Audio By Carbonatix

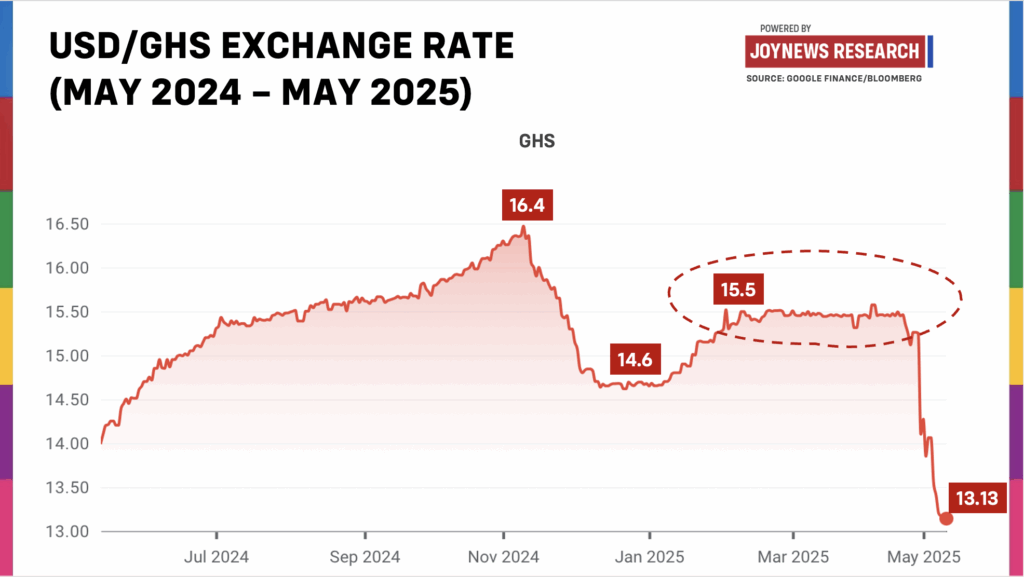

After months of relative calm, Ghana’s cedi has unexpectedly rallied. From February to April 2025, it held steady at around GHS15.50 to the US dollar.

But in the first weeks of May 2025, it surged to GHS13.1, its strongest level in a year. The question is whether this is the start of a sustained recovery or just another brief reprieve.

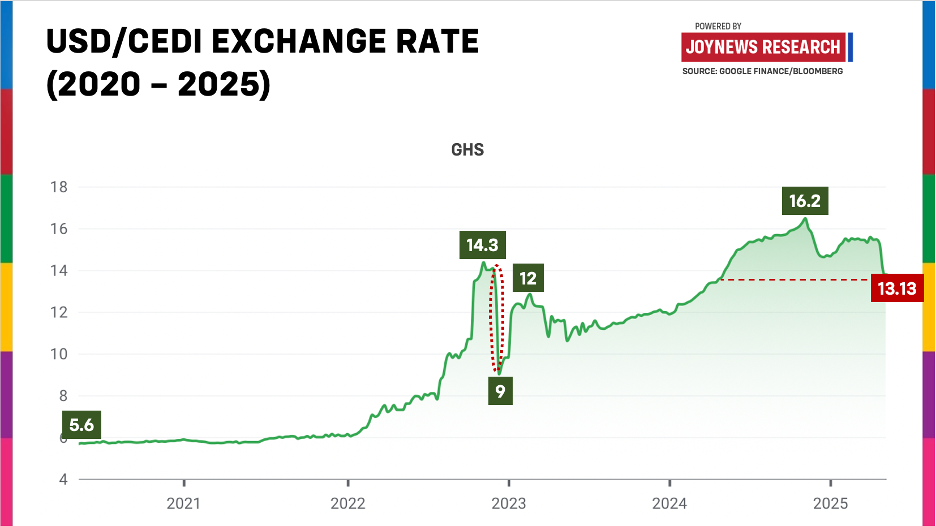

This isn’t the first time the cedi has surprised on the upside. In late 2022, it briefly strengthened from GHS14 to GHS9 before sliding back to GHS12. The difference this time is the duration. The cedi’s recent run is the longest stretch of relative calm it has seen in over three years.

