Audio By Carbonatix

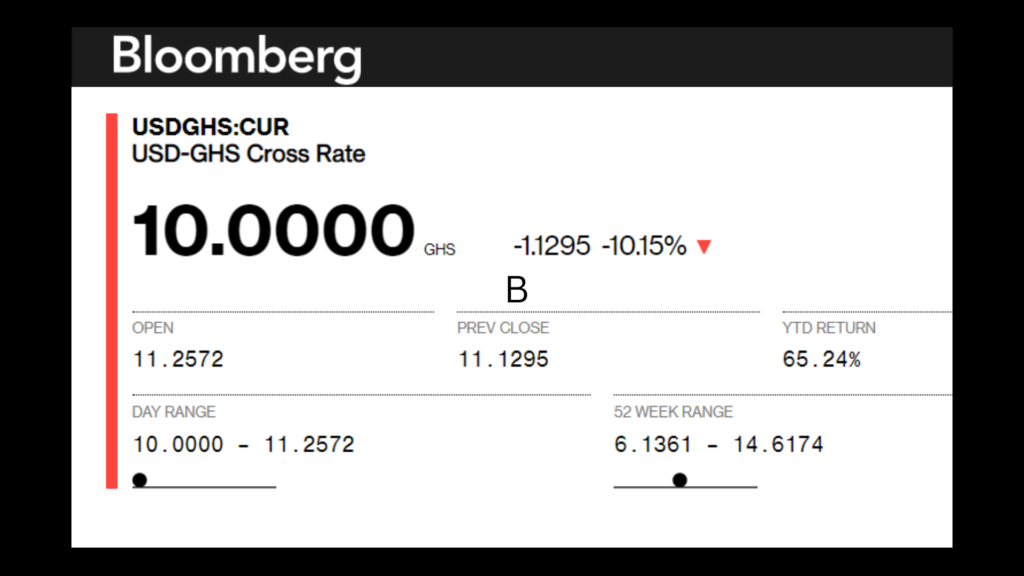

Bloomberg's currency dashboard has pegged $1.00 to ¢10.00, solidifying the cedi's position as the best performing currency against the dollar in the month of December 2022.

Within a span of two weeks, the cedi has regained more than 40% of its lost value since the arrival of the International Monetary Fund's team in Accra on December 1.

According to Bloomberg's currency dashboard, the forex market opened the day with $1 trading at approximately GH¢11.25 after closing at GH¢11.13 the previous day.

Through out the day, it's been a nosedive for the dollar giving the cedi an advantage to gain some additional 12%.

The IMF staff-level agreement, US Fed monetary policy easing, and investors turning bearish on the dollar for the first time since July 2021 have been outlined by some financial experts, as possible factors fueling the dollar's continuous depreciation against the Cedi. The 'greenback' shed more than 4% in the first 20 days of the fourth quarter, paving way for currencies such as cedi to find some comfort in a forlorn position.

According to Goldman Sachs' 2023 outlook, "markets are anxious for signs of a fundamental shift, and investors are increasingly fearful of missing out since corrections after a peak tend to be swift and steep,"

The cedi slumped by more than 54% against the dollar this year. However, it has strengthened by more than 40% since the start of December after Finance Minister, Ken Ofori-Atta disclosed government’s domestic debt exchange programme, followed by the latest IMF visit and the announcement of the Fund’s staff-level agreement of a bailout package worth some $3 billion.

After more than four months of negotiations, Ghana finally sealed a $3 billion programme with the Bretton Wood institution, pending the approval of its Executive Board.

According to Stéphane Roudet, Mission Chief for Ghana, his team “reached staff-level agreement with the Ghanaian authorities on a three-year program supported by an arrangement under the Extended Credit Facility (ECF) in the amount of SDR 2.242 billion or about $3 billion".

"The economic programme aims to restore macroeconomic stability and debt sustainability while laying the foundation for stronger and more inclusive growth. The staff-level agreement is subject to IMF Management and Executive Board approval and receipt of the necessary financing assurances by Ghana’s partners and creditors.”

Latest Stories

-

Open letter to Education Minister: Rising student deviance and the urgent need for national parental responsibility framework

2 minutes -

Mahama delivers State of the Nation Address on February 27

2 minutes -

Dr Kotia backs Ghana’s move to refer maritime boundary dispute with Togo to International arbitration

5 minutes -

When “substantive ” become a security strategy — Rev Ntim Fordjour’s nameplate doctrine

10 minutes -

No plan to pay cocoa farmers, yet ready to change NIB to BNI—Dr Ekua Amoakoh

12 minutes -

COCOBOD is not your cover story. It will not be your scapegoat

12 minutes -

BOST Energies welcomes Salifu Nat Acheampong as new Deputy Managing Director

19 minutes -

NIB or BNI: Will changing the name solve the problem? Asks Prof. Boadi

24 minutes -

Abidjan to host DRIF 2026 as global talks on digital rights and inclusion open for registration

28 minutes -

CEPI unveils new plan to protect the world from deadly disease outbreaks

32 minutes -

NVI survey aims to build trust in local vaccines across Ghana

38 minutes -

Kofi Asmah Writes: From seedlings to strategy: Can Ghana process 50%?

48 minutes -

Kofi Asmah Writes: The land we may never build on

50 minutes -

3, including woman, arrested in Obuasi anti-robbery operation

57 minutes -

How the Liberator Became the Strongman: Museveni’s long slide from revolutionary promise to entrenched power

58 minutes