The founder and leader of the Movement for Change, Alan Kyerematen, assured the Ghana Union of Traders Associations (GUTA) that he would eliminate several import taxes if elected into office.

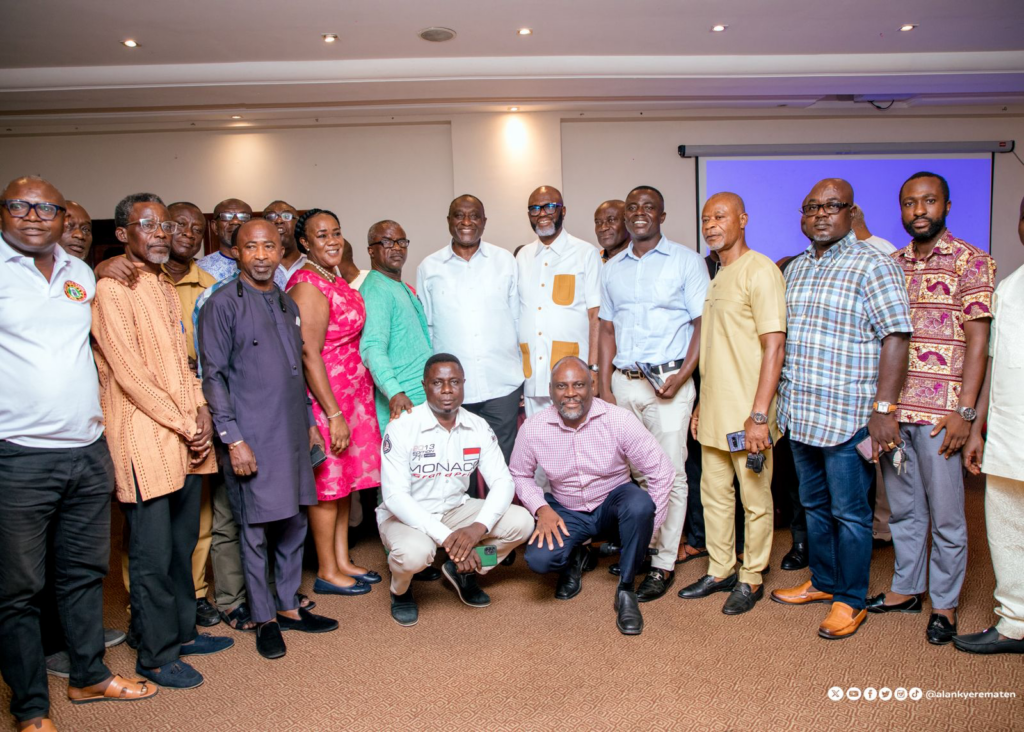

During a meeting with the Association on Wednesday, April 10, 2024, the independent presidential candidate expressed his belief that many of these taxes are unnecessary and impose a heavy burden on the trading community.

"Under my presidency, Ghana will boast the lowest tax rate regime in ECOWAS," he declared.

Kyerematen outlined a series of radical tax reforms aimed at reducing the tax burden on Ghanaians, particularly on imports. Immediate measures would include consolidating the existing NHIL & GETFund levies at the ports into the calculation of a new VAT rate.

He also pledged to abolish the Special Import Levy of 2%, the COVID-19 Health Recovery Levy, and the Ghana Health Service Disinfection Fee.

Within two years of his government's establishment, all taxes and charges on the importation of spare parts would be scrapped.

Moreover, a comprehensive review of all statutory fees on imports imposed by regulatory agencies would be conducted, to consolidate them into a convenient payment system. This system, which would include a new Cash Waterfall mechanism, aims to meet statutory agency requirements while reducing the burden on importers.

Additionally, Kyerematen proposed establishing a fixed exchange rate for the calculation of import duties over a specified period, as well as fixing the exchange rate for specified strategic and essential commodities below the prevailing rate in a 'second window' to mitigate imported inflation.

These proposed tax reforms represent the most extensive and radical review of the import tax regime to date, promising to positively transform the business environment in Ghana.

Dr Obeng, President of GUTA, highlighted the challenges posed by the multitude of taxes in Ghana, noting that apart from VAT, there are 32 additional taxes, totalling nearly 65% of the value of imports.

He also mentioned the presence of over 14 state agencies and various security agencies operating in the port, contributing to the high cost of doing business and encouraging unethical practices.

Kyerematen emphasized the importance of creating an enabling environment for private sector-led growth to improve the livelihoods of ordinary Ghanaians.

Furthermore, he proposed a shift from heavy reliance on indirect taxes to direct taxes to optimize revenue mobilization and make the corporate sector more competitive and profitable.

These plans align with Kyerematen's Great Transformational Plan (GTP), which aims to deliver the vision of Ghanaians for a prosperous, united, and peaceful Ghana that provides equal opportunities for all.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

8 hours