Audio By Carbonatix

A lower-than-targeted primary deficit indicates that Ghana’s fiscal adjustment is underway, IC Research, the analytical arm of IC Securities has stated.

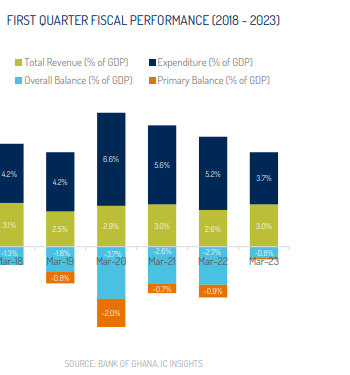

The country recorded a primary deficit of ¢596 million (0.1% of Gross Domestic Product) in the first quarter of 2023, against the target deficit of ¢4.6 billion (0.6 percent of GDP).

According to IC Research, fiscal adjustment is underway, with the help of expenditure containment.

The revenue and expenditure dynamics revealed that the fiscal adjustment in quarter one of 2023 was largely driven by expenditure controls instead of the revenue-based consolidation envisaged in the 2023 budget.

The Treasury’s budget execution for the first 3- months of 2023 showed a lower overall fiscal deficit of ¢6.7 billion (0.8% of GDP) against a target of 2.3% in quarter 1, 2023.

Total revenue and grants in the first quarter of 2023 turned out at ¢26.0 billion (3.3% of GDP), falling short of the target by 0.9% of GDP. Total expenditure amounted to ¢32.7 billion (4.1% of GDP), sufficiently below the target of ¢52.1 billion and supported the faster-than-expected compression in the budget deficit.

“Specifically, we observed a year-on-year fiscal adjustment equivalent to 0.8% of GDP as the primary deficit narrowed to 0.1% of GDP in quarter 1, 2023 compared to the target of -0.6% and outturn of -0.9% in quarter 1, 2022”, IC Securities explained.

Furthermore, it said “We attribute the ¢19.4 billion (2.3% of GDP) spending suppression to the impact of the Domestic Debt Exchange (DDE) and the suspension of external debt service”.

Falling revenue attributed to tax administration challenges

On falling revenue, IC Research attributed it to lingering challenges with tax administration and compliance as well as the softening of economic activity.

“We also believe the adverse impact of the DDE on banks’ financial results exerted a negative spillover to tax obligations toward the Treasury. In our view, the weakening economic activity and the medium-term impact of the DDE on banks’ financial position will pose a downside risk to the Treasury’s plan for a revenue-based fiscal adjustment”, it added.

Latest Stories

-

GIADEC dismisses claims gov’t plans to award Nyinahin Bauxite concessions to Ibrahim Mahama

19 minutes -

Ghana Celebrates Hanukkah: A Festival of Light and Freedom

35 minutes -

IMF seeks 3-month extension of Ghana’s Programme

48 minutes -

Government secures $200m World Bank support to end double-track system – Haruna Iddrisu

53 minutes -

GJA raises alarm over court order restraining investigative reporting

1 hour -

Ghana Embassy delegation visits Ghanaian detainees at ICE facility in Pennsylvania

2 hours -

The Licensure Fallacy: A misplaced narrative on WASSCE performance

2 hours -

Front-runner to be Bangladesh PM returns after 17 years in exile

2 hours -

NICKSETH recognised as Best Building & Civil Engineering Company of the Year 2024/2025 by GhCCI

2 hours -

MISA Energy rebrands in Kumasi, pledges better service and sustainability

3 hours -

Kenyasi assault case: Woman handed 15-month jail term for injuring child

5 hours -

Mahama’s trust well placed, I remain focused on fixing education – Haruna Iddrisu

5 hours -

IGP Yohuno promotes 13 senior officers in recognition of exemplary service

5 hours -

Miss Health Organisation unveils new Miss Health Africa and Ghana queens

6 hours -

Andy Dosty set to headline inaugural Ghana Independence Day celebrations in Europe

6 hours