The presidency has released the long-awaited KPMG audit report on the contracts between the Ghana Revenue Authority (GRA) and Strategic Mobilisation Limited (SML). The report uncovers several procurement breaches and highlights redundancies in SML's services, resulting in a substantial expenditure of GHS 1.4 billion to SML from 2018 to 2023. Here are the key takeaways and KPMG’s recommendations.

Evolution from SMEL to SML

- Feb 2017: SMEL was incorporated on 14 February 2017

- Jun-Sep 2017: GRA made 3 unsuccessful attempts to obtain PPA’s approval to single source SMEL to provide transaction audit services

- Nov 2017: SMEL changed its name to SML

- June 2018: SML appointed a subcontractor to West Blue Ghana Ltd, a service provider to GRA

- GRA extended the transaction audit service contract with SML

- SML then transitioned to become main contractor without PPA approval

- 2019 & 2020: GRA dished out additional contracts to SML

- 2023: MoF, GRA and SML consolidated the First Consolidation contract and Downstream Petroleum Audit contract and extended the scope of SML services, to include upstream petroleum and minerals audits

Redundant Services and Stakeholder Exclusion KPMG's findings reveal that SML’s sole client was the GRA, which hired the company for transaction audits, external price verification, and measurement audits for downstream petroleum products. Notably, 38% of stakeholders interviewed by KPMG suggested that existing institutions and systems could provide similar services, rendering SML’s role redundant. Additionally, there was a notable lack of input from key industry stakeholders before the contracts were signed, with some engagement occurring only afterward.

Procurement and Procedural Breaches The audit uncovered numerous procurement and procedural breaches. From June 2018 to July 2020, the GRA entered into “six service agreements with SML utilizingthe single-source method without approval from the Public Procurement Authority (PPA)”. Although the GRA disclosed these breaches to the PPA, which subsequently granted ratifications on August 27, 2020, the initial lack of compliance was significant.

Moreover, despite the Financial Management Act requiring parliamentary approval for financial agreements binding the government for more than one year, no such approval was obtained for the GRA's five-year contract with SML. Furthermore, there was no evidence that the contracts signed in 2018 and 2019 were submitted to the GRA's board for deliberation and approval.

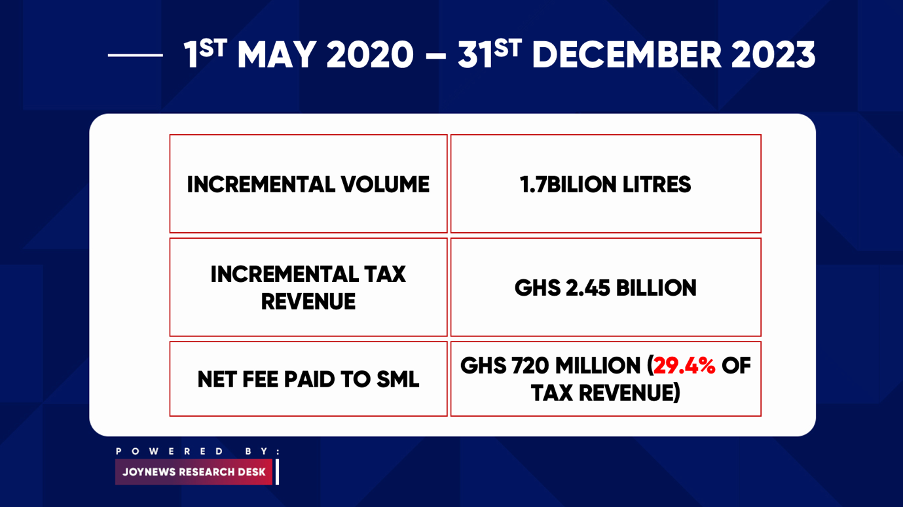

Revenue Impact and Financial Analysis A critical question addressed by the report was whether the GRA benefited from SML’s services. SML claimed its operations led to an increase in GRA’s revenue from the downstream petroleum sector. However, KPMG noted that from May 1, 2020 (after SML began its audit) to December 31, 2023, an additional 1.7 billion litres of petroleum products generated GHS 2.45 billion in tax revenue. KPMG highlighted that increased taxes—from two in 2015 to five in 2023—and hikes in tax rates in 2016, 2019, and 2021 significantly contributed to revenue growth, complicating the attribution of this increase directly to SML’s efforts. Interestingly, SML received GHS 720 million over this period, representing approximately 29% of the incremental tax revenue.

