Global growth is forecast to be stable, despite higher interest rates, avoiding contraction.

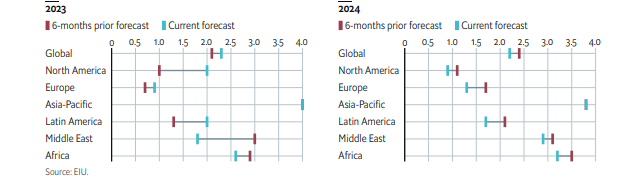

According to The Economist Intelligence Unit, the lagged impact of a broad rise in interest rates will constrain global economic activity in the remainder of 2023 and in 2024, but there are no indications of systemic strain in debt markets that could pull the world economy into a painful contraction.

“We forecast that US growth will slow significantly in 2024, but will avoid a recession, and some momentum will build in Europe as German industry normalises following energy-related disruptions. Moderate stimulus in China will inject sufficient momentum behind its economy to preserve expansion, while other emerging markets will benefit from reduced uncertainty that will come with the conclusion of global monetary tightening”.

“We forecast that global economic growth will decelerate to 2.2% (at market exchange rates) in 2024, from an estimated 2.3% in 2023. The outlook improves in subsequent years (we forecast growth of 2.7% a year on average in 2025-28) aided by the onset of monetary easing and increased funding for investment in technology and the energy transition”, it added in its latest Global Economic Outlook.

Africa is expected to grow at a rate of about 2.9% in 2023 and 3.5% in 2024.

Disinflation process to continue

It also forecasts that disinflation will continue, with risks weighted to the upside.

“The supply-side shocks that drove price increases in 2021-22 will reverse as supply-chain dislocation eases. This will drive inflation lower in most markets (we forecast that it will average 2.4% across developed economies in 2024), if not undo the rapid price gains of recent years”, it explained.

However, it said risks to the inflation outlook are skewed to the upside, adding, a widening of the Israel-Hamas war that disrupted oil supply would drive up hydrocarbon prices, and stronger than expected effects from El Niño climate conditions on agriculture production would push up food prices in 2024, especially in developing economies.

Also, there is a moderate risk that demand will prove more resilient than we expect in developed markets.

Latest Stories

-

Absa Bank CIB team refurbishes ICT lab for Derby Avenue R/C School

21 minutes -

Putting the community first: How Tullow is creating value in Ghana

33 minutes -

Don’t cut your coat just yet – Economist warns gov’t over budget austerity

42 minutes -

‘You call this discipline?’ – Prof. Ackah demands gov’t spending to solve Ghana’s crisis

1 hour -

Fire outbreak at Accra Tourist Information Centre

2 hours -

Budget surplus means nothing when trained nurses, others are jobless – Prof Charles Ackah

2 hours -

Andre Dede Ayew meets Ibrahim Mahama for entrepreneurship guidance

4 hours -

Son makes emotional Spurs farewell – how much will they miss him?

4 hours -

Lookman accuses Atalanta of ‘broken promises’

5 hours -

Osaka and Keys reach Canadian Open quarter-finals

5 hours -

Canadian teenager Mboko stuns Gauff in Montreal

5 hours -

Tsitsipas reappoints father after Ivanisevic split

5 hours -

Paqueta ‘committed’ to West Ham, Antonio to miss out

5 hours -

Marta scores stunner as Brazil retain Copa America

5 hours -

West Ham sign former Newcastle striker Wilson

6 hours