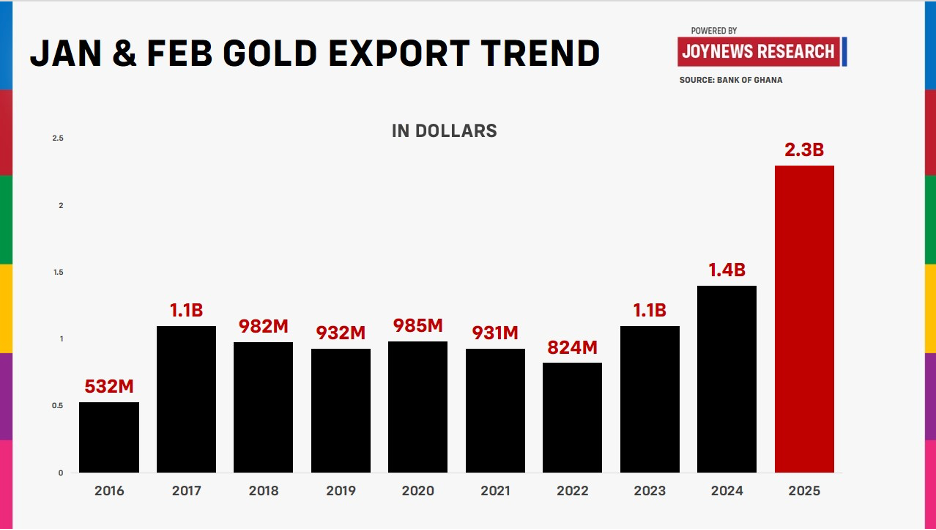

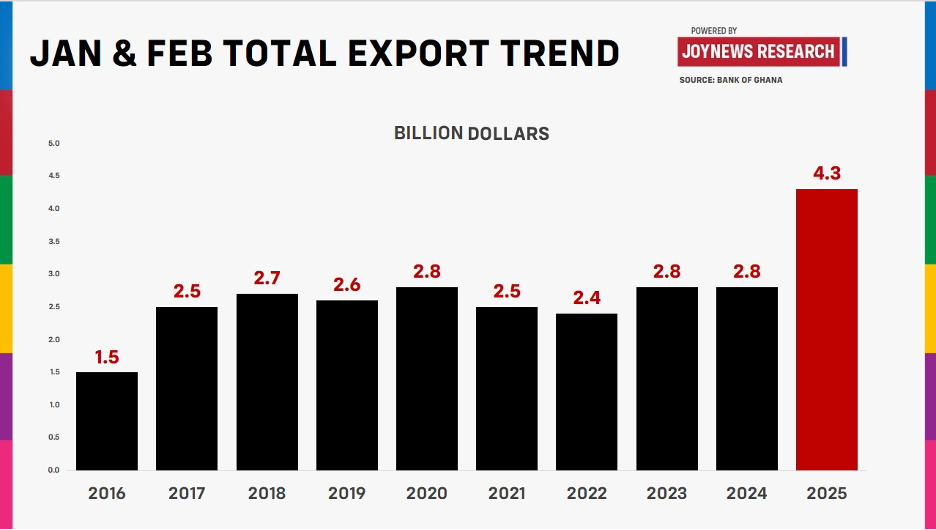

The most immediate factor behind the cedi’s recent strength is a sharp rise in export earnings. In the first two months of 2025, Ghana exported over $2.3 billion in gold, the highest in more than a decade.

This surge comes as gold prices hit an all-time high, trading above $3,000 per ounce. Given that gold is Ghana’s largest export, this has provided a crucial buffer, improving the country’s foreign exchange position and shoring up the cedi.

