Audio By Carbonatix

The International Monetary Fund (IMF) has recommended that Ghana places the losses incurred under its Gold for Reserves (G4R) programme on the Budget's balance sheet, rather than have the Bank of Ghana (BoG) absorb those costs.

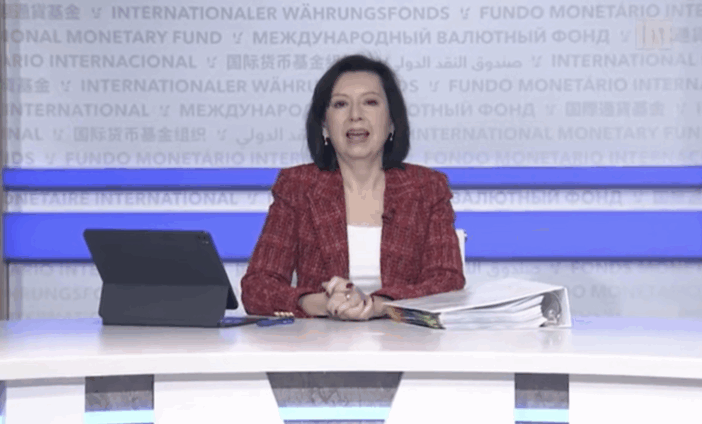

“We strongly recommend that the losses should be brought on the national balance sheet rather than being held on the balance sheet of the Central Bank,” Julie Kozack, Director of the Communications Department of the IMF, said on Thursday.

During a press briefing monitored, she called for transparency and strengthening of governance and risk management, especially for the Gold Board (GoldBod)- linked channel under the domestic gold purchase programme.

The IMF has said the country recorded US$214 million in losses through the end of quarter three, stemming from the artisanal and small-scale (ASM) doré gold transactions component of the Gold for Reserves programmes, including trading activities, fees, and exchange rate movements.

This has raised concerns, with the Governor of the Central Bank calling for a national response to address the losses and improve efficiency, while the government has taken on the costs incurred under the programme.

Ms Kozack explained that bringing the losses onto the national budget balance sheet was because “it’s important to ensure that the Bank of Ghana remains well-positioned to deliver on its key price stability mandates.”

“So, it’s about moving something that is quasi-fiscal onto the budget balance sheet. So, it’s transparent and ensures that the Bank of Ghana is able to deliver on its mandate,” she said.

She said the IMF Staff Report for the country’s Fifth Review showed that the G4R programme contributed to buildup of international reserves and reduced pressure on the foreign exchange market “during a difficult period for Ghana.”

Speaking about the performance of the country’s ongoing US$3 billion loan-supported programme, Ms Kozack said the Board approved a three-month extension to allow for sufficient time to complete the final review.

That included an assessment of data for the end of 2025 and the end of the first quarter of 2026.

Dr Johnson Pandit Asiama, the Governor of the Bank of Ghana, who appeared before Parliament’s Public Accounts Committee (PAC) on Monday, said the G4R programme remained relevant to the country.

“The scheme was introduced to solve national problems. The question now is how to reform it and make it more efficient,” he said, adding that the Bank had already reduced some charges and was pursuing additional reforms.

“The Gold for Reserves programme is still relevant. Its objective is to build reserves. Evidence shows that it is not a matter of shutting it down but rather enhancing efficiency and removing inefficiencies,” he said.

Latest Stories

-

Gov’t confirms Black Queens are safe in UAE

7 minutes -

Ghana’s Emmanuel Dogbevi elected Vice President of Africa Editors Forum

13 minutes -

Three arrested over alleged mob killing of 26-year-old Liberian at Lashibi

19 minutes -

Africa editors chart reform agenda and elect new executive council

22 minutes -

At least 153 dead after reported strike on school, Iran says

37 minutes -

President Mahama arrives in Tanzania to address African Court on human and peoples’ rights

48 minutes -

Ghana’s current surplus to average 3% of GDP in 2026 – Databank Research

1 hour -

Cedi to depreciate by 7.20% in 2026

1 hour -

Banks record GH¢15.0bn profit in 2025, a 43.5% growth

1 hour -

The Africa Editors Forum honours Ghana’s Kwame Karikari with Lifetime Service to Journalism Award

1 hour -

Weak revenue performance, pressures from compensation pose fiscal risks to economic outlook – BoG

1 hour -

2025/26 GPL: Bechem United held to goalless draw by Karela United

1 hour -

Specialised courts to fast-track justice on galamsey, corruption and financial crimes – Judicial Secretary

1 hour -

Ghanaians urged to embrace specialised courts for effective justice delivery

2 hours -

Sextortion offenders face up to 25 years in jail – Judicial Secretary warns

2 hours