Audio By Carbonatix

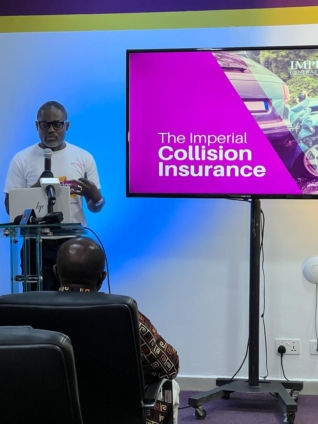

Imperial General Assurance, a leading general business insurance company in Ghana has launched “Imperial Collision Insurance’, an innovative mobility insurance product onto the Ghanaian market.

According to Deputy Director of the Imperial General Assurance, Harry Ofori-Atta, this product covers own damage, hospitalisation and financial interest in the vehicle.

“Collision insurance is not a third-party cover. It provides cover for individuals when their vehicle collides with objects or other vehicles, but it also includes a third-party component", said Mr. Ofori-Atta.

“This means the policy protects you not only from damages to your own car but also from any liability you may incur in case of an accident with another vehicle”, he added.

The collision insurance comes in two packages; the ‘Double Your Trouble’ which provides coverage of up to a maximum limit of GH¢6,000 for a third-party cover, and the ‘Big Bang’ which provides up to a maximum of GH¢10,000 for a third-party cover.

Mr. Ofori-Atta expressed confidence in the transformative potential of this new product, adding, "Imperial is taking the first step in driving innovation into the mobility insurance space”.

"We believe this will cause disruption and positive changes, ultimately giving our customers the insurance policy, they truly need", he continued.

The launch of the “Imperial Collision Insurance” directly addresses a critical gap in the market for car owners, and was attended by key industry players such as the Ghana Insurers Association (GIA), the Insurance Brokers Association of Ghana, Insurance Institute of Ghana (CIIG) among others.

Latest Stories

-

Party cannot overturn EC verdict without court – Inusah Fuseini on NDC Ayawaso East primaries

45 minutes -

Mahama reprimanded Baba Jamal – NDC says code of conduct is already working

1 hour -

Description of conduct as ‘inappropriate’ is based on NDC’s constitution – Gbande on vote-buying claims

2 hours -

NDC can only reprimand, not prosecute – Gbande explains limits of party sanctions

2 hours -

Even talking about it is progress – NDC’s Gbande defends probe into vote-buying claims

2 hours -

PM asks Sir Jim Ratcliffe to apologise for saying UK ‘colonised by immigrants’

5 hours -

16 hours of daily use is ‘problematic,’ not addiction – Instagram boss

5 hours -

US House votes to overturn Trump’s tariffs on Canada

5 hours -

Dad unlawfully killed daughter in Texas shooting, coroner rules

6 hours -

Anas wins 7 – 0 as SC unanimously rejects attempts to reverse judgment in his favour

6 hours -

Trump tells Netanyahu Iran nuclear talks must continue

6 hours -

The cocoa conundrum: Why Ghana’s farmers are poor despite making the world’s best chocolate

7 hours -

Powerful cyclone kills at least 31 as it tears through Madagascar port

7 hours -

GoldBod summons 6 gold service providers over compliance exercise

8 hours -

Power disruption expected in parts of Accra West as ECG conducts maintenance

8 hours