Audio By Carbonatix

Bills Micro-Credit Limited welcomed a high-level delegation from the Ghana National Chamber of Commerce & Industry (GNCCI) on a courtesy visit on Tuesday, August 5, to explore collaborative opportunities to empower Ghana’s Micro, Small, and Medium Enterprises (MSMEs).

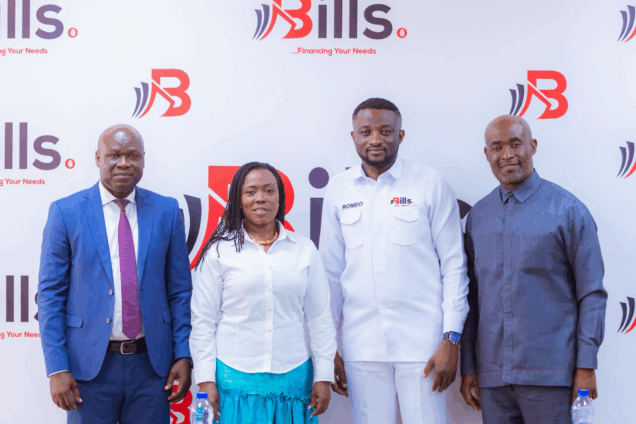

The delegation, led by GNCCI President Mr. Stephane Abbas Miezan, CEO Mark Badu-Aboagye, and 1st Vice President Dr Emelia Asiakwa, was received by Mr. Romeo-Richlove Elorm Seshie, CEO of Bills Micro-Credit Limited.

“With over 10,000 members and 8 regional branches, GNCCI serves as a critical voice for private sector growth and policy advocacy.

"We are happy to share insights into our ongoing work in business development, market access, and enterprise support, as we do for all members.

"Partnering with and onboarding Bills Micro-Credit will be great due to the significant role you play in the financial services sector,” stated Mr. Abbas Miezan.

The discussions focused on unlocking avenues for collaboration between the two institutions, particularly around enhancing access to finance, expanding financial literacy, and creating practical support pathways for MSMEs nationwide.

Mr. Seshie, on his part, emphasised the natural synergy between GNCCI’s mandate and Bills Micro-Credit’s mission.

He welcomed the opportunity to jointly design impactful programs that address the real challenges faced by Ghanaian entrepreneurs.

“This kind of partnership is what Ghana’s SME ecosystem needs, one that brings together advocacy, finance, and hands-on support to drive real results,” he said.

The leadership team from GNCCI was subsequently given a tour of the Bills Micro-Credit offices to familiarise themselves with the operations of the company.

About Bills Micro-Credit Limited

Bills Micro-Credit Limited is a licensed, non-bank financial institution dedicated to providing fast, flexible, and accessible financial solutions to individuals and SMEs across Ghana.

With a growing national footprint and over 2,000 staff, the company is committed to promoting financial inclusion and sustainable business growth.

Latest Stories

-

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

23 minutes -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

29 minutes -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

43 minutes -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

58 minutes -

Police conduct show of force exercise ahead of Ayawaso East by-election

3 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

3 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

3 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

3 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

4 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

4 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

4 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

4 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

5 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

5 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

5 hours