Ghana's hopes for economic stability in 2024 hang in the balance as discussions on restructuring its external debt with official creditors progress slowly.

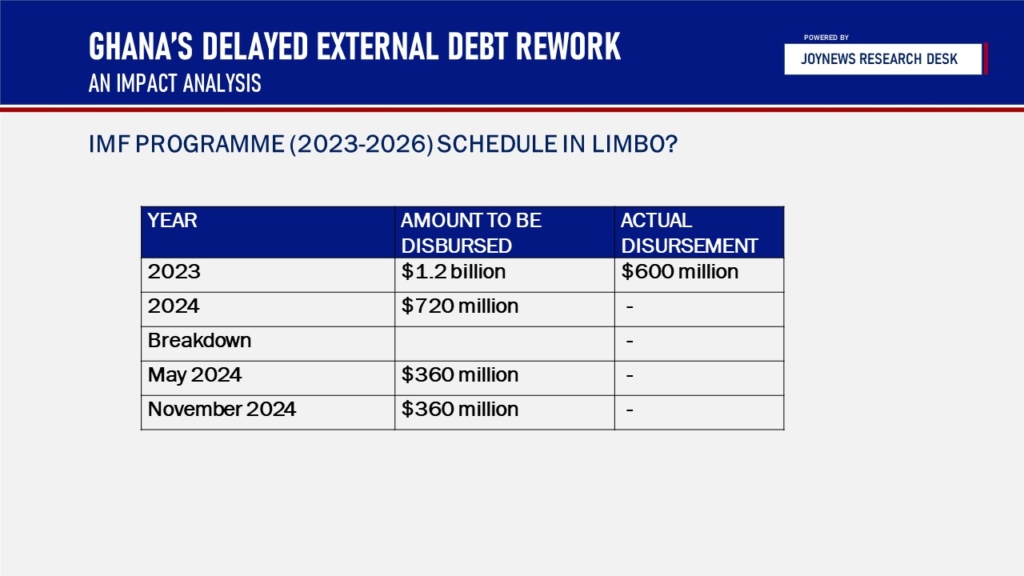

The New Year is over a week spent but Ghana is yet to see any clear advancement in its negotiations on external debt restructuring. There is a notable absence of a solid agreement from its official creditors, which is crucial in securing the next disbursement of $600 million from the IMF. External creditors have been debating for months on the magnitude of debt relief to offer Ghana.

The West African nation's bilateral creditors were expected to convene on January 8, 2024, to determine the extent of debt relief, particularly focusing on establishing a common cut-off date. However, as of now, there has been no communication from official creditors regarding the outcomes of this meeting.

Ghana is actively seeking debt relief, aiming to renegotiate approximately $5.4 billion of its bilateral debt. The delay in scheduled disbursements stems from Ghana's inability to acquire the necessary financial assurances from its external creditors, which are anticipated to unlock approximately $2.2 billion in fiscal space to bolster its balance of payments for 2024.

Experts and those well-versed in Ghana's IMF programme express worry that the country's failure to obtain the required financial assurances might extend the programme beyond 2026. This risk could jeopardise Ghana's ability to access the entirety of the available funds which could derail the country's medium term plan to return to acceptable debt sustainability levels.

This isn't the first time Ghana has engaged with its official creditors, notably the Paris Club, to request debt relief. The last similar engagement took place in May 2002 under the HIPC programme.

During those negotiations, Ghana's debt servicing cut-off date was adjusted from January 1, 1983, to June 20, 1999. Furthermore, the remaining amounts were rescheduled over 23 years, with a grace period of 6 years.

These measures were expected to decrease Ghana's debt service owed to Paris Club creditors between February 1, 2002, and November 30, 2002, from US$207 million to US$46 million.

Latest Stories

-

NPA Scandal: Four suspects remain in custody after failing to meet bail conditions

2 hours -

NPP to open 2028 flagbearer nominations on July 29

2 hours -

Sam George to open Pan-African AI Summit 2025

3 hours -

NDC opens nominations for Akwatia parliamentary primaries on July 28

4 hours -

Guinness Ghana DJ Awards opened new doors for my career – DJ Pho

4 hours -

Mohammed Sukparu commits to advancing Ghana’s Artificial Intelligence agenda

4 hours -

‘What is coding?’ – Question raises eyebrows during Deputy Communication Minister-nominee’s hearing

5 hours -

WAFCON 2024: Ghana’s Black Queens claim third-place after penalty win over South Africa

5 hours -

Ghana celebrates 100-year-old WWII veteran Joseph Ashitey Hammond

5 hours -

Measures announced in Mid-Year Budget Review fully in line with programme objectives – IMF

5 hours -

This Saturday on Newsfile: AG drops charges in uniBank trial, Aud-General’s report, and Mid-Year Budget Review

6 hours -

Parliament passes Road Maintenance Trust Fund Bill

6 hours -

Heavy security deployed at Manhyia Palace following Asawase shootings

6 hours -

Kumawu MP Ernest Anim urges Parliament to act on crisis in Ghana’s prisons

7 hours -

Kumawu MP decries ‘Inhumane’ feeding rate in Ghana’s prisons

7 hours