Audio By Carbonatix

The Economist Intelligence Unit (EIU) says Ghana and six African countries have enormous amounts of debt relative to Gross Domestic Product (GDP) and their governments will grapple with debt-servicing burdens that would eat up a substantial share of their revenue in 2023.

Tunisia, Egypt, Congo-Brazzaville, Zambia, Zimbabwe and Mozambique are the other African countries.

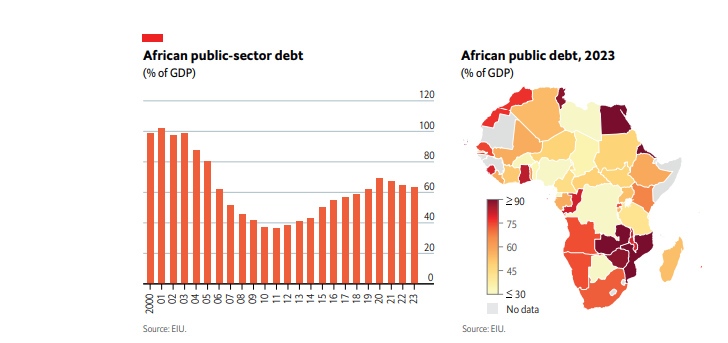

In its Africa Outlook 2023 Report, the EIU said the public-sector debt/GDP ratio will remain above 60% for Africa in 2022 and 2023 and some African countries will far exceed this level.

“The need to service and roll over large amounts of debt at a time when domestic and international borrowing costs are on the rise will weigh heavily on some countries in 2023 and things could get even more painful in 2024 when more capital repayments fall due”, it mentioned.

“African governments have ramped up their borrowing—domestically and internationally — and public sector debt ratios (relative to GDP) have pushed back towards the highs, last seen in the early 2000s just before the enormous debt restructuring of 2005, implemented under the umbrella of the heavily indebted poor countries (HIPC) initiative”, it explained.

More African nations to head towards external debt distress

The EIU also said more African states will head towards external debt distress in 2023 and 2024.

“African states are required to repay about US$75bn of external borrowing (medium- and long-term capital repayments that fall due) in 2023 and a similar amount in 2024. Foreign creditors have offered pandemic-related debt relief and relatively low—by historical standards—interest rates in recent years, but these lines of international financial support have come to an end”.

It further said the debt-servicing burden will become more painful because of higher interest rates, weaker currencies against the US dollar and softer capital inflows, while rolling over existing debt or accruing new debt will become much more of a challenge.

Already, it added many African states have found it difficult to issue new Eurobonds in 2022 and yields in secondary markets—which indicate where future refinancing costs are headed—have risen sharply.

“A widespread external debt crisis across the continent seems unlikely, but some highly leveraged states will face acute financing difficulties and a very uncertain period”, it concluded.

Latest Stories

-

Dad unlawfully killed daughter in Texas shooting, coroner rules

4 hours -

Anas wins 7 – 0 as SC unanimously rejects attempts to reverse judgment in his favour

4 hours -

The cocoa conundrum: Why Ghana’s farmers are poor despite making the world’s best chocolate

5 hours -

Powerful cyclone kills at least 31 as it tears through Madagascar port

5 hours -

GoldBod summons 6 gold service providers over compliance exercise

6 hours -

Power disruption expected in parts of Accra West as ECG conducts maintenance

6 hours -

Police investigate alleged arson attack at Alpha Hour Church

6 hours -

Heavy Sunday downpour wrecks Denyaseman SHS, schools, communities in Bekwai Municipality

6 hours -

Ridge Hospital is in critical condition – GMTF Boss appeals to corporate Ghana

7 hours -

Introduce long term measures to tackle challenges in cocoa sector – IERPP to government

7 hours -

Agricultural Economist proposes blended financing model to support cocoa sector

7 hours -

NPP MP warns against reducing producer price as government rolls out cocoa reforms

8 hours -

Tano North MP urges halt to grain exports over food glut

8 hours -

Farmers hopeful as government moves to expedite cocoa payments

8 hours -

Tensions at Agbogbloshie market women oppose AMA drain cleaning exercise, items confiscated

8 hours