Audio By Carbonatix

Ghana's real estate sector is on an unprecedented trajectory. From gated communities to luxury apartments and from smart offices to retail complexes, the skyline of Accra and its environs is transforming rapidly.

However, this physical boom is only part of the story. The more aggressive battle may be in the media — particularly in Out-of-Home (OOH) advertising — where developers are locked in a fierce competition for visibility and market share.

But as cranes rise and billboards multiply, key questions remain: Who is actually buying? Who is being targeted? And what does the future look like in this fiercely competitive space?

Property Prices on the Rise: What the Data Shows

Ghana has seen a steep increase in property prices over the past five years, especially in the capital:

- In prime Accra areas such as East Legon, Cantonments, and Airport Residential, the average price for a 2-bedroom home has climbed from $120,000 in 2018 to between $180,000 and $220,000 in 2024 — a rise of 50-80%.

- In developing suburbs like Oyarifa, Adenta, and Ayi Mensah, prices have moved from GHS $60,000 to over GHS $85,000-$120,000 during the same period.

- Monthly rents for 1-bedroom apartments in central Accra now range from $500 to $1,200, reflecting growing demand.

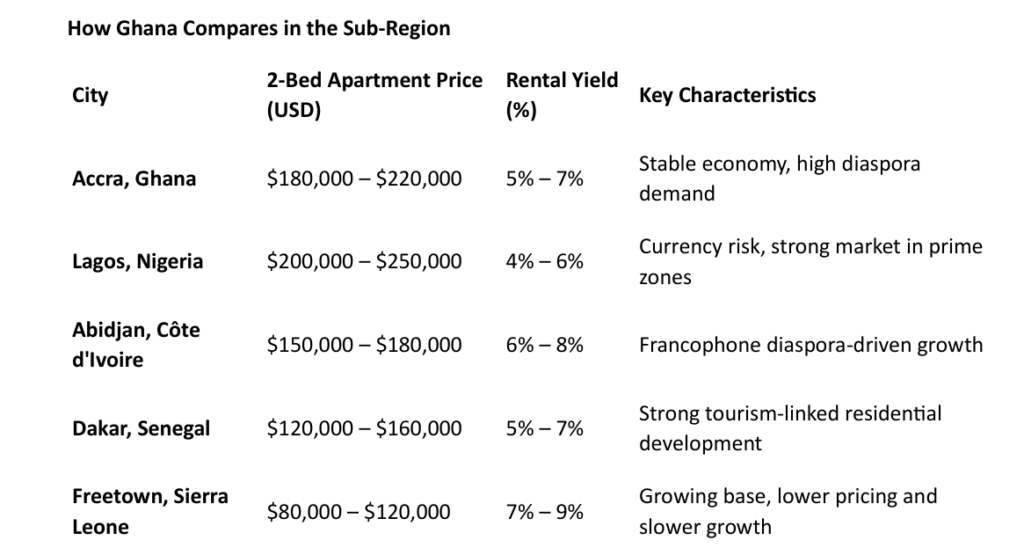

These figures position Accra as one of the most expensive cities in West Africa for real estate.

1. Diaspora BuyersThey are the backbone of Ghana's real estate demand — acquiring homes for retirement, family use, or investment. Their influence is shaping market trends, particularly in gated communities and serviced apartments.

Corporate executives, professionals in finance, tech, and oil sectors are investing in home ownership and buy-to-rent schemes in growing numbers.

Many Ghanaians are returning from Europe, the U.S., and Canada with savings and a desire to resettle — making them ideal clients for modern developments.

Both local and foreign investors are buying off-plan and reselling at higher prices. Rental demand in Accra makes this segment particularly active.

OOH Advertising: The Fierce Battle for Attention

The surge in real estate advertising — particularly in OOH media — is impossible to ignore. Major roads in Accra are flooded with billboards showcasing "exclusive" living, "smart" cities, and "investment-ready" properties.

But visibility doesn't always equal conversion. While millions view these ads, only a select, data- driven few are making purchases. Most buyers are increasingly savvy — researching online, comparing options on digital platforms, and relying on personal referrals or diaspora-focused consultants.

In effect, while developers are marketing broadly, their real buyers are watching quietly and choosing carefully.

Projecting the Future: What Next in This Competitive Market?

Stronger regulation of land sales, property development, and real estate brokerage will become inevitable. Only developers who operate transparently and professionally will survive long-term.

Blockchain for land verification, digital mortgages, virtual tours, and Al-driven property management will redefine how the market operates.

Expect developers to increasingly offer tailored packages to diasporans — including payment plans, full documentation, and property management services.

Though luxury housing dominates the headlines, the real opportunity lies in bridging Ghana's massive affordable housing gap. Developers who unlock scalable, quality solutions for this segment will dominate in the next decade.

As central Accra becomes more saturated and expensive, peripheral towns such as Prampram, Amasaman, Oyibi, and Nsawam will become real estate growth corridors, especially with improvements in transport infrastructure.

Ghana's real estate market is booming, but it's also in a fierce and evolving battle — one where not every developer will survive, and not every property will sell. Prices are rising, competition is intensifying, and buyers are becoming more discerning.

In such a landscape, success will depend not just on building properties, but on building trust, offering true value, and anticipating the needs of a shifting market.

In the end, only those who understand that visibility must be matched by credibility will win the race.

For inquiries, interviews, or reprints, contact: tehoda@gmail.com or DPIL

Latest Stories

-

International Women’s Day Spotlight: Mary Lalako Agboli breaking barriers as an Airport coach driver

6 minutes -

Ghana Link rejects claims of ICUMS outage amid fuel supply complaints

7 minutes -

Hindsight: Why Björkegren’s Black Stars role should not cause problems

27 minutes -

‘Women in Mining Ghana’ inspires next generation at Harvest Christian Academy

30 minutes -

BDCs accused of creating artificial fuel shortage to cash in on March 16 price increases

32 minutes -

NPP Tarkwa–Nsuaem elders rebuke Mireku Duker over registration controversy, demand national intervention

39 minutes -

Gov’t disburses GH¢2.6bn to settle NHIS debts to health providers

43 minutes -

2026 World Cup: GHANSU launches #GhanaIsInTheHouse campaign, pledges 400 supporters for tournament

1 hour -

Rev Dr Grace Sintim Adasi: Championing women’s leadership in faith-based institutions

1 hour -

What is wrong with us? Why do we always wait? Social media, mental health, and Africa’s leadership gap

1 hour -

MoMo vendor and customer killed in bloody armed robbery attack

1 hour -

Millions of displaced women and girls still lack safe shelter, IOM warns on International Women’s Day

1 hour -

Deputy minister breaks ground for Bole SHS infrastructure boost

1 hour -

Without government interventions, illegal mining will fester

1 hour -

Cybercrime is not innovation but a threat to youth—CSA

1 hour