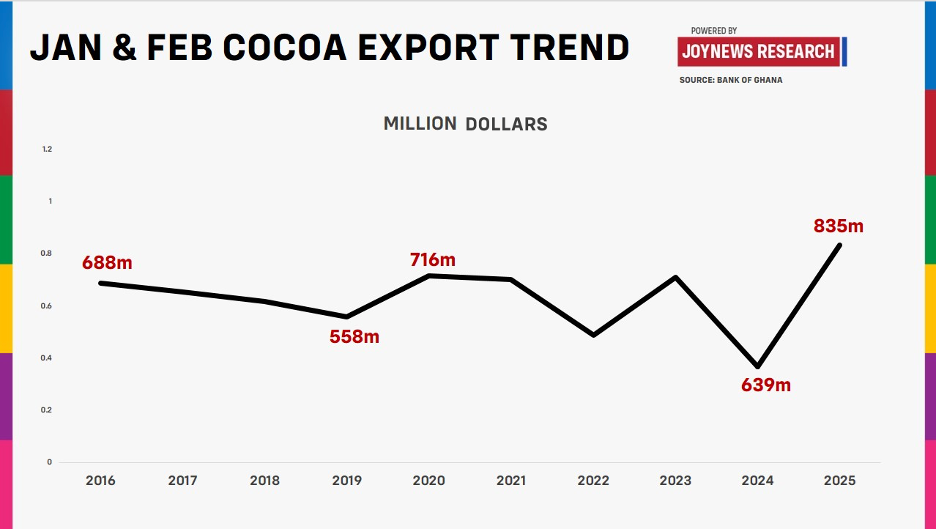

Meanwhile, cocoa, another major export, has seen revenues climb from around $600 million to $800 million, thanks to rising global prices.

Together, these two commodities have been a critical source of hard currency, helping to ease pressure on the cedi.

But this story isn’t just about Ghana. It’s also about the US dollar. President Donald Trump’s aggressive trade policies have cooled global demand for the US dollar, slightly weakening it.

Domestically, the government has taken steps to restore investor confidence. It has resisted high interest rate bids in the treasury bill market, signalling a tougher stance on debt accumulation.

Officially, foreign reserves remain intact, with the Bank of Ghana insisting it has not intervened directly in the forex market. The central bank’s gold reserves have also swelled to 31.37 tonnes, providing some cover against external shocks.

However, there are signs that the central bank is quietly supporting the cedi. According to the head of financial stability at the Bank of Ghana, the recent stability is partly due to a GHS490 million cash injection in April.

This was aimed at covering energy sector payments, including debts to independent power producers and fuel purchases.

The same official also pointed to increased remittances and stronger forex inflows from gold, cocoa, and oil as critical factors in stabilizing the currency.

He also noted that Trump’s trade policies have weakened the dollar globally, providing further support for the cedi.

