Audio By Carbonatix

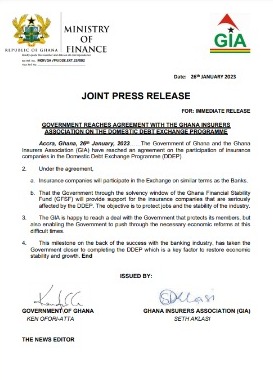

The Government of Ghana and the Ghana Insurers Association (GIA) have reached an agreement on the participation of insurance companies in the Domestic Debt Exchange Programme (DDEP).

Under the agreement, insurance companies will participate in the programme on similar terms as the Banks.

This was contained in a joint statement issued by the Ministry and the GIA on Thursday January 26, 2023.

"That the Government through the solvency window of the Ghana Financial Stability Fund (GFSF), will provide support for the insurance companies that are seriously affected by the DDEP. The objective is to protect jobs and the stability of the industry," a portion of the statement reads.

According to the statement, "The GIA is happy to reach a deal with the Government that protects its members, but also enabling the Government to push through the necessary economic reforms at this

difficult times."

It noted that, "This milestone on the back of the success with the banking industry, has taken the

Government closer to completing the DDEP which is a key factor to restore economic

stability and growth."

On Monday January 23, 2023, government and the Ghana Association of Banks (GAB) made significant progress on the terms of participation of Banks in the Domestic Debt Exchange Programme (DDEP).

The new agreement encompasses final improvements to the terms of the programme.

These include; an agreement to pay 5% coupon for 2023 and a single coupon rate for each of the twelve (12) new bonds resulting in an effective coupon rate of 9%, clarity on the operational framework and terms of access to the Ghana Financial Stability Fund (GFSF) and the removal or amendment of all clauses in the Exchange Memorandum that empowers the Republic to, at its sole discretion, vary the terms of the Exchange.

This was contained in a joint statement from the Finance Ministry and GAB issued on Monday.

The Association of Banks said per the new terms, the participation of member banks is subjected to individual bank’s internal governance and approval processes.

Latest Stories

-

I don’t want my people to be mistreated by ICE — Ambassador Victor Smith tells US Senator

1 minute -

Detained fugitives: If you’re not prepared to be accountable, don’t hold public office – Vicky Bright

8 minutes -

Adutwum outlines vision for a growth-minded Ghana, draws lessons from global experiences

10 minutes -

I wish former CSA boss Dr Antwi-Boasiako continues in office – Sampson Lardy

11 minutes -

Kotoko maintain title ambition despite mixed results – Sarfo Duku

19 minutes -

NPP Flagbearer Race: Dr Adutwum speaks on economy, Ghana’s current gains, and more

21 minutes -

We must show zero tolerance for corruption and punish political elites – Susan Adu-Amankwah

25 minutes -

I’ll raise the needed funds to win on January 31 – Adutwum

27 minutes -

Adutwum urges calm in NPP, tells Frimpong-Boateng to look ahead to better days

30 minutes -

Your choice will shape NPP’s future – Adutwum to delegates

33 minutes -

Sedina Tamakloe-Attionu must be arrested immediately on arrival; sent to prison – Ex-Deputy AG

45 minutes -

I’ll be surprised if Sedina Tamakloe-Attionu is granted bail on arrival – Bobby Banson

53 minutes -

Sedina Tamakloe’s US arrest vindicates work we started in office – Tuah-Yeboah

1 hour -

Ken Ofori-Atta’s case: Allow the legal process to work – Adutwum

2 hours -

Don’t underestimate NPP delegates; they’re looking for someone who’ll win 2028 polls – Adutwum

2 hours