Audio By Carbonatix

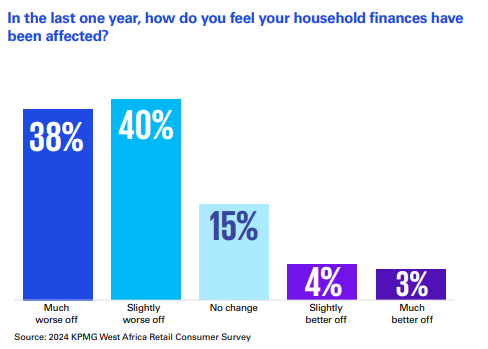

Thirty eight percent of Ghanaian retail consumers feel their finances have worsened in the last one year.

According to the 2024 West Africa Banking Industry Customer Experience Survey by KPMG, the rising costs of fuel and essential goods have further squeezed budgets, leaving little room for discretionary spending or long-term financial planning.

In response to these challenges, the report said many Ghanaians are adopting cost-saving strategies, such as seeking cheaper alternatives for food and clothing.

The financial pressure has also influenced personal decisions, with half of respondents in the retail consumer survey considering emigration to escape lasting economic hardship.

When respondents were asked respondents how they intend to adapt to the economic hardships, 36% indicated that they intend to increase their workload to cope with financial pressures while 29% remain hopeful about starting businesses, despite the economic climate.

However, 6% of respondents expressed reluctance to venture into entrepreneurship due to the uncertainties of the current environment.

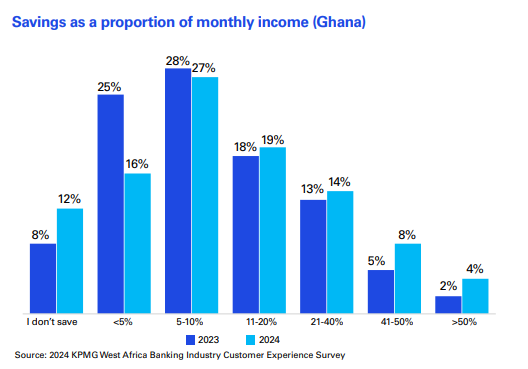

While aggregate level of savings remained largely the same compared to last year, the survey observed that respondents who do not save increased from 8% to 12% this year.

“We observed that savings and investments which was the fourth largest expense area last year for Millennials shifted to sixth place”, the report added.

6% Millennials Do Not Save

There were also fewer millennials who indicated that they do not save – a drop from 11% to 6% this year.

Contrary to the Nigerian situation, Baby Boomers had the largest proportion of people who do not save – 41%.

A review of their expenditure showed a focus on their health as well as fitness and catering to their family obligations. For Gen Zs, who are most likely students and early career starters, an impressive 13% indicated that they were able to save 21% to 40% of their monthly income.

The survey findings reveal that the top two expense areas for Ghanaians were food and dining (66%) and transportation (44%), same as in 2023.

Whereas savings and investments was considered a top five spending category last year, we observed a displacement by airtime and data expenses (35%) this year.

Latest Stories

-

NAIMOS has failed in galamsey fight; it’s time for a state of emergency – DYMOG to President Mahama

59 minutes -

Mahama to open African Court judicial year in Arusha, mark 20th anniversary

1 hour -

Ghana begins partial evacuation of Tehran Embassy as Middle East tensions escalate

1 hour -

EPA tightens surveillance on industries, moves to cut emissions with real-time monitoring system

2 hours -

Police conduct show of force exercise ahead of Ayawaso East by-election

3 hours -

Ghana launches revised Early Childhood Care and Development Policy to strengthen child development framework

4 hours -

AI to transform 49% of jobs in Africa within three years – PwC Survey

4 hours -

Physicist raises scientific and cost concerns over $35m EPA’s galamsey water cleaning technology

4 hours -

The road to approval: Inside Ghana’s AI strategy and KNUST’s leadership

5 hours -

Infrastructure deficit and power challenges affecting academics at AAMUSTED – SRC President

5 hours -

Former US diplomat sentenced to life for abusing two girls in Burkina Faso

5 hours -

At least 20 killed after military plane carrying banknotes crashes in Bolivia

5 hours -

UK reaffirms investment commitment at study UK Alumni Awards Ghana 2026

5 hours -

NCCE pays courtesy call on 66 Artillery Regiment, deepens stakeholder engagement

5 hours -

GHATOF leadership pays courtesy call on Chief of Staff, Julius Debrah

6 hours