Audio By Carbonatix

The Bank of Ghana (BoG) Credit Reporting for 2024 has shown a reduction in the issuance of dud cheques. A dud cheque is a cheque that a bank or financial institution refuses to honor because the account holder does not have enough money to cover the cheque's value. It is a criminal offense under the Bank of Ghana Act.

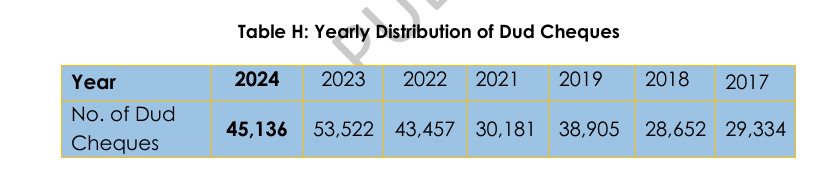

The report showed that in 2024, a total of 45,136 dud cheques were submitted by Banks and Specialised Deposit-Taking Institutions to credit bureaus.

This represents a 15.19% decrease from the 2023 figure of 53,522. The Bank of Ghana explained that the decline is attributable to the regulator’s constant sensitization of the public on the negative implications of issuing dud cheques on their ability to secure credit facilities.

The Bank of Ghana said it will continue to raise public awareness and enforce the directive on dud cheques to help boost public confidence in the cheque system.

The report pointed out that in 2024, bank customers who flouted the dud cheque directives were sanctioned accordingly.

Breakdown of the data

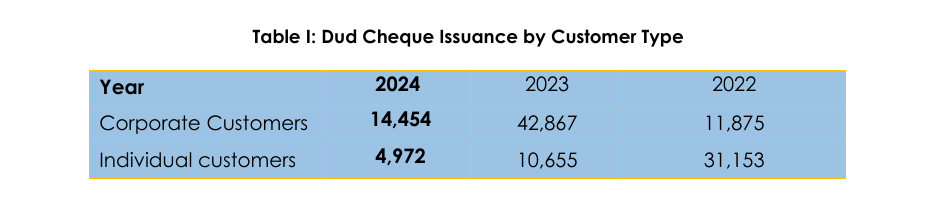

“Dud cheques issued by individuals decreased from 10,655 in 2023 to 4,972 in 2024. Corporate customers issued a total of 14,454 dud cheques in 2024, representing a decrease of 49.6 percent compared to 42,867 dud cheques in 2023”, the report said.

According to the Bank of Ghana, the notable reduction in dud cheque incidents, increased usage of credit reports by financial institutions and other lenders and enhanced public awareness of credit reporting systems are testaments to the growing robustness of the sector.

The central bank said it remains committed to strengthening the credit information infrastructure enforcement, and public education.

“These efforts are essential to fostering a credit reporting requirements through continuous stakeholder collaboration”.

Latest Stories

-

Zambia scraps taxes on Fugu from Ghana for personal use following social media drama

57 minutes -

Gunfire silences prosperity as PLO Lumumba warns of ‘bleeding’ African continent

2 hours -

African Leaders must shift from speeches to action – P.L.O Lumumba

3 hours -

Ace Ankomah demands radical overhaul of Ghana’s science and innovation sector

3 hours -

Trump signs executive order threatening tariffs for countries trading with Iran

3 hours -

From Hollywood to the homeland: Why African countries are courting black American stars

4 hours -

Ambulance service slams ‘taxi transfer’ of newborn as viral negligence claims debunked

4 hours -

High stakes in Ayawaso East as NDC delegates head to the polls today

4 hours -

Youth unemployment is the biggest threat to Africa – Gabby

5 hours -

Minority demands urgent Finance Minister summons as ‘Agbogbloshie’ prices ignite parliamentary clash

6 hours -

Baba Jamal’s highest will be 38% in Ayawaso East NDC primary – Mussa Dankwah

6 hours -

Stranded beans and staggering debts: Ghana’s cocoa sector faces systemic crisis

6 hours -

Chief Justice sets up special courts for corruption and galamsey

7 hours -

Airport renaming and inflation trends to take centre stage on Joy Prime’s Prime Insight this Saturday

8 hours -

Ghana losing long-term investment capital over absence of Limited Partnerships Law – GVCA CEO

8 hours