Audio By Carbonatix

The Finance Minister, Dr Cassiel Ato Forson on Thursday, March 13, presented eight bills to Parliament aimed at abolishing several taxes, including the Electronic Transaction Levy (E-Levy), the betting tax, amongst others.

The bills also seek to uncap statutory funds such as the National Health Insurance Levy (NHIL) and the GETFund levy.

These proposed tax repeals and amendments align with the National Democratic Congress’s (NDC) manifesto pledge to ease the financial burden on Ghanaians.

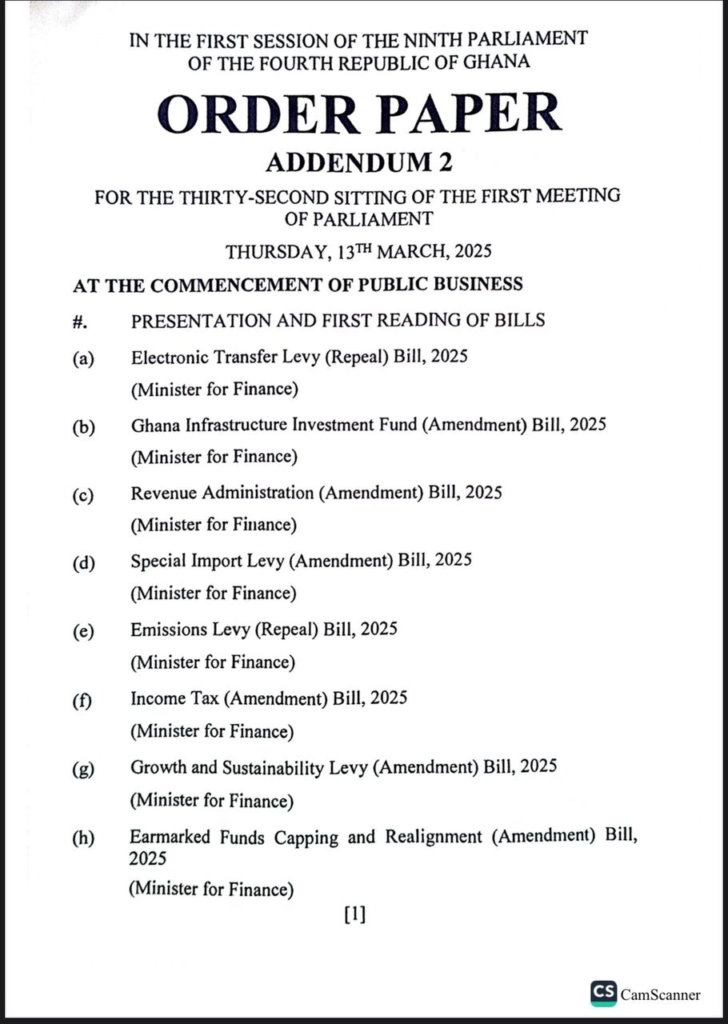

The proposed bills include Electronic Transfer Levy (Repeal) Bill, 2025, Ghana Infrastructure Investment Fund (Amendment) Bill, 2025, Revenue Administration (Amendment) Bill, 2025, Special Import Levy (Amendment) Bill, 2025, Emissions Levy (Repeal) Bill, 2025, Income Tax (Amendment) Bill, 2025, Growth and Sustainability Levy (Amendment) Bill, 2025, and Earmarked Funds Capping and Realignment (Amendment) Bill, 2025.

This move follows the Finance Minister's announcement during the presentation of the government’s first budget statement on March 11, 2025.

In addition to scrapping the E-Levy and betting tax, the government has also proposed abolishing the Emissions Tax and making amendments to other levies that have been deemed excessive.

Speaking on JoyNews PM Express on Tuesday, March 11, Dr Forson stated that he expects Parliament to consider the bills under a certificate of urgency to ensure their swift passage.

He expressed confidence that the process would be smooth due to the simplicity of the repeals, adding that each of the taxes to be scrapped only requires a single clause in the legislative process.

“Repealing these taxes will be straightforward. Each repeal is just a single clause. Removing the betting tax, the E-Levy, and others will be a simple process,” he assured.

He further stated that as revenue-related bills, they qualify to be presented under a certificate of urgency, which allows for expedited consideration.

Dr Forson also assured that once Parliament passes the bills, President John Dramani Mahama will sign them into law immediately, marking a significant step in fulfilling the government’s promise to alleviate the tax burden on citizens.

Latest Stories

-

Congo FA President Blaise Mayolas handed life prison sentence for embezzling COVID funds intended for women’s football

45 seconds -

SWESCO alumni alarmed as headmistress is transferred amid alleged political interference

2 minutes -

MiDA moves to transform Volta corridor into agro-industrial powerhouse

12 minutes -

Ablakwa urges stronger regional cooperation to tackle Sahel security threats

14 minutes -

Tamale Water Project to help address northern Ghana’s water shortages – Ghana Water Limited

44 minutes -

Sigma Appliances spreads the spirit of Ramadan with food distribution to Madina, Mamobi communities

51 minutes -

Oil prices fall and stocks rise after Trump says Iran war ‘very complete’

51 minutes -

Ghana-Peru Relations: Foreign Ministry outdoors new book focusing on a Journey of Friendship and Cooperation

54 minutes -

Kufuor advocates strict separation of powers to strengthen Ghana’s democracy

54 minutes -

Well-structured governance institutions improve efficiency and strengthen democracy – Kufuor

58 minutes -

Two Turkish firms to construct water treatment plant for Eastern Accra

1 hour -

Rising sophistication in science and technology is deepening corruption – Kufuor

1 hour -

Allegations of BDCs hoarding product by OMCs are baseless – CBOD

1 hour -

Council of State not enough to check executive – Kufuor

1 hour -

CLOGSAG strike without production: Ghana’s dangerous culture of entitlement

1 hour