Broader Gains

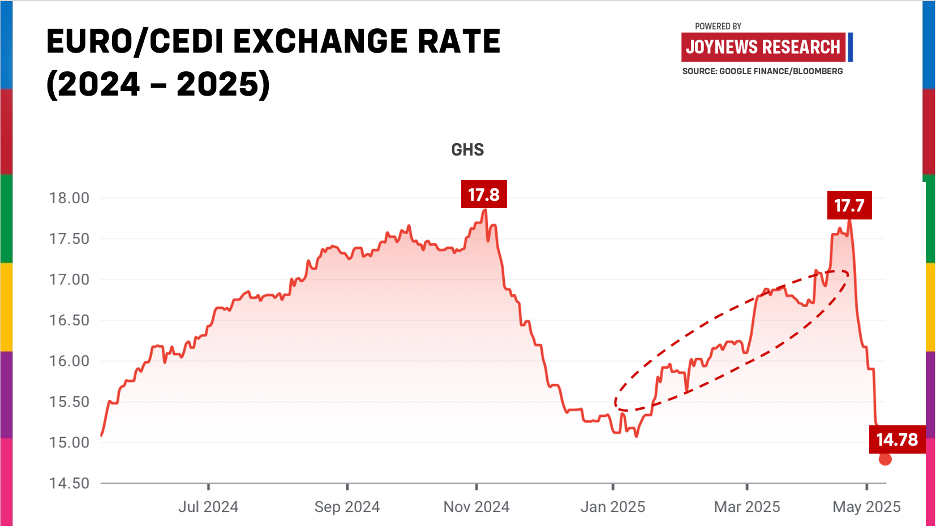

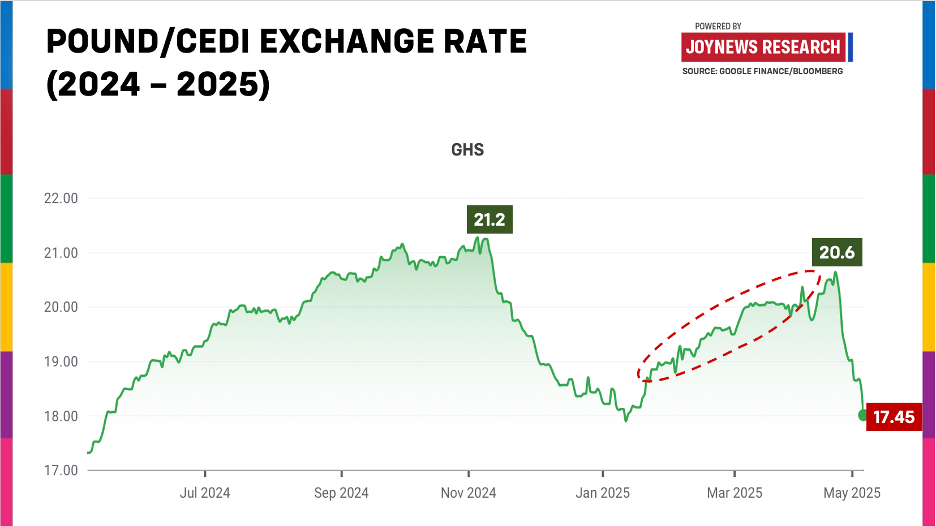

The cedi’s strength is not limited to the US dollar. The pound has fallen to GHS17.45 from GHS20.60 in late April, while the euro has slipped to GHS14.78 from GHS17.72.

The Canadian dollar is also down to GHS9.40 from GHS11.00 over the same period.

A Fragile Recovery

For now, the cedi’s rally offers some relief. If global dollar demand rebounds or commodity prices falter, the cedi could quickly reverse course.

- Read also: Explainer: Why one dollar can’t be one cedi

The real test will be whether Ghana can sustain this momentum without relying on short-term fixes and external windfalls.

Latest Stories

-

Goodbye officer, hello touchscreen – a vision for policing in Ethiopia

43 minutes -

Marketer remanded for alleged $13,000 fraud

54 minutes -

TikTok won’t protect DMs with controversial privacy tech, saying it would put users at risk

1 hour -

Funerals held for students and staff after Iran school strike

1 hour -

India’s top court angry after junior judge cites fake AI-generated orders

1 hour -

New charges for son of Norway’s crown princess on trial for rape

1 hour -

OpenAI changes deal with US military after backlash

2 hours -

Mexican drug lord ‘El Mencho’ buried in golden coffin

2 hours -

Building gold reserves, losing hospitals? – Finance professor flags 1% GDP cost

2 hours -

Those months in Nigeria added to my experience – Ayawaso East MP-elect Baba Jamal

4 hours -

‘The reset starts now’ – Baba Jamal promises Ayawaso East revival

5 hours -

My mother’s prophecy fulfilled – Baba Jamal as he heads back to Parliament

5 hours -

Trump ‘does not care’ if Iran play at World Cup

5 hours -

Burna Boy’s associate, Rahman Jago confirms singer converted to Islam

5 hours -

Amazon says drones damaged three facilities in UAE and Bahrain

6 hours