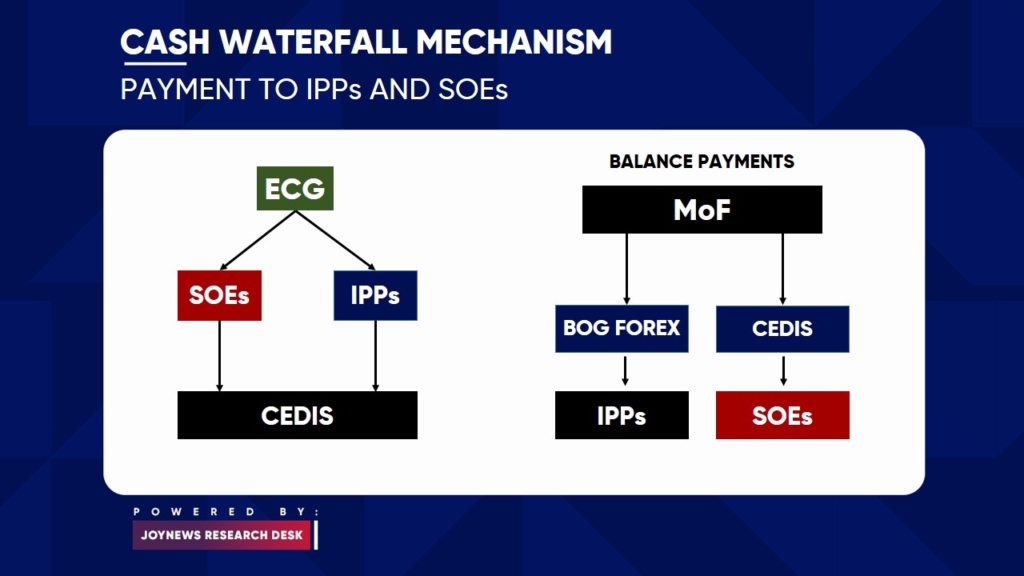

Arrangement of Payment to IPPs and SOEs

The Electricity Company of Ghana pays Independent Power Producers (IPPs) and State-Owned Enterprises (SOEs) in Ghanaian cedis. When there is a shortfall to be covered by the Ministry of Finance, the Bank of Ghana steps in to provide foreign currency for paying the IPP bills. This helps avoid delays in payments. State-owned enterprises also get their balances settled in Ghanaian cedis.

Latest Stories

-

Breaking borders, building futures: How African-led AI is rewriting the rules of global innovation

59 minutes -

Guinea orders dissolution of 40 political parties, including three main opposition groups

1 hour -

Iran Embassy in Ghana opens Book of condolence after death of Supreme leader in US-Israel attacks

3 hours -

GPL 2025/26: Vision FC cruise past Berekum Chelsea with emphatic 3–1 win

3 hours -

GPL 2025/26: Samartex held by Dreams FC as winless run extends to five

3 hours -

New Juaben North MP challenges gov’t to provide evidence of jobs created and cheap loans

4 hours -

Nadowli-Kaleo District marks 69th Independence Day with cultural exhibition, academic awards

5 hours -

Confusion, tension rock NPP polling station registration exercise in Tarkwa-Nsuaem

5 hours -

Burger King opens first Kumasi branch in Ahodwo

5 hours -

Burma Camp Tennis Club hosts successful 12th Ghana–Nigeria Independence Day Tennis Tournament

5 hours -

Rights, justice and action for all women and girls must include women and girls with disabilities

5 hours -

The Lover and the Fighter: China, the west, and Africa’s geopolitical awakening

6 hours -

UCC student dies in tragic road accident on campus

6 hours -

Health Ministry establishes committee to probe death of hit-and-run victim

6 hours -

RTI Commission, NACOC explore collaboration to promote transparency and accountability

7 hours