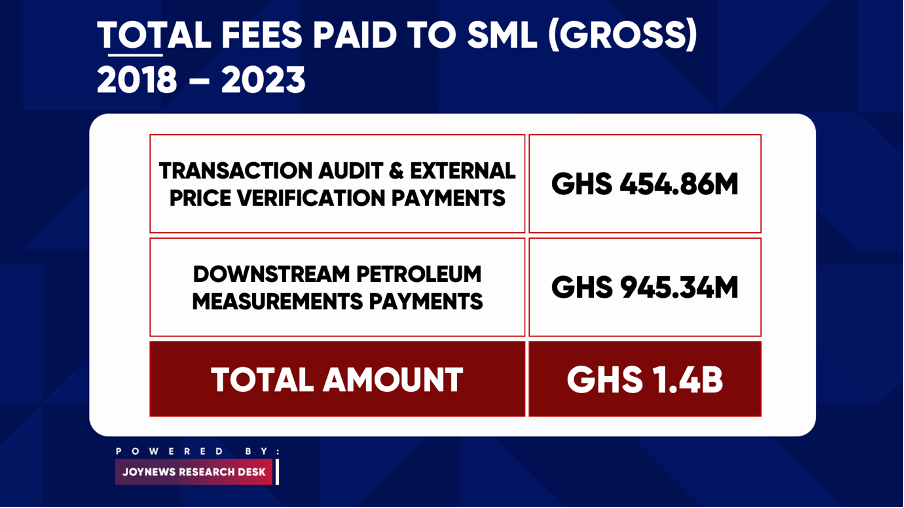

Financial Commitments and Unpaid Taxes The total payment from the GRA to SML from 2018 to 2023 amounted to GHS 1.4 billion. KPMG also discovered an unpaid amount of GHS 13.38 million in VAT and withheld taxes, which the GRA has since demanded from SML.

Recommendations and the Path Forward KPMG recommended either terminating the contract or resolving it orderly. Termination would require the GRA and GoG to settle SML for completed but unpaid services without entitlement to any refunds. Additionally, the GoG may need to pay SML a return on investment (ROI) if the investment claim is validated. SML asserts that about 80% of the expected investment of $54.5 million and $79 million for upstream and mineral audit services have been committed, although supporting documents were not provided for verification.

Further recommendations include incorporating a needs assessment into public procurement practices, adhering to Section 33 of the Public Financial Management Act for multi-year expenditure commitments, and developing a contract monitoring framework for evaluating significant contracts. KPMG also suggested adopting a fixed pricing model for contracts, submitting contracts to the Attorney-General for review, and conducting biennial value-for-money assessments for contracts exceeding a two-year lifespan.

Latest Stories

-

Trump bickers with Powell over Fed renovation costs

9 minutes -

‘We will not default’ – Ato Forson assures bondholders as GH¢20bn DDEP payment plan unfolds

18 minutes -

Take time to get VAT reforms right before scrapping COVID-19 levy – Prof. Asuming

34 minutes -

France will recognise Palestinian state, Macron says

37 minutes -

Foreign Affairs Ministry denies issuing Ghanaian passports to non-citizens

2 hours -

Uganda to host Asia/Africa play-off for 2027 Rugby World Cup

2 hours -

Landslide destroys farmlands and livelihoods in Santrokofi, sparks famine fears

2 hours -

UHAS Dean urges strategic role for laboratory managers in 24-hour health system reform

2 hours -

Society of Medical Laboratory Managers chair calls for inclusion in core health management

2 hours -

Mahama promises to renovate Atta Mills Presidential Library

2 hours -

My sister inspired me to start a fashion business – Diana Hamilton

3 hours -

SIC Insurance PLC donates 50 laptops to KNUST

3 hours -

I turned down specific brands because of my faith – Diana Hamilton

3 hours -

‘Those who validate ghosts will pay’ – Finance Minister declares war on public sector payroll fraud

3 hours -

GN Bank Chicago declared safe and sound by U.S. regulator

3 hours