The Director of Research at the Institute of Economic Affairs, Dr. John Kwakye, has blamed the Ghana Cocoa Board (COCOBOD) for the financial crisis the cocoa regulator finds itself in.

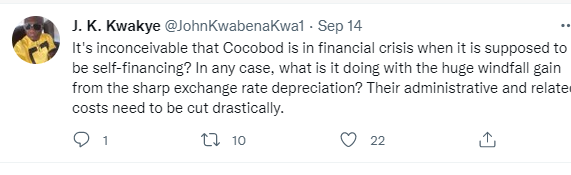

In a tweet, Economist Dr. Kwakye said it’s inconceivable that COCOBOD is in financial crisis when it is supposed to be self-financing.

“It’s inconceivable that COCOBOD is in financial crisis when it is supposed to be self-financing? In any case, what is it doing with the huge windfall gain from the sharp exchange rate depreciation”.

“Their administrative and related costs need to be cut drastically”, he added”.

Auditor General directs COCOBOD to recover ¢2.25bn government debt

The 2021 Auditor General’s Report charged Ghana Cocoa Board (COCOBOD) to engage the Ministry of Finance to recover ¢2.25 billion that the government owed the cocoa regulator as of September 30, 2020.

This was because of supply of cocoa beans to Genertec International Corporation (GIC), government’s revenue support on producer price of cocoa and excess export duties paid by the COCOBOD for GIC on cocoa beans exported.

The report also noted that COCOBOD has relatively huge loans portfolio totalling ¢12.301 billion as of the end of the 2019/2020 financial year.

This comes despite recording a record a little over one million metric tonnes of cocoa in the 2020/2021 crop season.

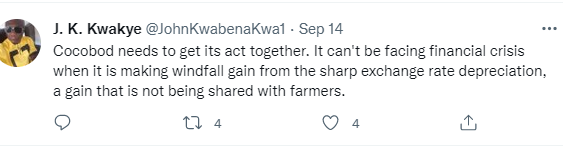

Dr. Kwakye said “COCOBOD needs to get its act together. It can’t be facing financial crisis when it is making windfall gain from the sharp exchange rate depreciation, a gain that is not being shared with farmers”.

COCOBOD Posted net loss of¢42m in 2020

COCOBOD posted a net loss of ¢42.14 million in 2020 compared to a net profit of ¢1.478 billion in 2019, a 102.85% decline.

This was largely due to the impact of Covid-19 on production of cocoa beans and its purchases.

According to the 2020 State Ownership Report, net profit margin was 0.24% compared to the net profit margin of 0.20 percent in 2019.

Latest Stories

-

Paris 2024: Opening ceremony showcases grandiose celebration of French culture and diversity

3 hours -

How decline of Indian vultures led to 500,000 human deaths

4 hours -

Paris 2024: Ghana rocks ‘fabulous fugu’ at olympics opening ceremony

4 hours -

Trust Hospital faces financial strain with rising debt levels – Auditor-General’s report

5 hours -

Electrochem lease: Allocate portions of land to Songor people – Resident demand

5 hours -

82 widows receive financial aid from Chayil Foundation

5 hours -

The silent struggles: Female journalists grapple with Ghana’s high cost of living

5 hours -

BoG yet to make any payment to Service Ghana Auto Group

5 hours -

‘Crushed Young’: The Multimedia Group, JL Properties surprise accident victim’s family with fully-furnished apartment

6 hours -

Asante Kotoko needs structure that would outlive any administration – Opoku Nti

6 hours -

JoyNews exposé on Customs officials demanding bribes airs on July 29

7 hours -

JoyNews Impact Maker Awardee ships first consignment of honey from Kwahu Afram Plains

8 hours -

Joint committee under fire over report on salt mining lease granted Electrochem

8 hours -

Life Lounge with Edem Knight-Tay: Don’t be beaten the third time

8 hours -

Pro-NPP group launched to help ‘Break the 8’

9 hours