Audio By Carbonatix

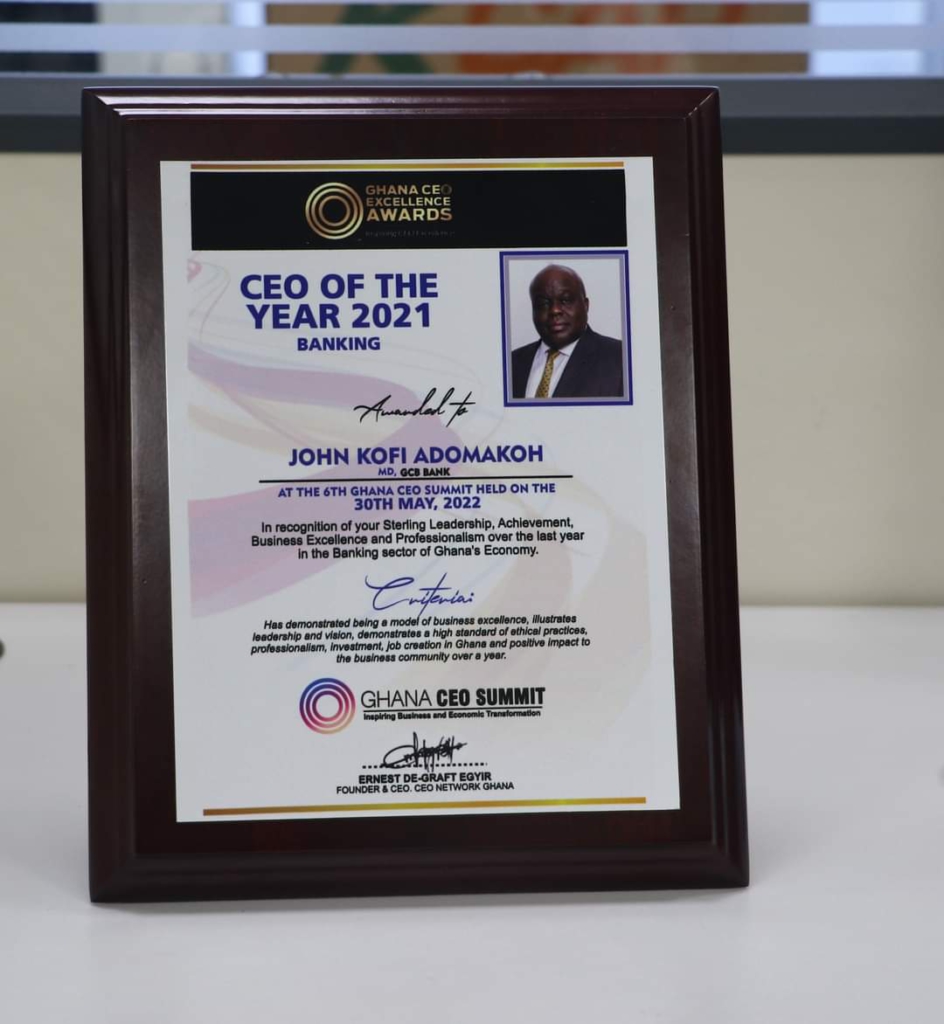

The Managing Director of the GCB Bank PLC, John Kofi Adomakoh, has been adjudged the Banking CEO of the Year for 2021.

The award was presented to him at the 6th CEO Summit held at the Kempinski Gold Coast City Hotel, Accra, on Monday, May 30, 2022, for his sterling performance in the banking sector.

The Summit was held under the theme “Digital leadership for a digital economy, leading digital business and government transformation, a private-public sector CEO dialogue and Learning.”

It brought together over 400 CEOs, experts and key stakeholders from various sectors of the economy.

Mr Adomakoh, who was appointed Managing Director of GCB in November 2020, and with the support of the Board of Directors, developed a revised medium-term strategy to make GCB PLC the most dominant bank in Ghana.

At the end of the 2021 financial year, he had led the Bank to achieve profit before income tax of ¢832 million, representing year-on-year growth of 36.2 per cent. The Bank’s total assets also increased by ¢18.4 billion in 2021, representing a growth of 19.1 per cent despite the difficult economic conditions occasioned by the Covid-19 pandemic.

Commenting on the award, Mr Kofi Adomakoh expressed appreciation for the recognition and dedicated the award to the Bank's hard-working staff and loyal customers.

“My role is to provide the needed executive leadership for GCB Bank PLC, but without the support and guidance of my Board of Directors, the dedication and experience of my Management and Staff, we would not have been able to achieve this sterling performance for 2021”, he stated.

“Our strategic ambition is anchored around three strategic pillars of revenue growth and profitability, operational excellence, people and talents. But, first, we will grow our market share to dominate the Retail and Wholesale Banking segments”.

Mr Adomakoh also highlighted the crucial role of digitisation in Banking. He stressed that digitisation is a critical enabler and a pivotal element of the Bank’s strategic ambition to dominate the market.

He also explained the Bank's efforts to improve its services to customers by identifying processes that can be re-engineered and digitalised to eliminate human intervention and make the bank nimbler and more responsive.

He added that consequent to these initiatives, "the Bank has also upgraded its core banking system from version 12.02 to 14.3, which has resulted in a remarkable improvement in the performance of our systems and in providing better services to our customers."

"We have also strengthened organisational rigour and brought in experienced human resources to join our management team to execute our strategy", he added.

Latest Stories

-

James Owusu declares bid for NPP–USA chairman, pledges renewal and unity

21 minutes -

Trump threatens strong force if Iran continues to retaliate

36 minutes -

Lekzy DeComic gears up for Easter comedy special ‘A Fool in April’

2 hours -

Iran declares 40 days of national mourning after Ayatollah Ali Khamenei’s death

3 hours -

Family of Maamobi shooting victim makes desperate plea for Presidential intervention

4 hours -

Middle East turmoil threatens to derail Ghana’s single-digit gains

4 hours -

Free-scoring Semenyo takes burden off Haaland

5 hours -

Explainer: Why did the US attack Iran?

6 hours -

Peaky Blinders to The Bride!: 10 of the best films to watch in March

6 hours -

Crude oil price crosses $91 as Strait of Hormuz blockade chokes 22% of global supply

6 hours -

Dr. Hilla Limann Technical University records 17% admission surge; launches region’s first cosmetology laboratory

7 hours -

Over 50 students hospitalised after horror crash ends sports tournament

8 hours -

Accra–Dubai flights cancelled as Middle East tensions deepen

8 hours -

See the areas that will be affected by ECG’s planned maintenance from March 1-5

9 hours -

Kane scores twice as Bayern beat rivals Dortmund

9 hours