Audio By Carbonatix

Government has set its macroeconomic targets for next year, as it anticipate a growth rate of 5.8% and an inflation rate of 8%.

This is however slightly higher the projections by the International Monetary Fund, the World Bank, Fitch Solutions, amongst other international research institutions.

Also, the government is anticipating a fiscal deficit of 7.4% of Gross Domestic Product and a primary surplus of 0.1% of GDP in 2022.

Total Revenue and Grants is projected at ¢89.1 billion (17.9% of GDP) for 2022 and represents a nominal growth of 23% over the projected outturn for 2021. It is expected to increase to ¢100.6 billion (17.9% of GDP) in 2023, ¢112.5 billion (17.7% of GDP) in 2024 and expected to reach ¢126.3 billion (17.7% of GDP) by 2025.

Total Expenditure (including payments for the clearance of arrears) is projected at ¢128.3 billion (25.8% of GDP) in 2022, ¢135.6 billion (24.1% of GDP) in 2023, and GH¢157.1 billion (22.1% of GDP) in 2025.

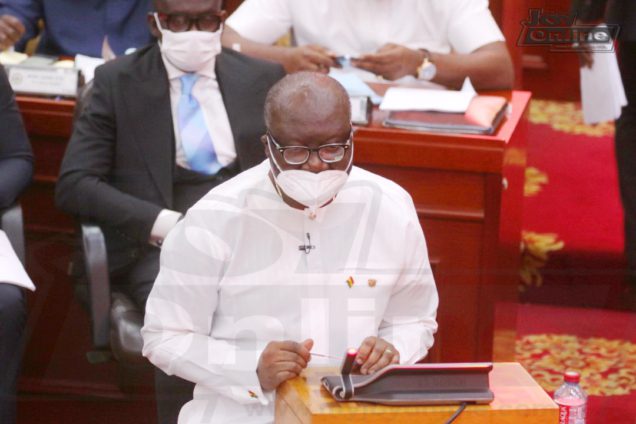

Presenting the 2022 Budget Statement and Economic Policy, Finance Minister, Ken Ofori-Atta said the economy is beginning to show signs of recovery from the impact of the COVID-19 pandemic, adding, to sustain this recovery phase, government will continue to support the productive sectors of the economy as well as the vulnerable through the implementation of the Ghana CARES (Obaatanpa) Programme and the flagship intervention programmes.

Medium-term fiscal policy objective is to achieve fiscal consolidation

He mentioned that the broad medium-term fiscal policy objective is to pursue a fiscal consolidation drive towards fiscal and debt sustainability to support macroeconomic stability whilst supporting the implementation of government’s flagship programmes and the Ghana CARES (Obaatanpa) Programme.

The strategy he explained is to progressively reduce the overall fiscal balance back to the Fiscal Responsibility Act (FRA) deficit threshold of 5% of GDP and a primary surplus by 2024.

Objectives of macroeconomic policy

The Finance Minister also said the main thrust of macroeconomic policy in 2022 will focus on ensuring restoration and sustainability of macroeconomic stability with a focus on fiscal and debt sustainability, maintain a good balance between the implementation of the revitalisation and transformation programme through the Ghana CARES (Obataanpa) Programme and fiscal consolidation to promote fiscal sustainability.

The others are to provide supportive private sector environment including promoting entrepreneurship for domestic businesses and for Foreign Direct Investments to thrive, build a robust financial sector to support growth and development; as well as deepen structural reforms to make the machinery of government work more efficiently and effectively to support socio-economic transformation.

Latest Stories

-

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

24 minutes -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

29 minutes -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

44 minutes -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

59 minutes -

Police conduct show of force exercise ahead of Ayawaso East by-election

3 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

3 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

3 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

3 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

4 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

4 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

4 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

4 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

5 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

5 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

5 hours