Audio By Carbonatix

The Finance Minister, Dr Cassiel Ato Forson on Thursday, March 13, presented eight bills to Parliament aimed at abolishing several taxes, including the Electronic Transaction Levy (E-Levy), the betting tax, amongst others.

The bills also seek to uncap statutory funds such as the National Health Insurance Levy (NHIL) and the GETFund levy.

These proposed tax repeals and amendments align with the National Democratic Congress’s (NDC) manifesto pledge to ease the financial burden on Ghanaians.

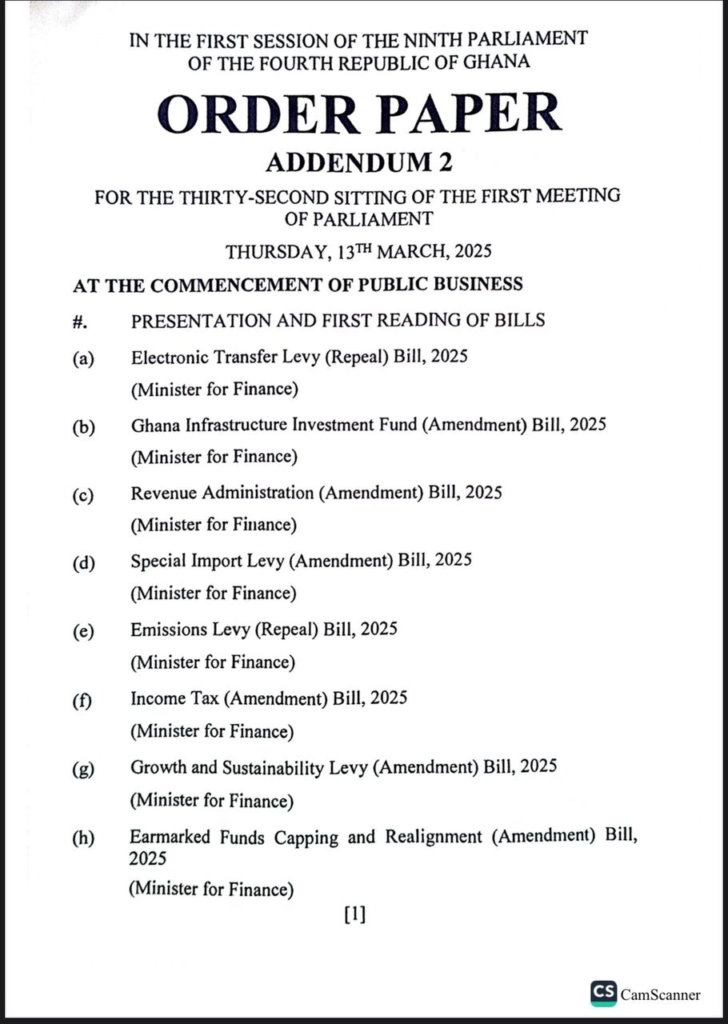

The proposed bills include Electronic Transfer Levy (Repeal) Bill, 2025, Ghana Infrastructure Investment Fund (Amendment) Bill, 2025, Revenue Administration (Amendment) Bill, 2025, Special Import Levy (Amendment) Bill, 2025, Emissions Levy (Repeal) Bill, 2025, Income Tax (Amendment) Bill, 2025, Growth and Sustainability Levy (Amendment) Bill, 2025, and Earmarked Funds Capping and Realignment (Amendment) Bill, 2025.

This move follows the Finance Minister's announcement during the presentation of the government’s first budget statement on March 11, 2025.

In addition to scrapping the E-Levy and betting tax, the government has also proposed abolishing the Emissions Tax and making amendments to other levies that have been deemed excessive.

Speaking on JoyNews PM Express on Tuesday, March 11, Dr Forson stated that he expects Parliament to consider the bills under a certificate of urgency to ensure their swift passage.

He expressed confidence that the process would be smooth due to the simplicity of the repeals, adding that each of the taxes to be scrapped only requires a single clause in the legislative process.

“Repealing these taxes will be straightforward. Each repeal is just a single clause. Removing the betting tax, the E-Levy, and others will be a simple process,” he assured.

He further stated that as revenue-related bills, they qualify to be presented under a certificate of urgency, which allows for expedited consideration.

Dr Forson also assured that once Parliament passes the bills, President John Dramani Mahama will sign them into law immediately, marking a significant step in fulfilling the government’s promise to alleviate the tax burden on citizens.

Latest Stories

-

Automated sampling removed bias in NPP delegate survey – Dr Evans Duah

7 minutes -

Bui Power Authority calls for urgent action against galamsey upstream of power plant

8 minutes -

Well-funded NGOs now controlling curriculum development in Ghana – ex-NaCCA head reveals

15 minutes -

Ibrahim Osman joins Birmingham City on season-long loan from Brighton

22 minutes -

IES defends NPA price floor policy amid debate over fuel pricing

24 minutes -

13 schoolchildren killed after bus collides with lorry in South Africa

26 minutes -

Moroccan FA to take legal action with CAF and FIFA over Senegal stoppage in AFCON final

35 minutes -

Arise Ghana set to picket US Embassy over Ofori-Atta’s return to face justice

46 minutes -

NPP Primary: Only Kennedy Agyapong is likely to secure 50%+1 votes – Researcher

47 minutes -

NPP sold over 300 Metro Mass buses amongst cronies in 2020 – Deputy MD

54 minutes -

Research highlights delegate behaviour ahead of NPP primaries

54 minutes -

Medical Kalabule: Inside Ridge Hospital’s system that exploits patients [Part One]

58 minutes -

FosCel founder calls for integration of sickle cell education into Ghana’s school curriculum

1 hour -

GCB Bank rewards first 10 winners in ‘Pa To Pa Promo’

1 hour -

GIPC hosts business forum with 54-member Japanese delegation following presidential state visit to Japan

1 hour